Dodging Taxes: No Loopholes Required

Cole Hansen, Wealth Management Associate Advisor | Ryan Richardson, CFP®, Wealth Management Associate Advisor | March 21, 2019

The TCJA that was signed into law on December 22, 2017 made significant changes to the tax code. The changes were broad and sweeping which leads to questions about what changed and what we can do to mitigate taxes under a new code. While the increase in the Standard Deduction has some individuals moving away from itemizing, there are still ways to decrease tax liability with “above-the-line” deductions, business and charitable planning and investment strategies. Our Key Data Chart outlines the main figures to focus on for tax planning. Read on to see our Top 5 strategies that might make a positive impact on your tax situation.

![]()

The What: Retirement plan contributions, an above-the-line deduction

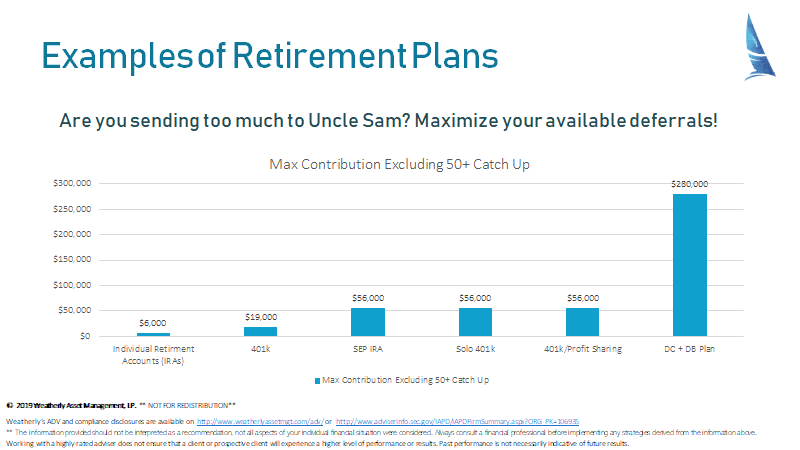

The How: The most common way to reduce taxable income is a contribution to an eligible retirement account. This strategy is beneficial for two reasons – you can lower your tax bill now and access tax-deferred growth for the future.

This chart highlights the allowable deferrable amounts for various types of retirement plans, depending on your business structure and compensation. These contributions are “above-the-line” and directly reduce your Adjusted Gross Income (AGI), even if you are not itemizing deductions on Schedule A.

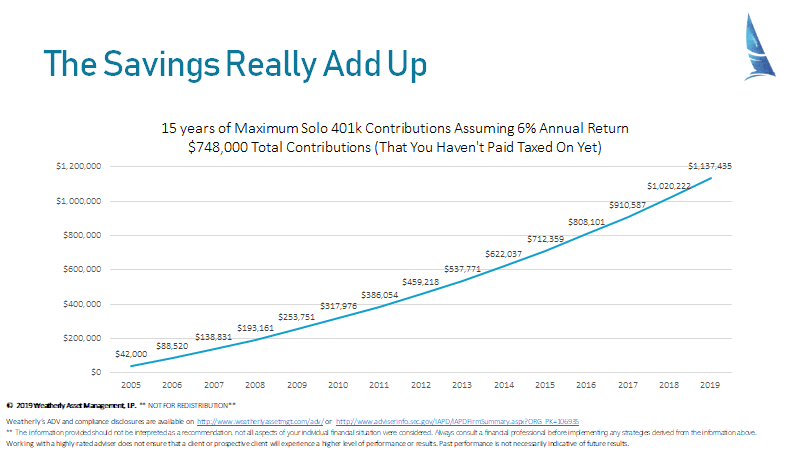

Retirement plan contributions not only reduce your taxes now, but also grow tax-deferred until you are required to take a distribution (RMD) at age 70.5. This graph notes the benefits of tax-deferred growth.

![]()

The What: Business structure, how the change in tax rates can impact your deductions

The How: C corps and qualified pass-through entities, including sole proprietorships, partnerships, S corps and LLCs benefit from the TCJA. C corps saw a reduction in tax rates from 35% to a flat 21%; pass-through entities with qualified business income are able to take a 20% tax deduction.

We’ve been encouraging our clients with business income of any sort to consult with their CPA on what business structure is appropriate for them and eligibility for the deduction. Similar to above-the-line contributions, you can take the 20% tax deduction, even if you aren’t itemizing under the new tax law.

![]()

The What: Charitable deductions, QCDs and bunching donations

The How: If you are over age 70.5, own a retirement account and are taking a Required Minimum Distribution, consider a Qualified Charitable Distribution. You are able to donate directly from an IRA up to $100,000/year. These donations are not included in taxable income on your 1040 and offer a tax benefit, even if you aren’t itemizing.

If you have a larger than usual tax year, consider “bunching” charitable donations to maximize your Schedule A deductions. With the TCJA reform, we’re seeing more individuals utilizing the standard deduction over itemizing. We’ve reviewed frontloading charitable funds on our blog, along with the advantages of donating stock and QCDs.

![]()

The What: Taking advantage of “gap years” with low income

The How: Financial planning is a tool most often used to visualize a path to retirement, but these plans are also helpful in identifying when you might have “gap years” of income in retirement. If you have a couple of years between retirement and collecting Social Security or RMDs, you might be able to take advantage of strategies like Roth IRA Conversions or even an IRA withdrawal to a taxable account. You might benefit your future self by removing assets from a Traditional or Rollover IRA in years when the tax rates are lower due to the TCJA versus having a higher RMD in later years when tax rates are less certain.

![]()

The What: Investing, utilizing tax-efficient stocks and bonds to maximize returns

The How: Although tax rates are lower, the limitation of itemized deductions, particularly in high tax states, makes tax-efficient investing even more attractive. Weatherly primarily utilizes individual stocks and bonds in our investment portfolios. Municipal bonds remain attractive, paying tax-free income at the federal level, and depending on the state of issuance and where you live, the income may be tax-free on your state return too. Qualified dividends and capital gains are taxed at a more favorable rate, and even in some of the “gap years” identified above we’ve seen individuals fall into the 0% bracket – you can offload low basis stock without the tax burden if planned appropriately.

Investment Management Fees and Tax Deduction

Prior to the TCJA, investment management and professional fees were tax deductible if they exceeded 2% of AGI. You can still pay investment management fees, as applicable, from a Traditional or Rollover IRA. This is a tax-free “withdrawal” which can help lower RMD impact in the future.

Some states conform to the TCJA at the federal level, mirroring the itemized deduction schedule. Others, like California, do not adhere to conformity and may still allow for deduction of investment management fees on your state return. You can check here or ask your CPA what you are eligible for at the state level.

Resources:

https://www.fidelity.com/viewpoints/personal-finance/taking-tax-deductions

https://www.nerdwallet.com/blog/taxes/pass-through-income-tax-deduction/

https://www.taxdebthelp.com/blog/pass-through-tax-deduction

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.