If you find taxes confusing, then you are not alone. Albert Einstein once said, “the hardest thing in the world to understand is the income tax.” While we outline many useful tax details in our Key Financial Data Sheet and even observed the US history of taxes in a prior blog post, it is truly the IRS’ job to fully understand and enforce the tax code. We also find the tax return essential to our services and we like to receive a secure copy each year.

Within your tax return is a wealth of information that we utilize to support our two core competencies – financial planning and investment management. Our goal is to get to know your full financial picture so we can tailor our advice to your specific situation to increase overall tax-efficiency. While we prefer to analyze your full tax return, the following sections give us specific insights into how we can best serve you.

1040

The 1040 gives our team a summary of your full tax picture. Numbers on your 1040 that are of particular interest to our team are your Adjusted Gross Income (AGI) and your Taxable Income. Your Taxable Income, in conjunction with your Filing Status, help us determine your Marginal Federal Tax Bracket. Your tax bracket drives the types of securities we purchase for your taxable portfolio, like a Trust or individual account. For example, a person in a very high marginal tax bracket may benefit from tax-exempt municipal bonds. Alternatively, a person in a low tax bracket has less of a need for tax-free income and may benefit from an allocation to taxable corporate bonds. Weatherly always looks at the Taxable Equivalent Yield (TEY) to compare a taxable bond to a tax-exempt bond to determine which offers the most attractive after-tax return per client account.

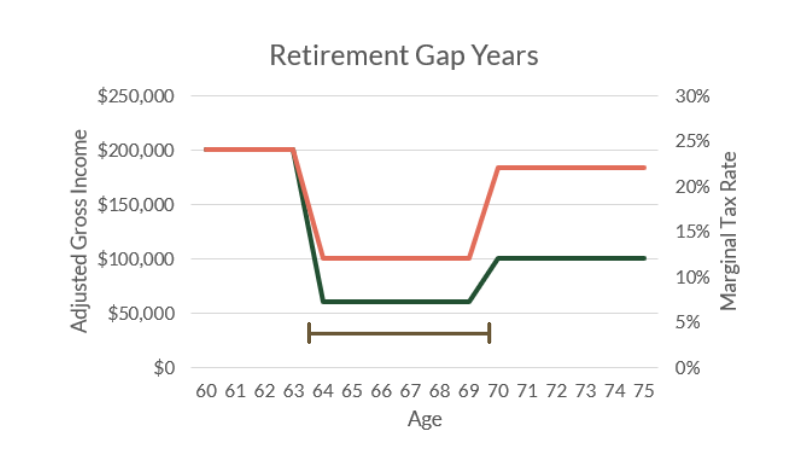

Tax brackets are also useful within financial planning to determine if it is a good year for a Roth conversion. This strategy can take advantage of a low-income year by leveraging current lower income tax brackets to enhance after-tax returns over time. Since Roth assets can grow tax free, they often become a desirable source of funds in legacy planning for beneficiaries.

This first page is also useful when onboarding new clients. It provides our team with your full name, Social Security Number, address, and lists any dependents you claim. This information facilitates us in filling out new client paperwork and expedites the client onboarding process. We also track your tax preparer as listed at the bottom of form 1040, as we may need to contact them with any questions that may come up regarding your tax situation and various tax strategies. With your consent, we can also contact them to directly and securely send your tax forms to assist them in filing your return.

Schedule 1

Schedule 1 outlines any additional income you earned throughout the tax year as well as adjustments to your income. Our team appreciates having a full outline of your revenue streams and how much you receive. It can be overwhelming to have to keep track of this information independently, so it is often easier to send this summary to your advisor to give them some context on your cashflow. We can also model the income into a financial evaluation and build out various scenarios.

Schedule A

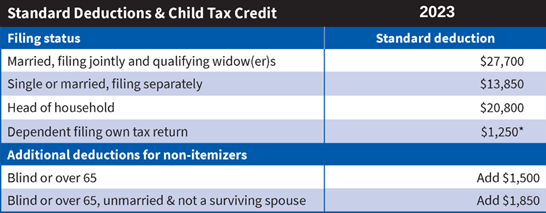

If you itemize your deductions, instead of taking the standard deduction, you will need to fill out a Schedule A. The Tax Cuts and Jobs Act (TCJA) in 2018 made significant changes to the deductions you can itemize. The main deductions are medical costs (that exceed 7.5% of AGI), state and local taxes (now capped at $10,000), mortgage interest and gifts to charities. The TCJA also significantly increased the standard deduction which dramatically reduced the amount of Americans itemizing their deductions. For the 2023 tax year, the standard deductions are mainly based on filing status but can also be affected by other factors. Please see the chart below for details:

Sourced from: https://www.weatherlyassetmgt.com/wp-content/uploads/2023/01/2023_KEY_FINANCIAL_DATA_CHART.pdf

Many of our clients itemize their deductions because their large donations to charities throughout the year frequently exceed the standard deduction. One of the strategies we utilize includes appreciated stock contributions to a Donor Advised Funds (DAF). If you have philanthropic goals, then our team can help evaluate timing and security selection for tax aware giving methods. Your generosity not only helps those in need but can decrease your taxable income for the year. It is important to note, if you do not itemize, your charitable contributions are not deductible but other strategies like Qualified Charitable Distributions (QCDs) may be an alternative.

Schedule C

If you are a sole proprietor, you should also have Schedule C included in your tax return. This form indicates any profit or loss your business experienced throughout the year. We use this to help us determine if it would be beneficial to take any gains or losses in your account to offset the profits or losses from your business. We can also incorporate the income streams and a future business sale into your financial evaluation. Seeing Schedule C typically leads into a conversation about retirement contributions and if a self-employed 401K or other retirement plan is appropriate.

Schedule D

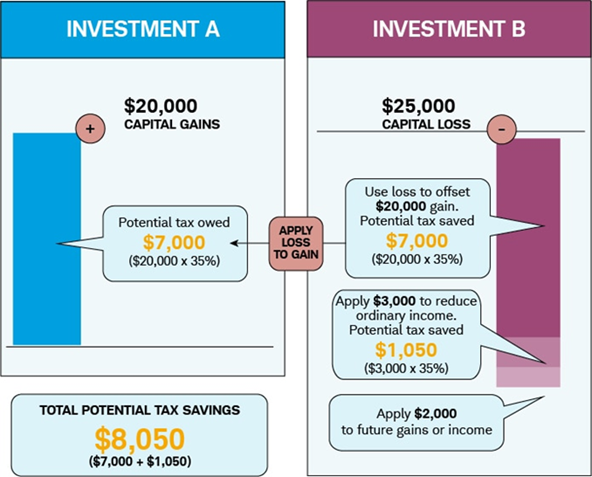

Schedule D reports capital gains and losses. Our team actively seeks to limit capital gains each year, through tax loss harvesting. This strategy includes taking losses (if available) to offset capital gains in taxable accounts. Occasionally, a client will have capital losses that exceed gains. In this instance you may deduct up to $3,000 ($1,500 if married filing separately) against ordinary income on your 1040 and carry forward the remaining losses to future years.

Sourced from: https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

In periods of extreme volatility, this strategy can be used proactively so unused losses can be used to offset future gains when the market recovers. This method along with other tactics are used to successfully reduce concentrated positions over time while limiting adverse tax consequences. As part of our ongoing investment management services, we actively seek to buy and sell securities with a tax conscious approach.

Schedule E

Many of our clients own rental properties, receive royalties, own S corporations, or receive income from estates and trusts. Schedule E is where the income and losses from those avenues are reported. Our advisors review this form to gain better understanding of your financial situation and can work different scenarios into financial evaluations.

1040-ES and Vouchers

These vouchers help our team plan out cash flows throughout the year. Understanding your cash needs allows our team to accumulate cash and send funds to your bank proactively to help cover quarterly tax estimated payments.

How Weatherly Can Help

The Weatherly team takes pride in our ability to create tax efficient strategies specific to each client so they can ultimately keep more money in their pockets. Each client not only has their own unique situation, but tax and estate laws can change. A current tax return allows us to identify any new planning opportunities for the year and assists in our tax conscious investment approach.

If you haven’t already done so, please send us your tax return by utilizing our secure portal or another secure method. If easier, feel free to connect us with your tax preparer and we can request the return directly from them. We work closely with many tax professionals to securely share tax documents and to collaborate on any tax planning initiatives.

As always, we welcome your questions and look forward to saving you money!

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

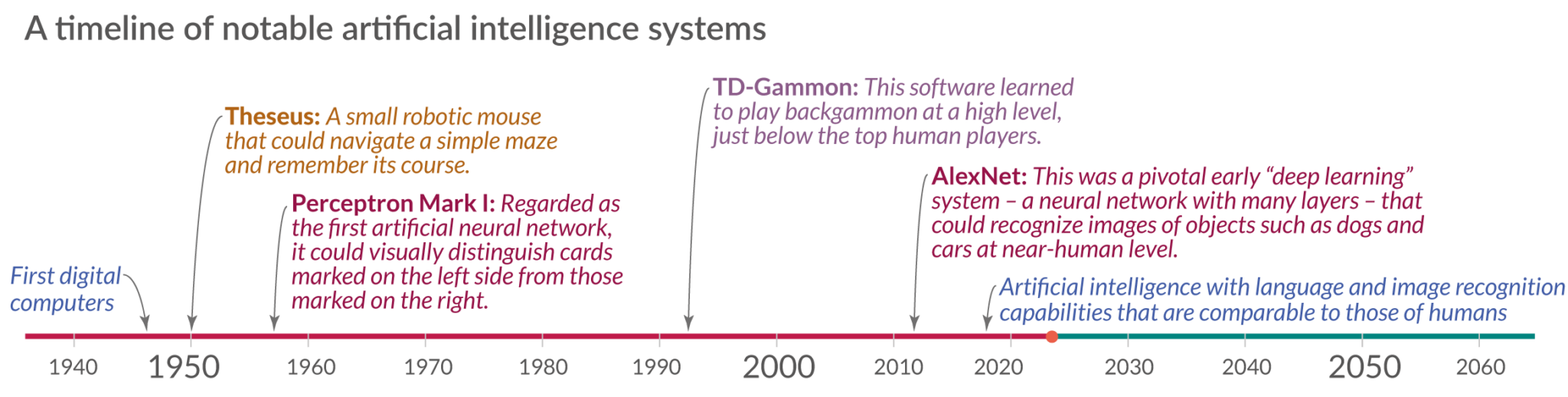

Artificial Intelligence, or its short form AI, is a term new to many people, but did you know that it has been around since the 1950s? In fact, AI has already woven itself into our day to day lives. While it is easier to identify certain technology that has been considered “life changing” such as the internet, social media and smart phones, AI helps drive these technological advancements. The broader technology sector has grown from the smallest sector by weight in the S&P500 to the largest sector within a handful of decades, and the spillover effect of technology has transformed other industries leading to overall growth in the global economy.

Timeline sourced from: Our World in Data

Today, AI is being popularized once again with large companies spending billions of dollars to back chatbot programs like ChatGPT, Microsoft’s revamp of Bing and Google’s newly released Bard. While AI and technology have had a relatively short existence, the snowball effect is leading to new opportunities and concerns for what the future might hold. With more companies beginning to weigh in on the potential impact of this new tech landscape, Weatherly has been observing opportunities for investment, identifying potential concerns and embracing ways to enhance our client experience.

The Good – AI Present and Future

With new applications and possibilities, advancements in artificial intelligence have impacted almost every industry and profession.

Education – Today, AI is being used to improve courses, grade papers and create interactive exams. The future holds a more personalized education system which can identify weaknesses and create teaching methods and adaptive programs specific to a student’s special education needs and learning styles. With AI to assist, students can have a more well-rounded knowledge base or choose to specialize in a certain area.

Legal – Though AI is more likely to aid than replace attorneys in the near term, its use to review contracts, find relevant documents in the discovery process, and conduct legal research has helped to eliminate some of most tedious tasks for lawyers. The use of AI in the legal sector has the potential to improve the efficiency and accuracy of legal services, while also reducing the cost for clients.

Health Care – While not a replacement for human doctors and healthcare providers, AI technologies have created unprecedented opportunities in the medical field. Currently, AI is being used to automate administrative tasks such as pre-authorizing insurance, following up on unpaid bills, and maintaining records. Additionally, the capabilities for AI powered programs to analyze vast amounts of data and detect information that may not be apparent to the human eye, can facilitate targeted cancer therapies such as radiation, and could lead to a radical impact on early detection of diseases, diagnosis, and treatment recommendations.

Travel/Transportation – At present, AI is very involved with how we get from point A to point B. Whether it’s a navigation app on a smart phone or an airline company using AI to determine ticket prices. With AI technology people can even be physically moved in a self-driving car. While this future is already here, it is still evolving and some consumers remain skeptical.

The Bad – The Consequences and Concerns of AI in Society

Despite its benefits, there are serious concerns about the impact of AI. Some of the major potential negatives to consider are:

Job displacement – As machines and algorithms are able to perform tasks previously done by humans with superior speed and accuracy, there could be a potential for job losses in many industries.

Bias and discrimination – AI systems have the potential to be biased and discriminatory if the data they are trained on is biased or designed with implicit biases. This can lead to unfair treatment and negative unintended consequences.

Privacy- AI systems thrive on collecting and analyzing large amounts of data, including personal data. This raises major concerns about privacy and security.

Lack of transparency – AI systems are complex and difficult to understand, making it especially difficult to determine how decisions are being made. This also raises concern for how to hold companies and organizations accountable for their actions when artificial intelligence was a factor in the decision-making process.

Ethical – Should machines and other AI software be granted legal rights? Can AI be trusted with decision making despite its lack of ethical, moral, and other human considerations?

Although advancements are continuously occurring, it remains clear that technologies struggle to provide the meaning, value, and creativity that real humans can.

AI and Weatherly

At Weatherly, it is our intent to embrace the good technology has to offer and protect ourselves (and you) against the bad. We seek to identify new technology to advance our business and serve our clients in the most efficient way possible while remaining cognizant of overall risk.

Our reporting tools are used to enhance what we do by analyzing a wide scope of data so that we can stay informed and provide accurate real-time updates. To help ensure our clients don’t outlive their assets, we use financial planning software and create alternative scenarios to outline future risks and opportunities. While we can generate countless reports and scenarios the true value and real understanding occurs when we verbalize the key outcomes.

We have also fully embraced automation in processes such as account opening and document verification. We have seen huge successes and advances in the turnaround times of account establishment through our custodian’s e-tools, as well as document verification through DocuSign e-signature.

Additionally, we remain on high alert to the threat of cyber-attacks. It is our best practice to utilize the Weatherly Portal for the secure exchange of information and are always happy to serve as a resource of how to protect yourself and loved ones against the ongoing threat of cybercrime. Check out our 7 Steps to Better Cyber Security for some quick tips!

At Weatherly we pride ourselves on providing high quality, holistic, and innovative wealth management service. It is our duty to use and embrace technology in a responsible and ethical manner to enhance what we do, not as a replacement to our expertise and experience.

We strive to pair human knowledge and common sense with modern technology to maximize efficiency and deliver information in an easy to digest way.

Resources –

https://ourworldindata.org/brief-history-of-ai

https://builtin.com/artificial-intelligence

https://www.pwc.com.au/digitalpulse/report-pwc-global-ceo-survey-ai-skills.html

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

During times of slowing growth and economic uncertainty the thought of one’s own employment can come into question. Whether you have another job lined up, are transitioning to retirement or planning to take a break between careers, there are several emotional and financial items to carefully consider. For some it’s an opportunity and others an obstacle to overcome. In either event, being prepared and having a plan of action will set you on a road to success. Once the decision is made, the next step is to take inventory of your financial life, including benefits offered by your employer.

What is the financial impact of this change?

If you have already sought out employment, is the move lateral or are you receiving a bump in salary and other benefits? If you are retiring or considering gap years before re-entering the workforce, do you have the assets and income to support your living expenses?

The answers to these questions will impact your financial plan, which is a dynamic way to review multiple outcomes in your savings/spending equation.

It’s also prudent to review your personal balance sheet and review opportunities to improve your debt-to-equity ratio. For example, if you were considering a financing home or car purchase, refinancing or obtaining a home equity line of credit (HELOC), you may want to take steps to secure a loan prior to making a change.

If you were laid off from your employer, you may also be able to collect unemployment benefits.

Take an inventory of the benefits provided by your current employer.

Benefits include more than salary, retirement plans and health care coverage. Many companies also offer compensation in the form of stock options, bonuses, pension plans and deferred compensation. It critical to review the following:

☐ Salary and bonus structure – are you able to receive severance pay or a partial bonus if the transition occurs mid-year?

-

-

- Many employers also compensate for unused vacation and PTO days.

-

☐ Retirement plans – did you max out your retirement plan contribution for the year? The current year contribution limits can be found on our website here.

-

-

- If you have an employer match, are the matches fully vested?

-

☐ Stock options – vesting schedules also apply to stock options. There are numerous types of options and some of the more common types can be found here. Complexity and planning opportunities can vary per individual so it’s an opportunity to work with your advisor to help navigate.

☐ Other executive compensation packages – incentive packages can also include things like pensions and deferred compensation. Depending on if you are retiring or leaving a job involuntarily, these benefits may be accelerated (paid out early) or eliminated. If benefits are paid out immediately upon retirement or resignation, this may create a tax liability for the departing employee.

☐ Health care – if you are covered by your employers’ heath care plan and not moving immediately to a new company, you may be able to continue benefits under COBRA.

☐ Parental and family leave – if you are considering growing your family or may need time off to care for dependents, it’s important to know what options your company supports for paid leave.

There are also intangible considerations when moving to a new company.

Tangible benefits, like those listed above, provide financial security. Intangible benefits offer personal fulfillment. It’s important to weigh the pros and cons of both benefit types when considering a change.

Examples of intangible benefits include:

- Company culture – do the company’s values align with your own values and ethics?

- Aside from strong values, many companies have well-being programs that are supportive of healthy living.

- Opportunities for education and collaboration – many employers reimburse for higher education expenses and offer growth trajectories to advance careers.

- Flexible work hours and/or hybrid work set up – after the abrupt shift to remote work at the start of 2020, many workplaces retained a hybrid work set up or offered flexible work hours so employees can maintain control their schedules.

- If you are required to work on site, and the company is located somewhere other than where you currently reside, what is the difference in cost of living?

- Work/life balance – do the new company’s expectations and work place policies allow for a work/life balance?

Be prepared for your current employer to counter your new opportunity if you are continuing in the workforce. Employers want to retain good talent, and they may be able to increase salaries or offer more benefits in order to do so.

What to account for when transitioning from your prior employer

Whether you’re transitioning to another employment opportunity or heading into the golden years there are various items to be aware of from a professional and personal standpoint that should be reviewed, including:

☐ Open communication with your employer and manager.

-

-

- Set time with HR

- Employers will often need to backfill your position which takes time and resources to train or hire your replacement and providing sufficient notice allows them to plan accordingly.

- This will also help ensure that you leave on good terms with the company and avoid burning bridges on your way out.

-

☐ Archiving any personal or permissible resources.

-

-

- Whether by design or accident people often commingle their personal life and work devices so it is important to review that you have transferred or saved these items elsewhere.

- Additionally, there may be useful company resources that may be allowed for you to take with you. Be sure to run these by HR to avoid any legal issues.

-

☐ Employer sponsored plans and benefits to review with HR.

-

-

- If you have a retirement plan or other benefits with the employer such as a 401(k), profit sharing or stock options for example it is important to review what options are available to you.

- In general, you can either keep retirement accounts within the company plan, roll it into an IRA, or transfer it to your new employer.

-

☐ Stock options: Reviewing whether they are transferable or if they would need to be exercised prior to leaving. It’s likely unvested shares will be forfeited and should be accounted for in the pros and cons list we spoke to earlier.

☐ Health Care: Life happens and it’s critical to ensure there is no gap in your health care coverage.

-

-

- If you are leaving the workforce or have a gap in employment, be sure to review your coverage options. Common options available are COBRA, purchasing a plan through a private marketplace, or enrolling in Medicare if 65 or older.

- Premiums will vary between these options so it’s important to review based on your situation and level of coverage.

- If you have life insurance through your employer, it may be portable and allow you to continue coverage and take over premium payments. Check with HR if this option is available to you.

- If you are leaving the workforce or have a gap in employment, be sure to review your coverage options. Common options available are COBRA, purchasing a plan through a private marketplace, or enrolling in Medicare if 65 or older.

-

☐ Review your final paycheck to verify that any accrued PTO or sick days have accounted for and that any pro-rated compensation is accurate.

Considerations if you are Starting your own Business

As small business owners ourselves, Weatherly works closely with entrepreneurs and business owners on their own planning.

For solo practitioners, self-employed 401ks can be an attractive way to continue to build on retirement assets. Many expenses may also be deductible on your tax return, including home office square footage, utilities, and some health insurance premiums.

Sailing off into the Sunset

You’ve worked hard throughout your career and with retirement on the horizon there is much to look forward to. Many of the items we’ve touched on in this blog apply to retirees from running a Financial Plan, taking inventory of your assets, cash flow planning, and securing health care coverage post-employment.

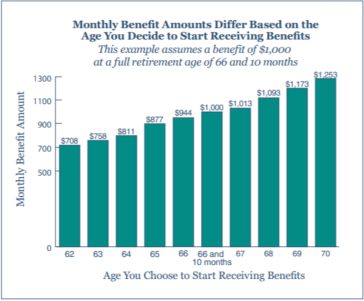

Social Security plays a critical role in the transition to part-time work or retirement. Be sure to review your retirement benefits and cash flows for planning opportunities such as claiming benefits at your Full Retirement Age or potentially delaying. You can review your eligibility and benefits at different ages here.

Whether you’re retiring partially through the year or the end we often recommend individuals max out their employer sponsored retirement plans reducing taxable earnings and continue to build savings. You may need to change your contribution rate in order to max out the plan if you’re not working the full year. We also recommend checking in with your tax professional to confirm if any withholding adjustments are needed.

An equally important aspect of transitioning to retirement and often overlooked is aligning the portfolio’s asset allocation based on the time horizon and risk tolerance. Many individuals will rely on the portfolio to fund their goals and expenses over their lifetime so it’s essential to ensure the asset allocation is appropriate for the needs of the investor.

How Weatherly can help

As we’ve outlined in this blog there is much to consider when transitioning either to a new employer or into retirement. While these are some of the more common topics to review, the dynamics of each individual’s professional and personal life will differ in some way. Weatherly is here to help bridge the gap and work with you to identify the impact of your options over the short and long-term.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

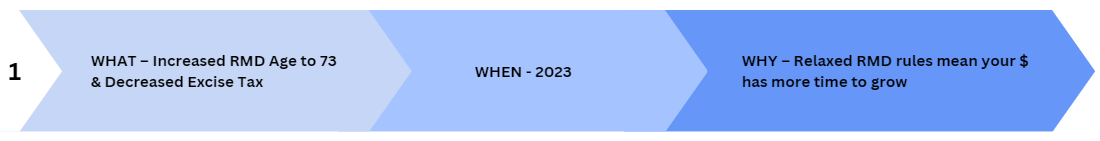

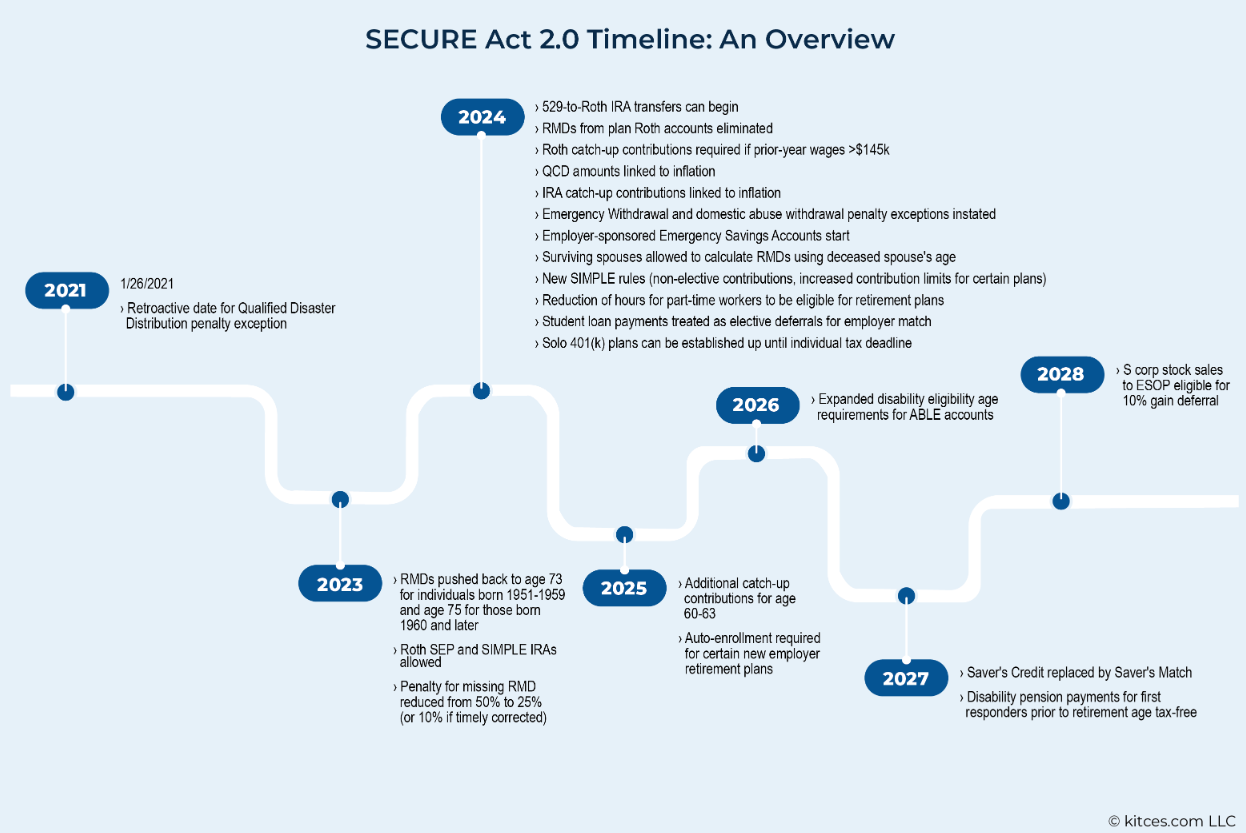

The Secure Act 2.0 is the newest version of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which was originally signed into law in December 2019 and recently updated in December 2022. It is important to note- the Secure Act is designed to help Americans save for retirement and will create more flexibility for retirement savers. These 92 provisions will make it easier to access retirement savings and increase the amount one can save for retirement. Additionally, the Secure Act 2.0 provides incentives for employers to offer retirement plans by expanding employer benefits and tax credits. In this blog, we will review the six key features of The Secure Act 2.0, its effect on clients, and how Weatherly can help navigate the planning opportunities that are created.

The Secure Act 2.0 is an important piece of legislation that has been passed to help

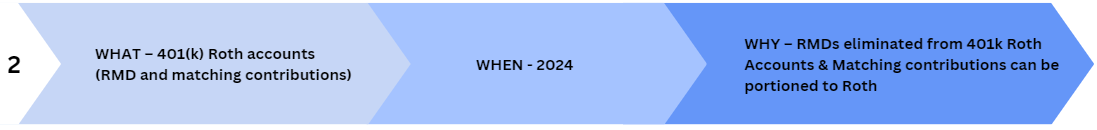

Another major development in the retirement savings landscape is the elimination of required minimum distributions (RMDs) from Roth accounts within 401(k) and other defined contribution plans. As a reminder, a “normal” Roth IRA account is never subject to RMD unless inherited, this is only in reference to 401(k) and other DC Plan Roth accounts. This means that individuals can now save more of their retirement funds for the future without having to worry about meeting RMD requirements. Additionally, the Act allows employers to make matching contributions to their employees’ Roth accounts (after previously only allowing pre-tax). This provides added incentive to save for retirement, giving individuals more flexibility and control over their retirement savings and allowing them to better plan for their future.

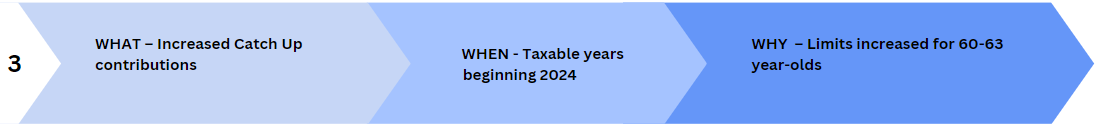

The Secure Act 2.0 has increased catch-up amounts in employer retirement plans for individuals aged 50 or older. This means that those individuals can make catch-up contributions to their 401(k), 403(b) or 457(b) plans, up to a limit of $7,500 for 2023. Starting in 2025, the limit is raised to 50% more than the regular catch-up limit for individuals aged 60 to 63. This is a major step in helping individuals save for retirement and ensuring that they have enough funds to live comfortably in their later years.

For more information please refer to Weatherly’s Key Financial Data Chart

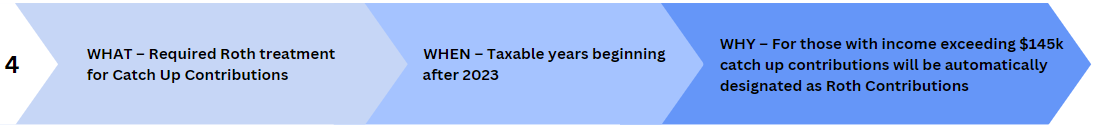

Beginning in 2024, the Secure Act 2.0 has a provision that states if an individual’s income is over $145,000, any catch-up contributions made to their retirement savings accounts must be Roth contributions. Roth contributions are made with after-tax dollars, meaning that the contributions are not tax-deductible. However, the money grows tax-free and can be withdrawn tax-free in retirement. This provision of the Secure Act 2.0 is intended to help individuals save more for retirement, while also providing tax benefits.

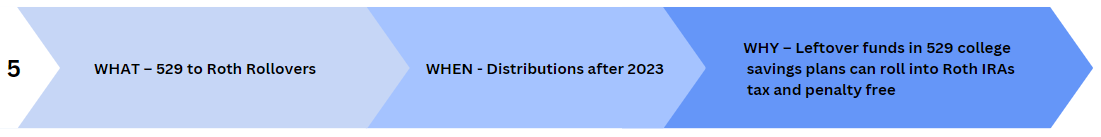

The Secure Act 2.0 has introduced an exciting new planning opportunity for parents wanting to balance retirement savings with college savings. 529 education accounts can now be rolled over to Roth IRAs for 529 beneficiaries, tax and penalty-free, if the 529 account has been open for at least 15 years. To avoid manipulation of the new rule, the 15-year clock is reset every time a beneficiary on the 529 is changed. The annual rollover amount is limited to the annual Roth contribution amount ($6,500 for 2023) and the rollover must be from earned income. Furthermore, there is a maximum lifetime rollover amount of $35k. This new provision provides a great opportunity for parents to plan for their children’s college expenses while also saving for their own retirement.

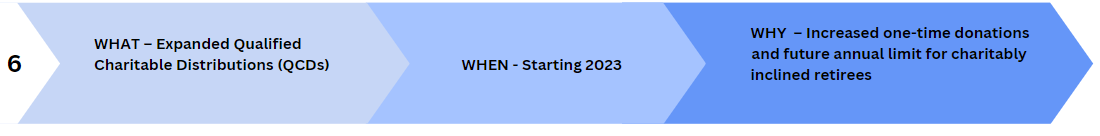

A QCD allows individuals who are 70.5 or older to donate up to $100,000 directly to one or more charities from a Taxable IRA instead of taking their RMD. Under SECURE 2.0 the QCD rules are expanded to allow for a one-time $50,000 distribution to a charity through a split-interest entity. This $50K distribution can go to one of the following- charitable gift annuities (CGA), charitable remainder unitrusts (CRUT), and charitable remainder annuity trusts (CRAT). Beginning in 2024, the $100K annual limit on QCDs will be indexed for inflation.

For more information on QCDs refer to WAM’s previous blog – Guide to Giving

Bonus – Impact on employers – auto enrollment 401(k) 403(b)

The Secure Act 2.0 includes a provision for auto enrollment in 401(k) and 403(b) plans. This means that employers now automatically enroll their employees in these retirement plans, unless the employee opts out. This is a great way to encourage employees to save for retirement, as it removes the burden of having to actively sign up for a plan. Additionally, employers can also choose to increase the default contribution rate over time, which can help employees save more for retirement. This provision of the Secure Act 2.0 can be a great way to help employees save for retirement and ensure that they are able to retire comfortably.

In Conclusion

Overall, the SECURE 2.0 is an important step forward in helping Americans save for retirement and secure their financial future. These new rules will continue to change retirement savings and retirement plan distributions over the next few years. We will continue to remain diligent in how that affects you as our clients and individuals. These provisions can be complex and everyone’s financial situation is different, reach out to your Weatherly Advisor today to learn more about how the Secure Act 2.0 changes apply to you.

Timeline of rollout and enforcement of provisions, see attachment:

Chart Sourced from: Kitces

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

When it comes to life, few gifts are more valuable than financial advice. As young professionals and their families navigate the complexities of today’s world, financial planning is essential in helping them reach various milestones in life. Whether they are just beginning their career, starting a family, or beginning to plan for retirement, a financial advisor can be an invaluable asset.

“Industry studies estimate that financial advice can add between 1.5% and 4% per year to account growth over extended periods.” Source: Fidelity

For young professionals and new families just getting started, having an advisor who takes a holistic approach to your situation can add tremendous value and have a long-term impact. A good financial advisor will help create a plan that considers income, expenses, and long-term goals, to optimize cash flow. In addition, they will help identify areas where money can be saved or invested for long-term objectives, like retirement or college savings plans for children. An experienced financial planner can also guide clients through the nuances of tax mitigation strategies and estate planning considerations.

In this blog post, we will discuss these topics in more detail alongside the benefits of working with an experienced wealth management advisor on the journey to financial success.

Cash Flow Optimization:

For young professionals and families, financial planning can be one of the most intimidating aspects of life. One of the critical steps in achieving your financial goals is to understand how to optimize cash flow between discretionary and non-discretionary spending, 401K contributions, and 529 college savings plans. This can help provide clarity around how to achieve financial goals in the short term and long term.

Non-Discretionary vs. Discretionary Spending

When it comes to allocating a paycheck, there are several factors to consider. First, it is vital to set aside money for essential expenses such as rent or mortgage payments, insurance premiums, utilities, food, gas/transportation, and other necessary living costs. Additionally, it is prudent to establish an emergency fund with at least three to six months’ worth of expenses. These items should take precedence over any other form of spending or saving.

Retirement Contributions

After assessing the difference between non-discretionary and discretionary spending it is essential to think strategically about how the remaining funds should be allocated between retirement savings (401k) and college savings (529), as applicable. Through dialogue with a WAM advisor, we can offer tailored advice on what you should prioritize based on your individual goals.

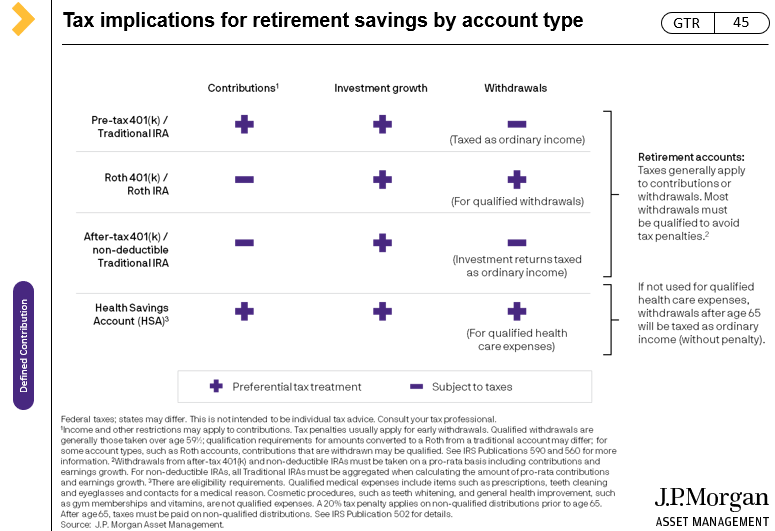

Contributing to a 401K is often a great idea because of its tax advantages and investment options available through employer plans. Often, 401K plans come in two forms: a Traditional or a Roth option. Traditional 401K contributions are made before taxes, which offers a tax deduction today, and grow tax-free until funds are withdrawn in retirement. Conversely, the Roth option consists of after-tax contributions, with no tax deduction today, but no taxes are owed upon withdrawal during retirement.

Source: JP Morgan Guide to Retirement (page 45)

Additionally, by working with one of our advisors, we can assist in recommending an appropriate asset allocation strategy for your retirement funds, based on your risk tolerance and investment goals. Another benefit of participating in a company’s 401K plan is that many employers will match contributions up to a certain amount – this provides an excellent incentive to save more and get the maximum benefits from the plan.

College Savings Plans

Regarding college savings plans, 529s are the most popular vehicles due to their tax advantaged nature. Contributions to these plans are made with after-tax dollars, but the earnings grow tax-free and can be withdrawn tax-free when used for qualified higher education expenses. Additionally, many states offer tax deductions or credits for contributions to a 529 plan, making it an even more attractive option for millennials looking to optimize their cash flow. The WAM team can help facilitate the establishment of 529 accounts to ease the burden of increasing educational costs.

Tax Mitigation Strategies:

Young professionals face unique financial challenges, and it is important to understand the best strategies for managing their money. One of the most important financial strategies for millennials is tax mitigation. Tax mitigation strategies include utilizing a Roth IRA, taking full advantage of their mortgage, and utilizing other applicable tax credits/deductions.

Roth IRA

In addition to the benefits above, if you have a Roth IRA for more than five years, there are no taxes or penalties when withdrawing earnings for a first-time home purchase, up to $10,000.

Tax Loss Harvesting

Tax loss harvesting is an effective way for investors to reduce their taxable income by selling investments at a loss in order to offset any realized gains from appreciating investments. In a year characterized by stock market losses, you may find that there are few opportunities to offset gains in your investment accounts. If that is the case, you can still utilize the lax loss carry-forward which will allow you to offset capital gains in future years. Alternatively, the IRS allows an individual to use $3,000 of capital losses per year to offset ordinary income. This technique can assist in tax mitigation throughout your lifetime if used properly.

Mortgage Deductions

Mortgage interest payments are deductible from your taxable income when filing taxes which can significantly reduce liability owed. This deduction applies to both primary residences (purchased or refinanced) as well as second homes such as vacation properties or rental properties that may generate rental income or be used for recreational use. If your home was purchased after December 15th, 2017 you are allowed to deduct interest on the first $750,000 of the mortgage. Additionally, if you have a HELOC you may deduct up to a max of $100,000 in interest.

Child Tax Credit

The Child Tax Credit is available for parents who have dependent children under the age of 17 living with them full time in the United States. The Child Tax Credit can be claimed up to $2,000 per qualifying dependent with half being refundable if certain criteria are met such as adjusted gross income (AGI). Additionally, if AGI exceeds certain thresholds, then this credit may be reduced or phased out completely.

Charitable Contributions

In a recent study conducted by Fidelity Charitable, they found that approximately 74% of millennials consider themselves philanthropists. With the future of philanthropy in the hands of the next generation, please refer to WAM’s Guide to Giving to learn about the most tax-efficient ways to maximize charitable contributions to influence the world in a positive way.

Estate Planning:

Millennials are the largest generation in the United States, and it is important for them to start planning for their future. An estate plan is one of the best ways to ensure their wishes are followed and their assets are handled appropriately in the event of their death or incapacity. A comprehensive estate plan should include a trust, will, power of attorney, and health care power of attorney.

Trust

A trust is an important document to have in an estate plan. It can be used to protect assets, provide for minor children, and manage assets in the event of incapacity or death. Assets that are listed within the trust will avoid probate court, saving your family members valuable time and expenses. There are several types of trusts all with varying implications.

Will

A will is another important part of an estate plan. It allows a person to designate beneficiaries, provide instructions for how and when beneficiaries receive assets, and can name guardians for minor children.

Power of Attorney/Health Care Power of Attorney

A power of attorney and health care power of attorney are also important documents to have in an estate plan. A power of attorney allows a person to appoint someone to manage their finances and legal affairs in the event of their incapacity. While a health care power of attorney is a document that allows an individual to designate someone to carry out their health care directives in the event of incapacity.

These four essential documents are important because they allow you to specify what you want to happen to your property and assets after you pass away. These documents can also help to protect your loved ones and ensure that your wishes are carried out according to your specifications. Without these documents, your property and assets may be distributed according to state law, which may not be in line with your wishes. Additionally, estate planning documents can help minimize taxes and other expenses and can provide guidance to your loved ones during a difficult time.

Why Work with a Weatherly Advisor:

Younger investors are looking for ways to manage their cash flow, make sound investment decisions, and protect their wealth. Working with our experienced professionals at Weatherly can help achieve these goals efficiently.

Advisors can help young professionals optimize their budget, save and invest, and provide tailored advice on tax mitigation strategies, such as understanding deductions and knowing which tax credits apply in different scenarios. Financial advisors can also help young families create realistic estate plans that prioritize their goals while minimizing the potential impact of taxes or other liabilities.

Learn more about our services and how our customized approach may benefit you or your family:

https://www.weatherlyassetmgt.com/our-services/

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

It’s that time of the year again when we celebrate Thanksgiving and start preparing for year end! For many of our clients it is an opportunity to give thanks and give back to their communities in the form of charitable donations. The charitable landscape has grown significantly during the last couple of decades and progressed even further in recent years in the midst of a global pandemic, Russia/Ukraine war, and global inflation. In 2021 alone, charitable giving by Americans totaled $484.85 billion, up approximately 4% from the prior year. Donations are most impactful when there is a specific need, and we have seen our fair share of new challenges in recent years.

While the most common way to give is in the form of cash or check, it isn’t always the most tax efficient method to give to charity. In this blog post, we outline tax efficient strategies to help maximize charitable giving in hopes to have a positive influence on the world.

Donor Advised Fund (DAF)

A Donor Advised Fund (DAF) allows donors to contribute appreciated assets to a charitable account and capture a current year tax deduction*. The funds can then be invested tax free until they are granted out over time to qualified 501c3 public charities.

The ins and outs of the DAF is best summarized by the three Gs- Give, Grow and Grant.

Give→

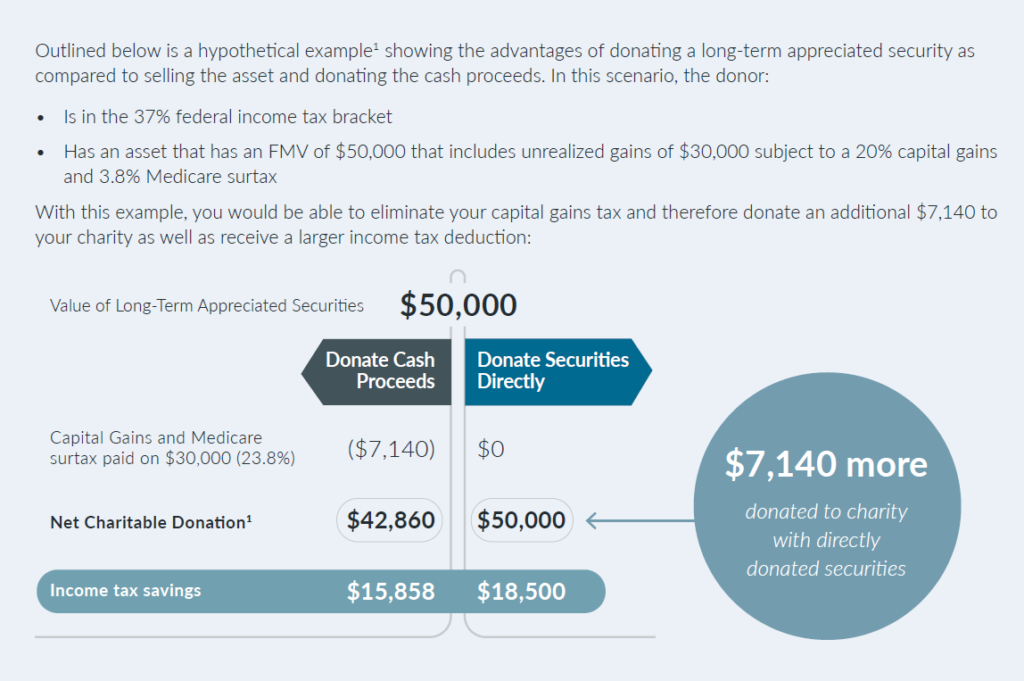

For a current year tax deduction*, donors can make an irrevocable contribution of cash, publicly held and some privately held assets prior to December 31. While the DAF does allow for cash donations, contributing a long term, appreciated asset may allow the donor to deduct the Fair Market Value (FMV) of the asset and effectively eliminate the associated capital gain tax implications had the donor sold the asset and donated cash. Donating appreciated securities typically results in a larger deduction and more money for the end charity, as the following example illustrates:

Chart Sourced from Fidelity Charitable

Tax Benefits:

Donors who itemize their deductions can have their turkey and “gravy”, too, as they may be eligible for a tax deduction* in the year an appreciated asset contribution is made to a DAF, with some Adjusted Gross Income (AGI) limitations:

Chart Sourced from Fidelity Charitable

Although the AGI figures above may limit your current year deduction, any unused amount that exceeds the limits can be carried forward and deducted within the next 5 years. For this reason, charitable giving and year end tax planning should have a seat at the same table to ensure charitable intent and tax benefits are aligned.

Grow →

Once the assets are transferred into the DAF, most large custodians allow the funds to be invested for potential tax-free growth.

Grant →

Since tax deductions are captured on the front end, when assets were initially contributed to the account, it allows the donors to take their time in granting out to 501c3 public charities. This may come in subsequent years or whenever the donor is ready.

DAF Strategies to consider –

• Contribute long term, highly appreciated securities and/or to limit concentration risk in a portfolio: The Weatherly team can assist in opening a DAF and subsequent asset selection to fund the account.

• Consider a Bunching strategy in high income tax years: If income is higher in a particular tax year, multiple year’s worth of contributions can be “bunched” into the high-income tax year for a larger deduction. Donors can then take their time granting out the funds in future years.

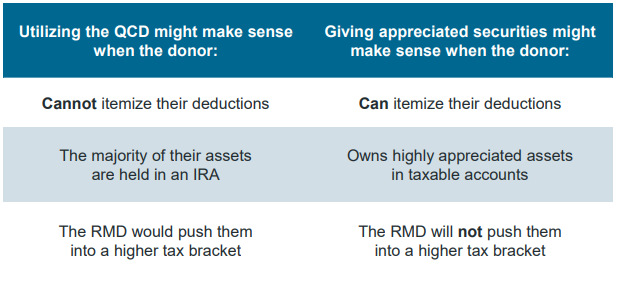

Qualified Charitable Distribution (QCD)

A Qualified Charitable Distribution (QCD) allows an individual age 70.5 or older to donate up to $100K per year from IRAs directly to one or more charities. These distributions are not included in taxable income and can be beneficial for those taking Required Minimum Distributions (RMD) at age 72 and/or claiming the standard deduction.

QCD client example:

A now retired married couple, Mr. And Mrs. Awesome, worked hard and saved some money in the Awesome Family Trust, but much of their savings were through salary deferrals to their employer’s 401k plans. Since retiring, they have rolled their 401ks into IRA accounts. For the current tax year, Mrs. Awesome, age 75, has an IRA RMD of $50k. Mr. Awesome is not RMD age, 72, yet. The Awesome’s paid off their home mortgage and therefore, anticipate they will take the standard deduction for this tax year. They have minimal expenses and can live off their Social Security Income and pension income, totaling around $250k a year.

As they adjust to retirement, a big goal is to continue their annual charitable donations of $50k. The Awesome’s advisor recommends they complete a QCD direct from Mrs. Awesome’s IRA to the various charities they are passionate about. Since they do not need the RMD income, Mrs. Awesome selects 5 different charities to give $10k in QCDs to, and therefore, satisfying her RMD requirement for the year. They can meet their philanthropic goals without itemizing their deductions and get to exclude $50k from their taxable income.

The next tax year, Mrs. Awesome’s IRA RMD is approximately $60k. After a few dialogues, the Awesome’s decide that they would like to be consist with their $50k annual gifting goal. Their advisor helps them complete the same 5 QCDs of $10k each. The remaining $10k RMD is sent to the Awesome’s Family Trust and is included in their taxable income for the year.

QCD Strategies to consider:

• Using QCDs to satisfy a portion or entire RMD for the year can limit taxable income and keep you in a lower overall tax bracket.

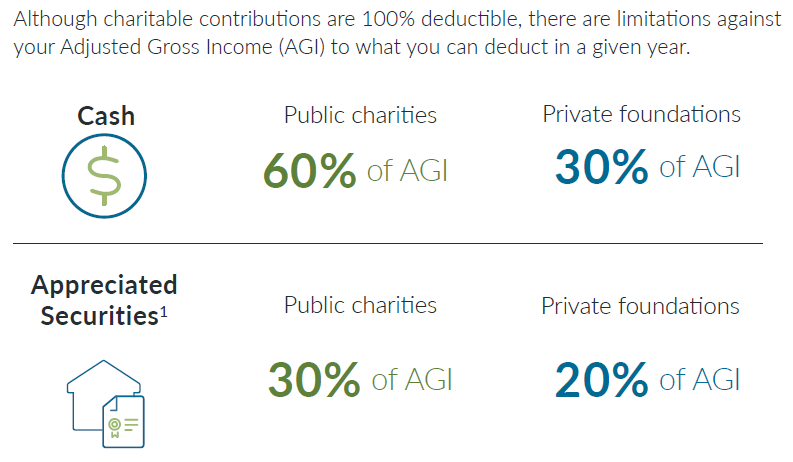

• The chart below highlights a typical client profile for a QCD strategy versus giving appreciated securities to a DAF:

Appreciated Stock Donation to DAF vs QCD Strategy

Chart Sourced from Fidelity Charitable

Charitable Trusts and Estate Planning

For Ultra High Net Worth and philanthropic individuals, more complex strategies can be considered as part of an estate and legacy plan. Depending on the donor’s philanthropic and estate planning goals, Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs) can create income streams for an individual or a charity for a certain period with the remaining balance going to a charity or other heirs. These types of trusts pair philanthropy with other financial goals and can even help reduce estate taxes. The Weatherly team is here to coordinate with your estate attorney to ensure these trusts are set up correctly and with your tax professional to determine initial funding and tax deductions.

Another item that combines charitable giving with estate and legacy planning would be to list a DAF as a beneficiary in your trust or retirement account. This allows for ultimate flexibility as a DAF successor can be updated at any time without involving an estate attorney. Donors can list either individual(s) or public charity(ies) as successors on the account. If an individual is listed as successor, then the successor takes over the DAF at the original accountholder’s passing and can donate to charities as they wish. This could be used to start the family conversation surrounding wealth and/or help carry out the family legacy. If a charity is listed as a successor, the DAF balance will go directly to the charity of your choosing. This can help reduce estate taxes and fulfill charitable goals while maintaining assets during a donor’s lifetime. Consult with your attorney, tax professional and Weatherly before implementing this strategy.

Strategies to consider:

• Incorporating family members in charitable giving and planning.

• Charitable giving at passing can reduce estate tax liability

How Can WAM help?

Your Weatherly team is here to assist in your charitable endeavors while considering your overall tax situations. We can determine the best strategy to facilitate your giving, research charitable organizations and coordinate with your attorney and tax professional as appropriate. We also request tax returns to review prior year giving and to identify strategies going forward. As always, please don’t hesitate to reach out with any questions or to schedule a yearend planning call. In the meantime, we would like to give THANKS to all our clients for our partnership over the years.

*In order to receive a tax deduction for charitable giving, one must itemize deductions on with Schedule A.

Additional Resources:

Top San Diego Charities

Top National Charities

2022 Fidelity Giving Report

2022 Key Financial Data Sheet

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

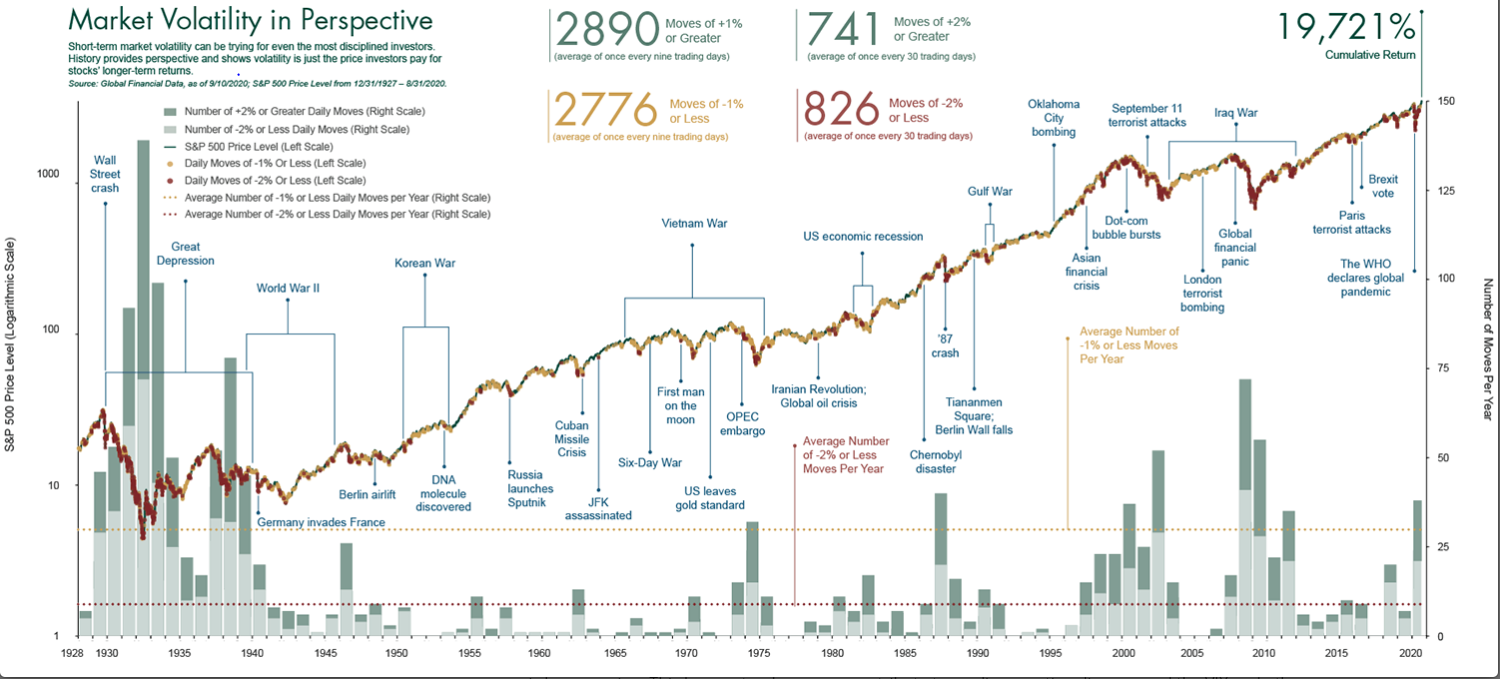

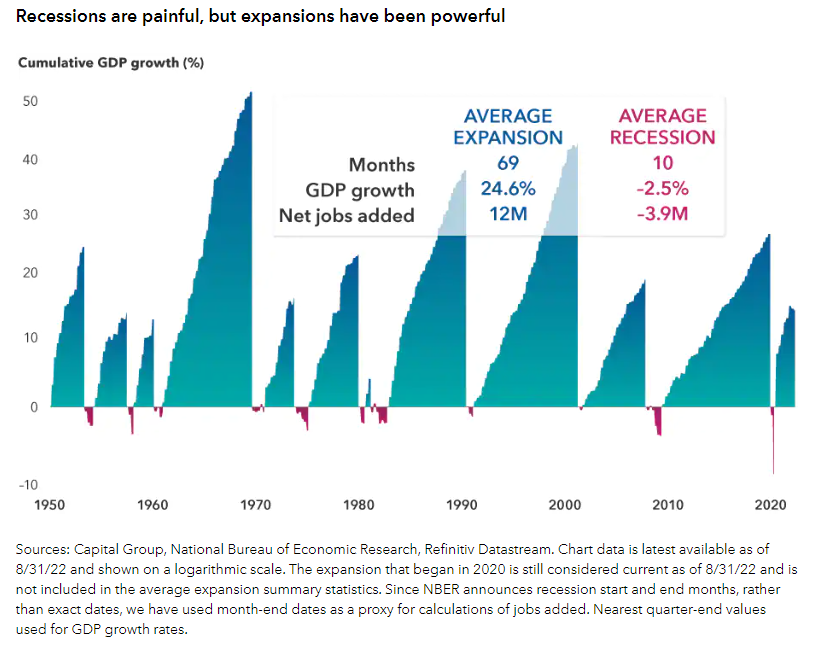

As we emerge from the pandemic, there’s a lot on everyone’s mind- unrelenting health concerns, an upcoming election, escalations on the war in Ukraine, and the highest inflation the US has seen in 40 years. So, it comes as no surprise to us here at Weatherly that our most common client dialog these days begins with “When is the next recession?” And despite Weatherly’s in office crystal ball, we are balancing a historic level of uncertainty and volatility. Therefore, we wanted to take a look at current economic conditions through the lens of past recessions. By putting historical volatility in context, we hope to add perspective on current market uncertainty.

As we emerge from the pandemic, there’s a lot on everyone’s mind- unrelenting health concerns, an upcoming election, escalations on the war in Ukraine, and the highest inflation the US has seen in 40 years. So, it comes as no surprise to us here at Weatherly that our most common client dialog these days begins with “When is the next recession?” And despite Weatherly’s in office crystal ball, we are balancing a historic level of uncertainty and volatility. Therefore, we wanted to take a look at current economic conditions through the lens of past recessions. By putting historical volatility in context, we hope to add perspective on current market uncertainty.

What is a Recession?

A recession is a slowdown or contraction of the economy over a business cycle and is often defined as two consecutive quarters of negative gross domestic product, or GDP. However, in the US we have the National Bureau of Economic Research (NBER), who ultimately makes recession related determinations. NBER has expanded the definition of recession beyond GDP to capture a range of indicators such as real personal income, employment, personal consumption spending, wholesale-retail sales, and industrial production.

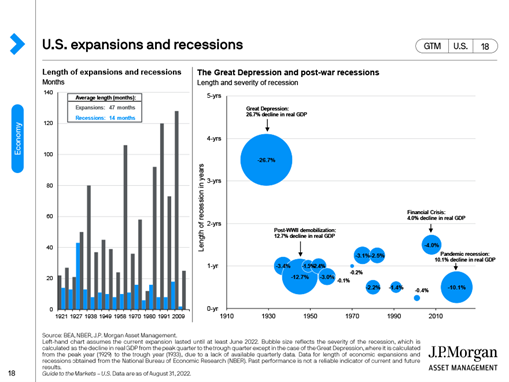

Since the Great Depression of the early 1930s, there have been 14 US recessions. An important observation is that historical recessions are relatively small blips in economic history and are relatively short lived. Over the last 100 years- the average recession has lasted 14 months, while the average expansion was 47 months (JP Morgan’s Guide to the Markets). Similarly, their net economic impact is comparatively small. The average expansion increased GDP by almost 25%, whereas the average recession reduced economic output by 2.5%. All to say, recessions are painful but subsequent recovery can be powerful. For investors with a long-term outlook, recessions can be viewed as an opportunity to deploy capital into assets at a discount.

The Great Depression (1929-1933)

In the 1920s, America bounced back from the disruptions and destruction of World War I. The US economy thrived and Americans dove headfirst into their favorite, newfound wealth generating system – the New York Stock Exchange. During the Roaring Twenties, investors watched the ticker tape and leveraged their bets with historically high levels of margin to trade. Eventually, spending escalated and fueled an unprecedented increase in security pricing which caused assets to be dramatically overvalued. On October 29th, 1929, the bubble burst when the stock market crashed on Black Tuesday- beginning a period of economic contagion now considered to be the biggest recession in US History.

Chart Sourced From: https://www.capitalgroup.com/advisor/insights/articles/guide-to-recessions.html

It’s not easy, even for people who have lived through the economic downturn caused by the COVID-19 pandemic, to grasp the depths of deprivation to which the economy sank during the Great Depression. GDP fell 26.7% and in 1933, unemployment reached a striking 25.6%. The Great Depression triggered a series of economic regulation and reform that revolutionized US financial markets. After Black Tuesday and the collapse of more than 1/5th of American banks by 1933, strict trading and bank regulations were put in place. These updated financial protections were enforced by the newly formed Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC). FDR’s New Deal also expanded the role of the government and introduced an array of services, regulations, and subsidiaries to address the high rates of unemployment and poverty.

The Roosevelt Recession (May 1937 – June 1938)

The Roosevelt Recession pales in comparison to the Great Depression, despite being one of the worst recessions of the 20th century. Sometimes referred to as “the recession within the Depression”, it came before the Great Depression’s recovery was complete. Real GDP fell 11% and industrial production fell 32%, which was widely attributed to a tightening of fiscal and monetary policy related to the New Deal. (Refer to Weatherly’s A Presidential Look at U.S. Taxes for more information) It isn’t until after this recession, in 1939, that the United States economy is thought to have fully recovered from the Great Depression.

Chart Sourced From (Page 18): https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

The Union Recession (February – October 1945)

As the US entered the sixth and final year of World War II, a decline in government spending led to a drop in GDP. The Union Recession was the result of subsequent demobilization and a general shift from wartime to peacetime. This recession got its name from the large increase in union related work stoppages at the time, which directly translated to a decrease in production and subsequent economic output. Contrary to the prognostication of economists at the time, this recession was much slower and shallower than predicted – perhaps due to the conditioned expectations of previous recessions.

The Post-War Recession (November 1948 – October 1949)

Similarly, the Post-War Recession was relatively short- lasting eight months from peak to trough. This recession proved to economists that the US had successfully adapted to the post-World War conditions. In late 1949, another robust expansionary period began that lasted 45 months with 6.9% annual GDP growth.

The Post-Korean War Recession (July 1953 – May 1954)

The Post-Korean War Recession ultimately occurred due to the high level of war related expenditures in the US and subsequent inflationary pressures. During this time, the inflation rate in the US soared from its pre-war 2% to a staggering 10%. To curb inflation, the Fed tightened money supply and the cost of borrowing. Relatively speaking, this was a brief recession- lasting only 10 months from peak to trough.

The Eisenhower Recession (August 1957 – April 1958)

In early 1957, a large influenza outbreak in Asia began to spread to Europe and then the United States by late summer. “The Asian Flu” reduced labor supply and slowed production at the same time the Federal Reserve was tightening interest rates to fight inflation. This stagnated the housing sector and auto sales plummeted. A moderate recession with a wide reach, growth restarted only 8 months later after the Eisenhower administration implemented various stimulus measures. The Federal reserve also pivoted to lower rates to 1.75%.

The “Rolling Adjustment” Recession (April 1960 – February 1961)

A “rolling adjustment” recession occurs when a slowdown in one economic sector has a pervasive effect on the entire economy. This recession occurred in line with the globalization of the automotive industry and subsequent decrease in domestic auto sales/production. During this 10-month recession, GDP declined 2.4% and unemployment reached nearly 7%. The light at the end of the tunnel was a long expansionary period that lasted nine years from 1961 to 1969. Throughout this time, cumulative GDP almost doubled, with a growth of more than 90%. This was the longest period of economic expansion during the 20th century.

The Nixon Recession (December 1969 – November 1970)

The Nixon Recession followed the lengthy period of expansion. This recession was also relatively short, lasting only 11 months from peak to trough and fairly mild. A more consequential event happened shortly after in 1971 when Nixon eliminated the gold standard. This paved way for floating currencies and the ability of central banks to exhibit more control over their economies through monetary policy. This also contributed to exacerbating the following recession and inflation due to the dollar losing value relative to other currencies.

The Oil Shock Recession (November 1973 – March 1975)

Growth resumed after the brief Nixon Recession for three healthy years. Annual GDP increased by 5.1% and annual employment increased by 3.4% during this time. This expansionary period came to an end abruptly with the 1973 oil crisis. Inflation remained stubbornly high and would soon rise to double digits despite stagnating growth, a phenomenon that came to be known as stagflation. A quadrupling of oil prices by OPEC, coupled with the 1973 stock market crash led to a stagflation recession.

The Energy Crisis I Recession (January – July 1980) and Energy Crisis II Recession (July 1981 – November 1982)

Following the Oil Shock Recession, an expansion occurred for the remainder of the decade. Inflation remained high during this period, peaking around 15% in 1980, and energy prices continued to be a particular sore point. Oil prices reached an all-time high that would not be surpassed until more than 25 years later, in 2008. This expansion was followed by a “double dip” recession. One short recession in 1980, triggered in part by the Federal Reserve’s decision to combat rising prices by raising interest rates, followed by the worst economic downturn in the US since the Great Depression from 1981 to 1982. Unemployment reached nearly 11% and GDP fell by 1.8%.

The Gulf War Recession (July 1990 – March 1991)

After the lengthy peacetime expansion of the 1980s, the Gulf War recession was mild and brief. It lasted just eight months and was a combined result of the Gulf War’s effect on oil prices and the savings and loan crisis. In August of 1990, Iraq invaded its oil-producing neighbor, Kuwait. The ensuing Gulf War created a shortage in oil production and therefore an increase in price per barrel. This, coupled with the state of residential mortgage markets caused the market to go into a recession. By the end of the 1980s, after years of historically low interest rate debt accumulation on residential mortgages, small local banks suffered as the Fed had begun steadily raising interest rates in response to growing inflation.

The Dot Com Recession (March – November 2001)

The 1990’s were the longest period of economic growth in American history up until the Dot Com Bubble. A frenzy of exuberance around the first wave of internet companies coupled with low interest rates came to a head as tech IPOs and stock prices became grossly overvalued. As the name insinuates, this recession began when the stock prices of internet companies crashed as the Fed began raising interest rates in 1999 and 2000. The tech-heavy NASDAQ ended up losing nearly 77% of its value and took over 15 years to recover its losses.

It’s important to distinguish- a stock market crash does not necessarily result in a recession. But on September 11th, 2001, the devastating attack on the World Trade Center solidified a pessimistic outlook that teetered the US economy into a recession

All things considered, the Dot Com Recession lasted 8 months with unemployment reaching 5.5% and GDP falling by 0.95%.

The Great Recession of 2008 (December 2007 – June 2009)

The Great Recession was the longest economic downturn since World War II and was the deepest prior to the COVID-19 Recession. Real GDP fell 8.5% in the fourth quarter of 2008, and unemployment peaked at 10% in October 2009. The Great Recession was triggered by the subprime mortgage crisis and the collapse of the US housing bubble. In the years leading up to the recession, financial institutions created complex securities that bundled bad mortgages and sold them as high-quality investments known as CDOs (Collateralized Debt Obligations). In 2007, major subprime lenders began filing for bankruptcy as borrowers were unable to repay their mortgages, which burst the housing market bubble. Over the next year–and–a–half, stock markets tanked, and major financial firms started going bankrupt, triggering a worldwide financial crisis and a recession.

The effects of the Great Recession of 2007-2009 continued to be felt for years. The Fed cut interest rates to zero in an effort to encourage borrowing. Congress passed two stimulus packages, and later passed the Dodd-Frank Act to tighten financial market regulation and prevent a similar catastrophe in the future.

The COVID-19 Recession (February – April 2020)

The Coronavirus recession was the shortest in US history, lasting just two months, but had the steepest GDP decline since the 1945 recession. More than 24 million people lost their jobs in the US the first three weeks of April 2020. The economic impact of the virus and the ensuing stay at home orders is to still be determined but was quickly propped up by government intervention. The Fed rapidly slashed interest rates to zero, Congress passed stimulus packages that put cash directly into American’s pockets, and PPE loans were extended to small businesses to stay afloat. Amongst the medical, social, and economic crisis- sentiment improved and the recovery from the Covid-19 pandemic was remarkably fast. Real GDP grew 5.6% throughout 2021 and the unemployment rate reached 50-year lows.

Looking Forward

Recessions are a natural and necessary part of every business cycle to remove excess, reprice assets, and tame risky behavior. While recessions have been relatively short and infrequent in comparison to expansions, they must be expected and can be mitigated through proper asset allocation, diversification of asset classes, and emergency funds- to name a few. It is vital to maintain perspective and have a long-term view. Financial plans are an excellent way to test your ability to withstand a large recession and give confidence that your assets are sufficient to meet your goals before, during, and after recessions.

Chart Sourced From: https://www.fisherinvestments.com/en-us/insights/market-cycles/volatility/in-perspective

Further Reading

• Capital Group: Guide to Recessions

• US Economic Recession Timeline

• Net Suite’s History of Economic Recession

• Great Depression

• NYTimes Coronavirus

• Nixon Shock

Charts Sourced From:

• Chart 1: https://www.capitalgroup.com/advisor/insights/articles/guide-to-recessions.html

• Chart 2: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

• Chart 3: https://www.fisherinvestments.com/en-us/insights/market-cycles/volatility/in-perspective

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Whether you’re new to investing or have decades of experience in financial markets, having an asset allocation aligned with your goals and risk tolerance remains one of the most important decisions investors can make. Having an appropriate asset allocation aims to balance the risk and reward, through diversification across asset classes and types. There is no one size fits all when it comes to determining an asset allocation for every investor, however it will ultimately have a larger impact on portfolio returns than security selection. In this blog post we will explore what factors to consider, importance of diversification, how an investor’s asset allocation may change over time, and various ways the Weatherly team can help you achieve your goals.

An investor’s allocation will determine how their portfolio will be appropriated across different asset classes commonly classified as equities, fixed income, and cash. Additional assets classes of importance can include alternatives such as real estate, commodities, or collectibles. Each of these different asset classes carry a different set of risk and return characteristics highlighting the necessity of setting an allocation that aligned with the investor’s overall goals.

There are several factors to consider when determining an appropriate asset allocation, including:

Time Horizon

An investor should review each of their goals to determine the amount of time until the funds will ultimately be needed. With short time horizons, within a few years, a sudden market decline may significantly decrease the original investment preventing the individual to reach their goal or recoup losses. Therefore, it’s often recommended to allocate more funds into historically safer assets such as money markets, high yield savings accounts, CDs, and other short-term high-quality fixed income securities. While the returns on these assets are low, the investor’s principle is more protected.

Conversely, longer time horizons such as saving for retirement may be decades away and can afford the investor to have a more aggressive allocation with a larger exposure to riskier assets such as stocks, equity funds, or alternatives. While stocks have more implied risk than cash or high-quality fixed income, they historically have provided greater returns over the long run, helping investors ultimately reach their financial goals.

Risk Tolerance

This refers to the degree of risk an investor is willing to endure in times of market volatility. An investor with an aggressive allocation may be willing to lose a greater share of their original investment to achieve potentially higher rates of return while a conservative investor may prioritize capital preservation and guaranteed returns.

https://www.brightstart.com/risk-tolerance-questionnaire/

While it’s important to consider both your time horizon and risk tolerance when determining an appropriate asset allocation, they might not always align. For instance, your ability to emotionally endure losses could exceed your ability to withstand them given your financial situation. Alternatively, some investors are very risk averse even if they have a significant level of assets.

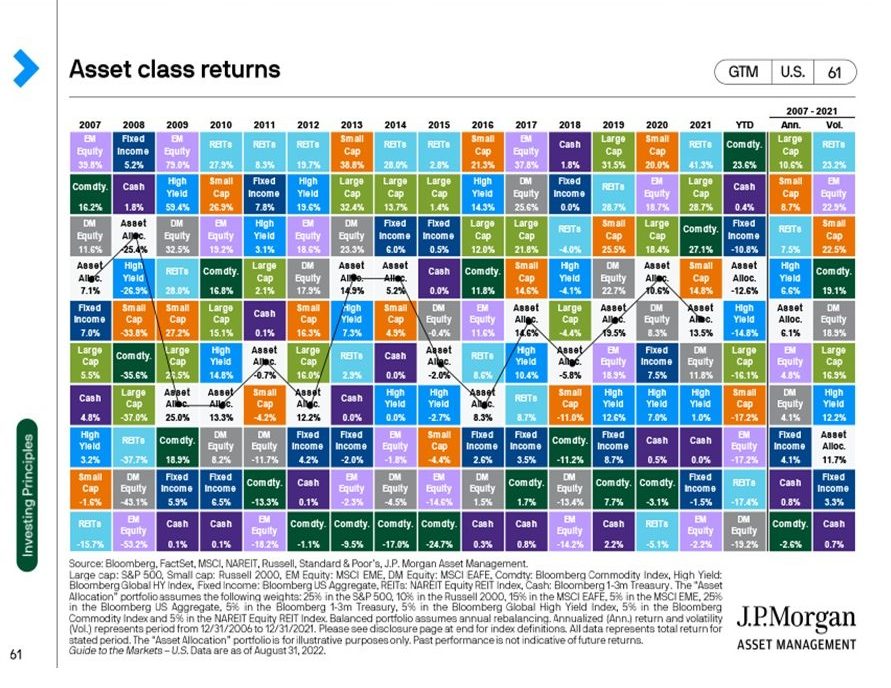

The balance between risk and reward should be top of mind for investors and diversification remains a key driver. The chart below breaks down historical performance and volatility of different asset classes over time. The balanced portfolio represented by the white box highlights how diversification can help reduce risk in the portfolio and enhance returns.

Chart sourced from: JP Morgan Guide to the Markets – August 2022, Page 61

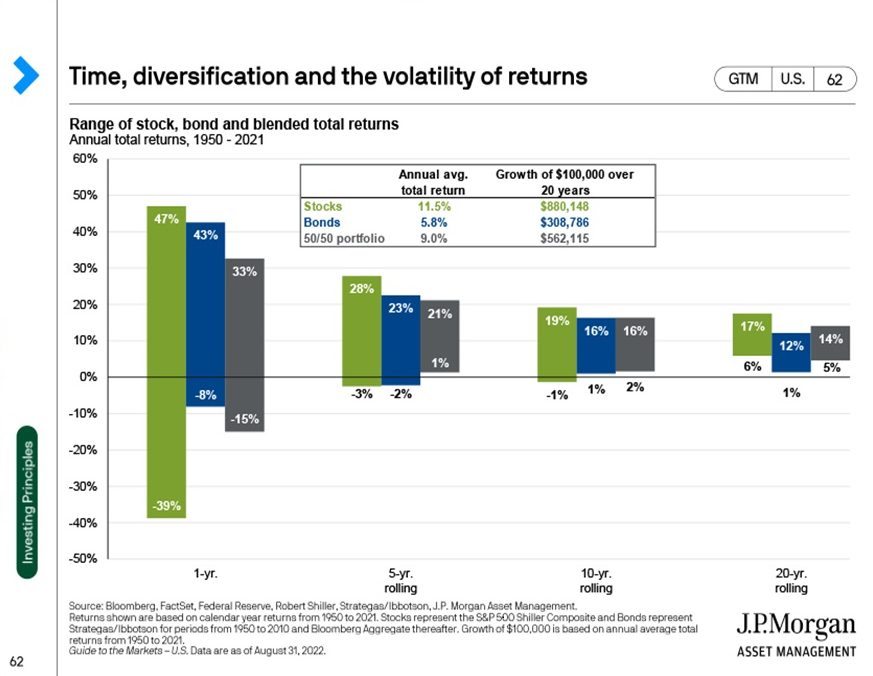

The slide below represents the importance of an investor understanding both their personal goals and the time horizon associated. Short time periods may experience greater volatility but over the long term returns typically return to the mean.

Chart sourced from: JP Morgan Guide to the Markets – August 2022, Page 62

Total Asset Allocation

Asset Allocation is the main driver of returns and should not only be reviewed on the account level but also as it relates to net worth. This can include alternative investments such as real estate, business interests, commodities, collectibles or other assets that are held outside a traditional investment account. Any concentration in these other asset types should be considered when determining the asset allocations at the account level. For example, if a client has a large position in a startup business, they may have a more conservative approach in their investment accounts to help balance total risk they are subject to. Total asset allocation can even impact individual positions in a portfolio. For example, an investor who has a large chunk of their net worth tied to real estate, may rethink investing in a residential Real Estate Investment Trust (REIT) to limit concentration to the real estate industry. Similarly, concentration in a employer stock due to stock options may impact overall investment strategy and portfolio risk. Reviewing total allocation can sometimes improve concentration concerns found in a specific account.

Asset Allocation Per Account

Although asset allocation can be viewed on an aggregate basis, it should also be reviewed on an account basis. Retirement accounts often have a tax deferral component, and benefit from long-term accumulation. Therefore, retirement accounts may favor a higher equity allocation until Required Minimum Distributions (RMDs) begin at age 72 or the client becomes reliant on income from this type of account. If possible, cash flows are taken from non-retirement accounts first, so a more conservative allocation is generally used for these accounts. Tailoring asset allocation this way can help maximize tax efficient returns over time. Additionally, there are planning opportunities that may span across multiple generations and thus require a different allocation than the individuals establishing the accounts. This can especially be seen in a Roth IRA given tax treatment and no mandatory withdrawals while the account owner is alive. A more aggressive asset allocation to this account can capture a longer period of tax-free growth and enhance a future inheritance for beneficiary or loved one.

When to Review Asset Allocation

It should also be noted that asset allocation may evolve over time as new goals develop and life happens. For example, a large liquidity event may cause investors to increase or decrease their asset allocation as their priorities may have changed. Also, investors generally shift to a more conservative allocation to reduce near term risk if they anticipate upcoming cash flow needs from a portfolio. Some examples of this could include a home purchase, looming child education expenses, large medical costs or beginning retirement. This same type of progression can be seen in target date funds which utilizes passive investing to automatically adjust asset allocation to be more conservative as a certain goal approaches.

Periods of volatility can also cause investors to review their asset allocation. During a down market, investors tend to reevaluate the amount of risk they were originally taking. If they are comfortable with the volatility, then it may be an opportune time to rebalance the portfolio by bringing the equity allocation back up to help reinflate the portfolio faster. This is often forgotten during periods of exuberance in the stock market, but it may be appropriate to rebalance the portfolio to fixed income to limit overall concentration to equities. During these periods of volatility, an active management investment style tends to benefit clients. Being able to quickly reevaluate risk profiles, allow for gains to be taken or a portfolio to be repositioned. Financial Planning can be helpful in determining the amount of risk needed to take to fulfil various goals.

How Can WAM Help

Whether you’re a new or an existing Weatherly client, we pride ourselves on open dialogue to ensure we understand each client’s needs and goals both for the short and long term to determine an appropriate asset allocation. You’ll often find a question we always ask on the front end is if there are any upcoming liquidity needs. This allows us to properly align the portfolio while also exploring areas of opportunities to reduce risk. We review current and target asset allocations several times a year to ensure the appropriate amount of risk is being taken to achieve goals and meet cash flow needs. If periods of volatility cause concern, then we revisit the target asset allocation with the client and implement adjustments, if necessary. We lean on our financial planning capabilities that help clients bring together their financial picture into a holistic and consolidated view to prioritize goals based on importance and timing. We encourage you to reach out to your trusted advisor with any questions about how life changes can impact your allocation, risk mitigation, or any other questions.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

For those approaching retirement, it can be an exciting time as they look forward to the next chapter in their life, whether it’s spending more time with family and/or focusing on the causes closest to them. We often see individuals ease into retirement by continuing on a part-time basis with their employer or through consulting work within their related field. This transition may bring a level of uncertainty as they shift focus to a different set of priorities such as income and spending, asset preservation, and estate planning to name a few. Many of these priorities will carry through to those already in retirement along with additional planning opportunities that will be discussed later. In this blog post, we will explore a variety of topics to help individuals prepare for retirement and build confidence as they enter and live out their golden years.

SAVE:

As you close in on retirement, it is an essential time to take inventory of your financial picture and prioritize based on importance. A quick win is to ensure that you are saving as much as possible. Individuals are often in their prime earning years as they approach retirement and should focus on maxing out employer retirement plans or contributing enough to take advantage of a full employer match, if available. The 2021 maximum contribution an employee can put into an employer retirement plan is $19,500 for those under 50 and $26,000 for 50 and over. Additional savings can be allocated to taxable or Trust accounts that do not have carry contribution limits. If self-employed, there are additional opportunities to fund a Profit-Sharing or Defined Benefit plan that can go beyond the traditional limits above. For additional contribution limits please see Weatherly’s Key Data Chart.

SPENDING/BUDGET:

After ensuring you are saving as much as possible, we recommend tracking how much you are spending on a monthly basis on both discretionary and non-discretionary items. Non-discretionary items can include bills such as utilities, mortgage payments, insurance etc. while discretionary items fall into areas such as going out to eat, vacations, and hobby related expenses. We suggest reviewing the past three months of your bank transactions to get a sense of your average monthly expenses. Alternatively, there are various budgeting websites that can track your expenses such as Mint.com that can be a helpful resource and found here.

ACCOUNTS:

Now that you have an idea of how much you are saving and spending, it is time to review where each of your accounts is held and the balances thereof. It is quite common for people to change jobs throughout their careers and leave their accounts within a prior employer’s plan. It is important to make sure you are able to access these accounts and Weatherly can help you consolidate them, if appropriate. While going through this process can be time consuming it is important to also look at the allocation of each of these accounts to ensure your entire portfolio is aligned with your risk tolerance and time horizon.

ESTATE REVIEW:

As you work through locating and accessing each of your accounts, it is a great opportunity to review the titling and beneficiaries of the accounts to verify they reflect your current estate planning objectives. While estate planning can vary widely between families depending on their unique situation and desires, we recommend all individuals have the following four documents in place.

- First, is a Will and Testament which is a key instrument used to outline how an estate is to be settled in a manner desired by the deceased. They typically include an executor of the estate, named beneficiaries, instructions for how and when the beneficiaries will receive assets, and guardians for any minor children.

- Secondly, a Revocable Trust that each of the assets are registered under excluding those with beneficiary designations. Assets in the trust will pass outside of probate, saving time, court fees, and potentially reducing estate taxes. You can also specify the terms of the trust precisely, controlling when and to whom distributions may be made.

- Third, a Power of Attorney document that provides legal authorization to a designated person to make decisions on your behalf regarding property, finances, investments, or medical care. Power of Attorney is most frequently used in the event an individual has a temporary or permanent illness or disability, or when they are unable to be present to sign necessary documents.