Concentrated Positions & Evaluating Risk

Chase Hayhurst, CFP®, Wealth Management Associate Advisor | Brent Armstrong, CFP®, Wealth Management Advisor, Partner | May 27, 2021

We all know the phrase “don’t put all your eggs in one basket” and there is one concept in the world of investing that universally applies to all individuals… diversification. Often, the very asset that has helped generate wealth over times poses the biggest risk to your financial future. We will be exploring highly concentrated positions and what this means to you as an investor.

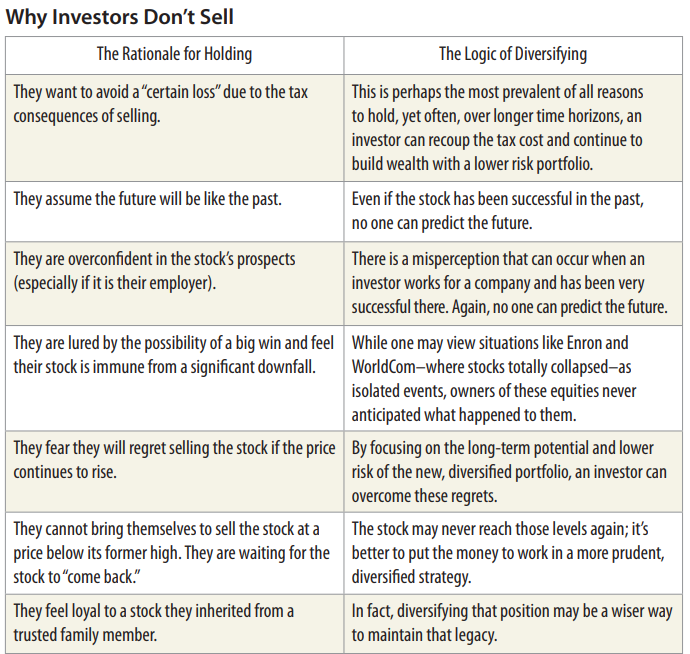

Concentration occurs when an investor owns shares of a stock or other security type that represents a large portion of their overall portfolio or net worth. A position is typically considered to be concentrated when it represents 10% or more of the portfolio. Investors may understand the risk these positions represent but may choose not to take action for a variety for reasons including:

- Tax Ramifications – Often times, it’s as simple as not wanting to pay the capital gains tax associated with selling a portion of a highly appreciated security if held in taxable account. Alternatively, stock options awarded from employers can lead to significant tax liabilities due to supplemental income when exercised, highlighting the need for proper exercise strategies.

- Emotional Bias – Others may experience an emotional or behavioral connection to the company. This could stem from shares received from an employer and a sense of betrayal by selling these shares. Another emotional connection could arise from individuals who inherited concentrated positions from a loved one who felt strongly on the prospects of the company.

- Behavioral Bias – Lastly, investors may fall victim to a behavioral bias of a stock that has outperformed over time and believe past performance will continue into the future.

Chart Sourced From: https://content.rwbaird.com/RWB/Content/PDF/Insights/Whitepapers/Hidden-Cost-Holding-Concentrated-Position.pdf

Portfolios with large concentration in individual holdings can introduce risk that could otherwise be mitigated through proper diversification. Without proper planning, an investor’s overall portfolio performance can be driven by the heavily weighted security. There are copious factors that could put downward pressure on stock prices, such as a deterioration of company fundamentals, shift in public outlook or perception of the company/industry, regulation or change in key leadership to name a few. While not as common, black swan events can occur such as the well-known Enron scandal that evaporated wealth from shareholders and employees seemingly overnight. Additionally, changes in a company’s corporate structure may lead to unintended ramifications for shareholders. For example, Medtronic’s decision to change the location of their headquarters forced employees and shareholders to fully realize (pay tax on) their deferred capital gains without actually transacting the security. You can read more about it here.

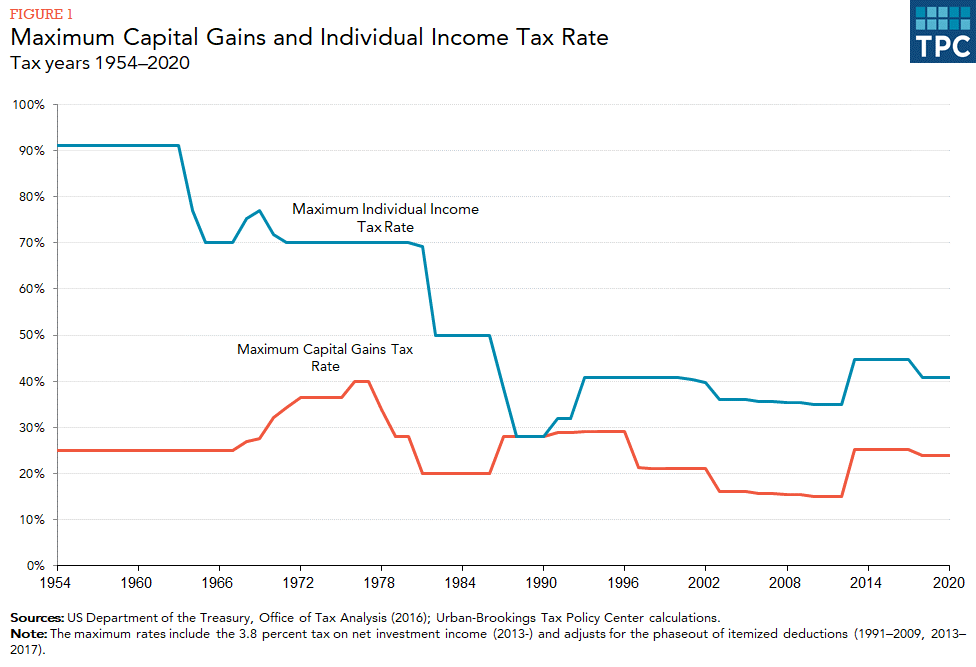

With a better understanding of some factors that lead to security concentration and associated risks, let’s circle back to the tax conversation. As of this posting, the Biden administration has proposed legislation to nearly double the top capital gain rate from the current 20% to 39.6%, excluding the additional 3.8% Medicare surtax. While this would only apply to those individuals with incomes of more than $1 million, current capital gains rates are historically low with most investors falling in the 0%-15% bracket. For context, top capital gain rates were roughly 40% in the late 1970s and have only decreased over the years. Whether the new legislation will be passed by Congress in its current form or if amendments to the rate and/or income limits is still unknown at this time. As a result of COVID-19, roughly $5.3 trillion of fiscal stimulus has been paid out to support the economy with trillions more on the table under the proposed American Families Plan and American Jobs Plan. This level of spending will need to be supported and as such we anticipate taxes to increase into the future. As the saying goes, “there’s no time like the present”, and certainly applies when looking to de-risk the portfolio and chip away at concentrated positions.

Graph Sourced From: https://www.taxpolicycenter.org/briefing-book/how-are-capital-gains-taxed

Aside from the capital gains we spoke to, another key aspect of tax legislation proposed by the Biden administration is the potential to limit the “step-up” in cost basis to the first $1 million of a deceased person’s assets and $2 million for married couples. This could lead to significant tax implications for the heirs looking to diversify concentrated positions as the original cost basis of the deceased will carry over to their beneficiaries.

How WAM Can Help

Through continuous collaboration with our clients, we help identify areas of concentration across your managed accounts in conjunction with your entire investment portfolio, including assets held away, as appropriate. With tax mitigation at the forefront, we can help create a plan of action to strategize the timing of de-risking the portfolio in low tax years or reducing concentration within tax deferred accounts, allowing the funds to be re-deployed into our new thematic ideas. We will continue to work alongside your trusted professionals to explore additional strategies such as tax loss harvesting and potential gifting scenarios for each client’s unique situation.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.