As we entered 2023, economic uncertainties and raising concerns about market volatility extended into the New Year. However, as the year progressed, markets rebounded, and earnings reports showed strength and resilience quarter over quarter. While Weatherly cannot control the economy, markets, or future tax environments, we can focus on helping our clients build well-structured plans to achieve financial goals.

We think the new year is an opportune time to pause and take inventory of your overall financial health. To help guide our clients along that process, we’ve outlined a framework with 20 key, tangible steps to consider.

Using the new year as an excuse to pause and perform a personal financial planning assessment allows individuals to optimize tax strategies, align financial goals with current circumstances, review and adjust investment portfolios, manage debts effectively, ensure financial security, assess retirement plans, and stay informed about relevant financial changes.

By taking advantage of the year-end period for a comprehensive financial review, you position yourself to start the new year with a well-informed and adjusted financial plan. Consider consulting your Weatherly advisor if you believe you could benefit from any of the following strategies.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

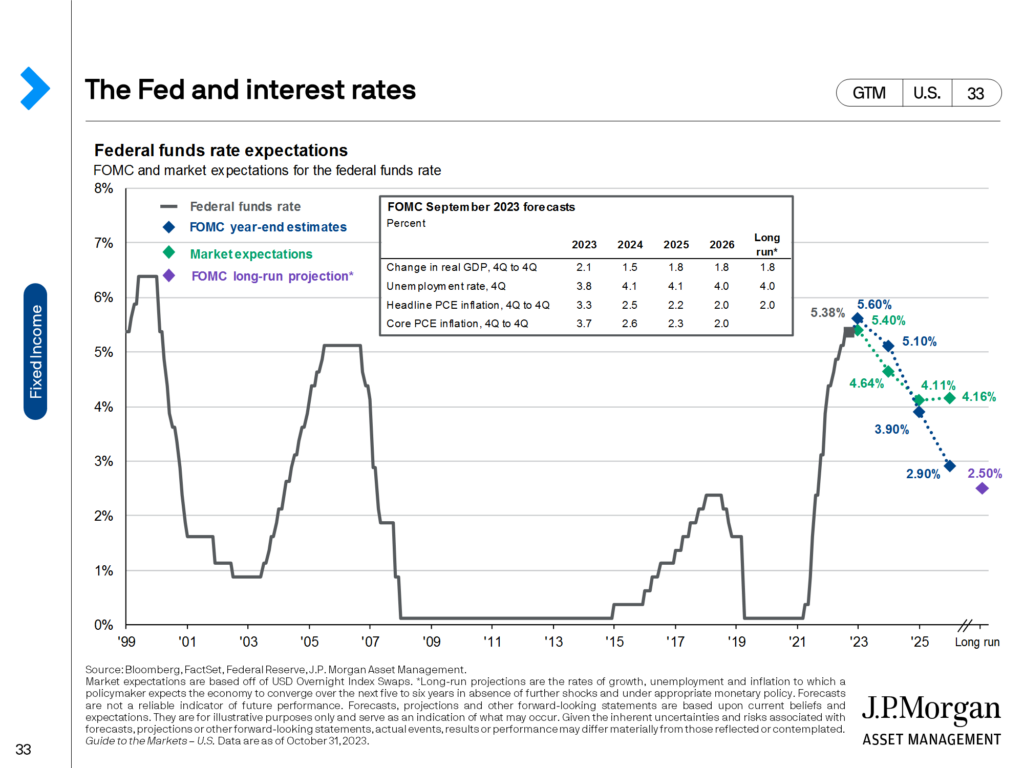

Thorough financial planning and a well-diversified portfolio provide some of the best resources to handle volatile interest rates and inflation. These rates affect everything from spending and borrowing costs to mortgage rates, making it relevant for every level of consumer. Throughout history, the Federal Reserve, the central bank of the United States, has used different tools and data points to foster the US economy and to mitigate financial crises. Used by the Federal Reserve, the federal funds rate is the interest rate that financial institutions use to make loans to one another. The federal funds rate is also the tool the Fed uses to maintain stability in inflation and unemployment, leaving inflation and interest rates tightly intertwined. The Federal Reserve will lower rates to spur the economy and raise them to keep an inflating economy in check.

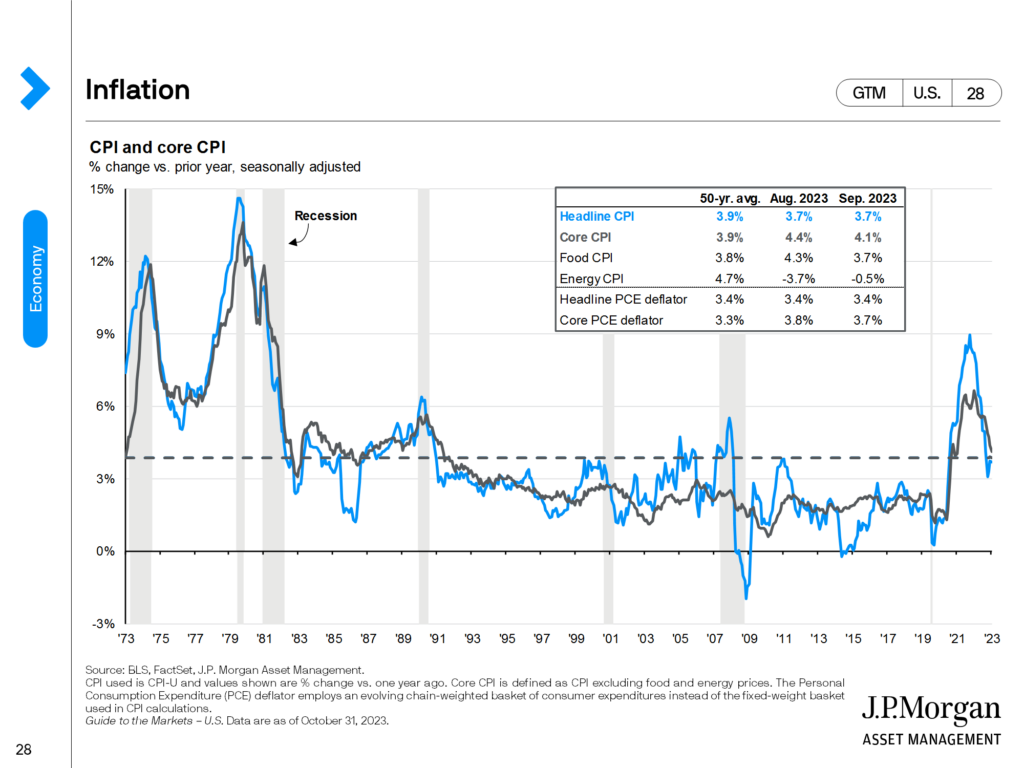

The Federal Reserve also uses Consumer Price Index and Personal Consumption Expenditures data to gauge inflation. Core CPI is another useful gauge as it provides the same data as CPI, less food and energy, the prices that tend to be the most volatile. CPI data is categorized as a lagging indicator, meaning its data points are known after they have occurred. Additional lagging indicators such as unemployment and rent provide information on the direction of the economy.

Source: J.P. Morgan Bonds are back

Understanding previous periods of volatility, and the goal of the Fed, provides groundwork for understanding the state of today’s current environment. The following will look at periods of times with high volatility in inflation and interest rates and how they coincided with periods of expansion and recession.

Great Depression (1929-Late 1930s)

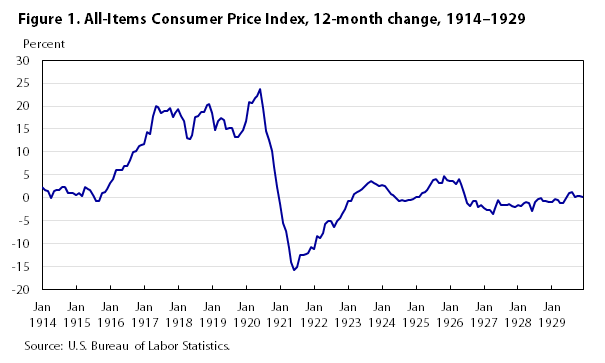

After a long period of expansion, the stock market crashed in October of 1929 due to an overpricing of assets. After the crash, the United States economy saw a rapid economic decline across the board. The price of goods in the 1939 CPI were cheaper than the basket seen 20 years earlier, while people still struggled widely to afford them . From October 1929 to April 1933, the price of the CPI basket declined over 27%, leaving the Fed to navigate a deflationary period of the economy. Leading up to the crash, interest rates were around 6.25%, Interest rates were increased to 4% due to global macroeconomic factors such as the UK abandoning the gold standard, putting a deeper dampening on the US economy. The gold standard is a monetary system where a country bases the value of its currency in direct relation to the value of gold. Using the gold standard can curb the phenomena of inflation, but it comes with its challenges like supply and demand issues. The US, feeling the global pressure, moved to abandon the gold standard in 1933. Interest rates remained low until mass economic expansion post WWII, and the CPI basket did not reach pre-depression prices until 1943.

Source: U.S. Bureau of Labor Statistics

The Great Inflation (1965-1982)

The Fed spent the period between the Great Depression and the Great Inflation introducing policies and efforts that raised the money supply, stimulating the economy, while also creating record levels of inflation. The federal funds rate rose to its highest level in history during the 1980s. The United States was heading towards record levels of inflation with CPI being over 14% and core CPI being above 13%. To combat the rising interest rates, the Fed set their target rate to 14% in January of 1980. Shortly after, raising the target rate to the highest it has ever been, just under 20%. Due to the increase, the cost to borrow also went through the roof, as 30-year fixed-rate mortgages hit nearly 20% for a short period of time. There are similarities between The Great Inflation and now. In October 1981, there was a 5% increase on mortgage rates YoY, while November of 2022 saw a 4.1% increase YoY. Home sales dropped over 20% in 1980, not unlike the trend seen in 2022. Leading up to this inflationary period, the Fed held rates around 5%, the common target rate also seen today, while CPI hovered between 5-6.5%. Between 1978 and May 1980, there were several rate hikes put into effect by the Fed, raising rates from 6.5% to 20%. The quick and steady increase of rates was needed to reestablish price stability within the US economy with an inflation rate over 12%. From September 1981 to September 1983, inflation dropped 8% but bounced around throughout the rest of the decade. Interest rates were ultimately lowered to 3% in the early 90s through a long series of rate cuts by the Fed.

The Dot Com Bubble (Late 1990s-2002)

A period of long economic growth in the 90s followed the Great Inflation. The Fed was able to reduce interest rates and keep them stable to promote economic growth and create huge levels of growth in the stock market. The Dot Com bubble was an overvaluation of internet-based companies, causing a large influx of investments into lower quality companies. The economic loosening of the Fed mixed with the overpricing of these assets caused the Nasdaq 100 index to increase over 500% from 1995-2000. Interest rates rose slightly during this time from 5% to 6.5%. Following the bubble burst, the Fed dropped interest rates from 6% to 1% in hopes of stimulating a stock market that saw some of its indices lose over 70% of their value. CPI data rose slightly during the build-up of the bubble but declined steadily after, settling in around the Fed’s goal of 2%. The dot-com recession lasted from March to November 2001, but the Fed was initially worried that the economic recovery was lacking as measures of consumer confidence continued to drop till early 2003. The 9/11 terrorist attacks also added to the continued negative outlook, causing more rate cuts due to geopolitical tensions. By mid-2003, inflation was extremely low—core PCE was at 1.78% in January and bottomed out at 1.3% towards the end of 2003.

The Great Recession (2008-2015)

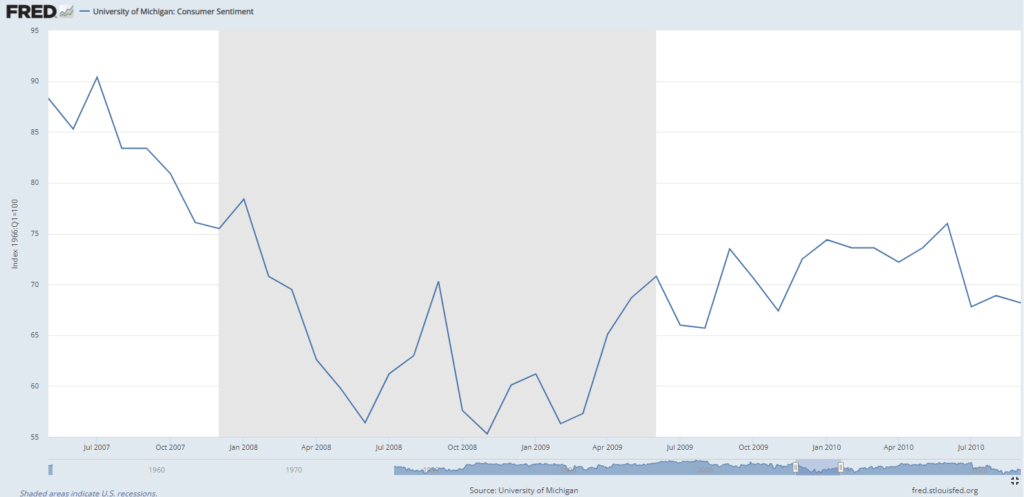

The mid-2000s were a recovery phase for the United States economy, the stock market slowly recovered, mortgage rates came down, and Core CPI remained between 2-3%. During this recovery period, the Fed systematically raised rates 17 times between 2004 and 2006, each time by 25 basis points, from 1.25% to 5.25%. The rate increases were designed to tame the bubbling housing market that ultimately came to a head at the end of 2007. The Fed quickly tried to cut rates in the last quarter of 2007, with the funds rate ultimately reaching near-0% in December 2008. The recession caused CPI data to experience a short deflation period as parts of the stock market lost over 50% of their value in the span of 18 months. Consumer sentiment in the middle of 2008 was extremely low and comparable to feelings had in mid-2022 during the bear market. Crude oil at the start of the recession cost over $140 a barrel, dropping to $70 by the end of the recession. This price movement is also very similar to what was experienced during the bear market, inflationary period in 2022. With low rates and disinflation periods, unemployment doubled to over 10% causing one of the most widely felt recessions in quite some time.

Source: FRED. Shaded in portion of the graph is designated as the Great Recession.

COVID Pandemic (2020-2022)

After leaving rates near-zero, the Fed slowly raised their target rate throughout the mid-to-late 2010s. Core PCE inflation was 1.1% in December 2015, well below the Fed’s target of 2%. It would slowly rise as the Fed raised rates, reaching its target level in March of 2018. Following conflicts stemming from a trade war with China, the Fed cut rates a total of 0.75% during the end of 2019 to mitigate any negative geopolitical catalysts. The COVID-19 pandemic struck early in 2020 and immediately shut down the globe. Production, trade, employment, and markets plummeted as public safety and recovery came to the forefront. The Federal Reserve dropped rates to zero and congress introduced stimulus packages to help a declining economy. The stock market and consumers responded well as the market climbed throughout the remainder of 2020 and into 2021. While the economy was growing again by May 2020, marking the shortest recession on record, the fallout from the economic measures to cope with the COVID pandemic are still being felt. Supply chain issues, a shortage of labor, and low rates with a large influx of cash being injected into the economy raised CPI to its highest levels since the Great Inflation in the 1980s . In turn with this the Fed began raising rates in March 2022, with the last raise coming in August 2023. These rate hikes have been able to wrangle inflation as the October 2023 CPI data came back at 3.2%, down from the almost 9% inflation seen in mid-2022. Consumer sentiment is slowly on the rise from its lowest level since 1980 as economic data continues to show recovery from the fallout of the COVID pandemic.

Post Pandemic and the Now

As we enter a period post pandemic, consumers and businesses budgets are feeling the heat of higher borrowing costs, easing but higher inflation, and resumption of student loans repayments. Each central bank around the world is continuing to evaluate data and current policies to define their policies moving forward. During the pandemic we saw globalization trends regress a bit with global supply chain issues coming to the forefront. While many of the world’s activities have resumed, such as travel and discretionary spending, we have seen dramatic volatility of demand worldwide impacted by inflation and interest rates. Moving forward, the economic outlook, spending and hiring will continue to ebb and flow with the variation of inflation and interest rates.

Inflation, Interest Rates and Your Individual Financial Plan

Having a successful financial plan, along with a well-diversified portfolio puts you in a better position to weather the storm in volatile environments. Long-term financial success is driven by an accurate financial evaluation that successfully manages cash flows and future expenses, accounting for inflation. Your advisory team is here to review and modify your financial plan to adjust for economic circumstances while offering you peace of mind. Continually reviewing items like your debt/interest rates, income projections and asset allocation are paramount to a successful long-term plan.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

It was truly rewarding to see the impact we made on the lives of so many families. The WAM team spent an afternoon volunteering with Feeding San Diego, and we are happy to share that we rescued 2,397 pounds of apples that will help provide 1,409 families with food. Feeding San Diego has an impressive mission to serve millions of meals each year, and we’re glad to have been a part of their mission. Learn more about Feeding San Diego here: https://feedingsandiego.org/

On a beautiful day in September, the Weatherly Crew seized the opportunity to revel in the outdoors. Our mission? Joining forces with the Del Mar Village Association to partake in the Keep Del Mar Green Community Cleanup! Before setting out on our quest to enhance our beloved city, our team took a quick snapshot to commemorate the moment. Who could have guessed that cleaning up our streets could bring such enjoyment? Check out the DMVA website to learn more about the next clean up!

Why is Equity Compensation Used?

In today’s competitive landscape companies of all sizes, both private and public, look for innovative ways to attract top talent. One of the most common ways in which companies entice employees to join their teams is through a special form of payment called equity compensation, colloquially referred to as stock options or stock awards. Equity compensation is defined as a form of non-cash compensation that awards an employee with stock (equity) in their company allowing them to participate in the ownership of their firm.

From a company’s perspective, equity compensation can provide many benefits such as:

- Attracting talent

- Retaining employees

- Performance motivations

- Conserving cash

There are also many benefits that equity compensation packages can provide an employee:

- Ownership Stake

- Alignment of Interests

- Potential wealth accumulation

- Potential tax benefits

While there are many benefits to receiving an equity compensation package, they can often be very complex and affect an individual’s financial plan from many different angles. Below we highlight the main types of equity compensation packages, their nuances, and important considerations for each.

The Types of Equity Compensation

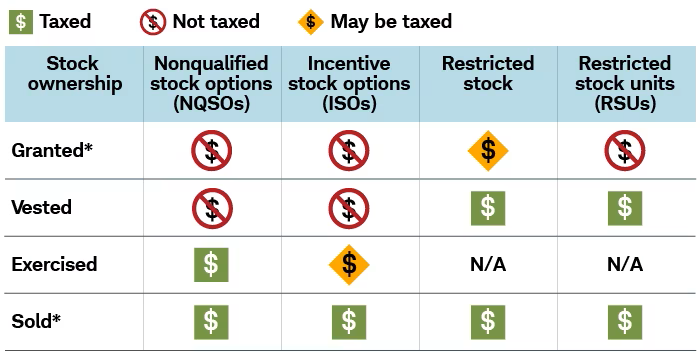

There are many forms that equity compensation packages can take. The most common forms of equity awards are stock options, which can take the form of incentive stock options (ISOs) and non-qualified stock options (NQSOs), and restricted stock units (RSUs). Each vehicle carries its own nuances and mechanics that are important to consider for anyone’s financial plan.

Stock Options

Whether you are granted ISOs or NQSOs it is important to understand the mechanics in which stock options operate. Stock options allow the recipient the right, but not the obligation, to purchase company shares at a pre-determined price often referred to as the grant price or strike price. Since there is a pre-determined price options will only have value if the value of the company is higher than the grant price. If that is the case, an employee has the option to purchase company stock at a discount which can potentially provide enormous financial benefits.

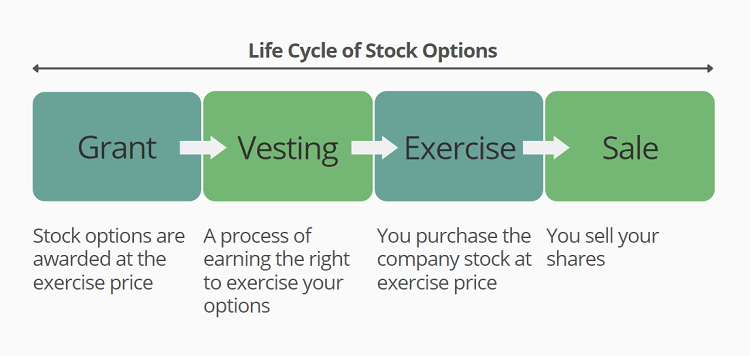

It is important to note that stock options are a formal contract between employer and employee with specific rules and stipulations. The contract will clearly define the vesting schedule, the grant date and price, rules surrounding when an employee can exercise the options, and more. Below is a general outline of the stock option lifecycle.

Also, within the contract the company will define which type of option they are granting the employee, an incentive stock option (ISO) or a non-qualified stock option (NQSO). The type of option offered to an employee can have a major impact on their overall financial plan and decision-making.

Incentive Stock Options (ISOs):

Incentive or Statutory Stock Options can provide the opportunity for preferential tax treatment if certain requirements are met. This benefit can potentially provide enormous savings as gains are taxed at capital gains rates rather than ordinary income tax rates. With an ISO package, there are items to consider before you exercise or sell the stock.

Important considerations with ISOs:

- Holding Period Requirements & Taxation: To receive the preferred tax treatment with ISOs, an individual cannot sell their stock within 2 years of the grant date and the stock must be held for at least one year after exercise. If an individual sells their ISO shares before meeting the required holding period, this is referred to as a disqualifying disposition and any gains will be taxed as ordinary income rather than long-term capital gains. Visit Weatherly’s Key Financial Data Chart for 2023 for a more detailed breakdown of tax rates and capital gains rates.

- Alternative Minimum Tax (AMT): Although ISOs offer preferential tax treatment, it is important to mention that an AMT adjustment may be necessary upon exercising options. With ISOs you may need to file an AMT adjustment on the “bargain element”, the difference between the fair market value of the options and what you paid for the stock (the grant price/strike price).

- $100,000 Per Year Limitation: Per the Internal Revenue Code 422(d), the fair market value of stock exercised in any calendar year cannot exceed $100,000. Anything in excess of $100,000 will be treated as a non-qualified stock options (NQSOs).

- Estate Planning: Generally, an individual is not allowed to transfer or gift ISOs during their lifetime, and if they do, that could potentially disqualify them as ISOs which forfeits the tax benefits. However, ISOs can be transferred upon an individual’s passing to their heirs or beneficiaries through their estate.

Non-Qualified Stock Options (NQSOs):

Non-Qualified Stock Options are the most common form of stock option offered in equity compensation packages. NQSOs are much simpler in nature relative to ISOs, they have straightforward tax events and are not subject to the same stringent rules. The major difference between NQSOs and ISOs revolves around taxation because gains from NQSOs are taxed as ordinary income rather than long-term capital gains rates.

Important considerations for NQSOs:

- Tax Implications: When you exercise NQSOs the difference between the grant price and the fair market value of the stock is treated as ordinary income. With NQSOs, you will owe taxes in the year you decide to exercise your options.

- Holding Period: Once exercised, depending on the length of time you hold onto your company stock you may be subject to either short-term or long-term capital gains rates.

- Timing of Exercise: Since taxes are owed in the year you exercise your options, it is important to consider your entire financial situation in order to minimize your tax liabilities. Weatherly often works with our clients’ tax team in order to ensure that our clients are utilizing their stock options optimally.

- Estate Planning: NQSOs are generally more flexible when it comes to gifting to heirs, family members, or other individuals than ISOs. During an individual’s lifetime, subject to rules from the employer, NQSOs can be easily gifted or transferred to family members, heirs, or beneficiaries.

How to Exercise Stock Options:

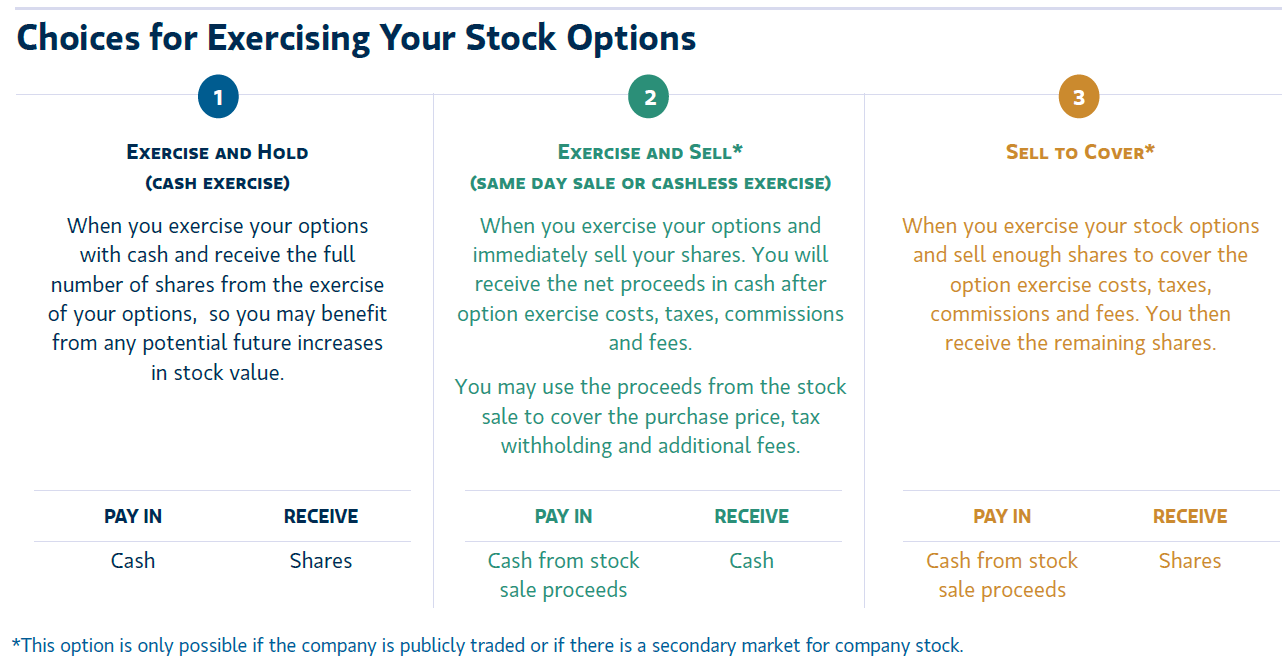

Both ISOs and NQSOs can potentially provide significant financial benefits to employees based on the ability to purchase company shares at a pre-determined price which would ideally be lower than the market value when exercised. When preparing to exercise options, it is important to keep in mind any specific blackout periods imposed by your company that dictate when and when you cannot exercise or trade company stock. Most importantly, with stock options, the employee is responsible for funding the purchase of their shares, and oftentimes this can mean a significant outlay of cash. Our team at Weatherly can assist you in navigating your choices when it comes to exercising your options. We can walk you through your options and tailor the advice to your specific situation considering cash flow needs, investment assets, and financial goals to ensure that you make a well-informed decision. Below we highlight the most common strategies when it comes to handling stock options:

Sourced from: https://www.morganstanley.com/cs/pdf/NQSO-Basics.pdf

Restricted Stock Units (RSUs):

Restricted stock units are another common form of equity compensation offered by companies. With this form of compensation, a company will provide an employee with a specified number of shares at a future date. Like stock options discussed above RSUs are granted under a vesting schedule for a specified period of time or can be tied to performance metrics. Unlike stock options, RSUs are delivered outright meaning that there is no choice granted to the employee with regards to receiving shares. RSUs are converted to stock and awarded on a set series of dates during a vesting period, and once delivered the employee can then decide whether to hold or sell the shares.

Important considerations for RSUs:

- Taxation: With RSUs, you are taxed when the shares are delivered on the specified vesting date. Taxation is based on the market value of the shares received and is treated as ordinary income. Typically, a company will withhold a certain amount of shares for tax purposes, and you will receive the net amount of shares thereafter.

- Holding Period: Once the shares are received the employee has the decision to either sell the shares immediately and receive cash or hold the shares as part of their investment portfolio. If shares are sold immediately there will likely be minimal to non-existent capital gain considerations. If shares are held then any increase in the fair market value from the time shares are received to when they are ultimately sold will be subject to either short or long-term capital gains taxes.

- Estate Planning: While RSUs are subject to vesting, they cannot be transferred or gifted to heirs or beneficiaries. Once vested and shares are delivered to an individual, they can be included as part of an estate plan and pass through to heirs and beneficiaries according to an individual’s estate planning documents.

Important Considerations for Your Financial Plan:

At Weatherly we have a team of dedicated professionals with deep knowledge and experience in the world of equity compensation packages and how to utilize them optimally to accomplish a client’s financial goals. We often work with our clients outside financial team of tax advisors and estate planners to coordinate the various moving pieces when it comes to receiving RSUs or exercising and managing stock options. From a financial planning perspective there are several factors to consider if you have an equity compensation package.

- What do I own?: Often times equity compensation packages may include a combination of ISOs, NQSOs, or RSUs. It is important to identify the various types of vehicles that are provided to you by your employer because there are various implications for your personal financial situation. Our team at Weatherly will request all the documentation associated with your equity compensation package to understand your benefits to begin implementing a plan appropriate for you.

- When do I pay taxes?: With the various vehicles available in an equity compensation package it can be very confusing to keep track of all the various tax implications and the timing of when taxes are owed. Our team of financial advisors often consults with your tax professionals to ensure that all parties are on the same page. We want to ensure that you have a clear picture of how exercising your options or receiving your RSUs will affect your tax liability.

- How does my equity compensation package affect my overall portfolio?: If you are receiving stock awards as part of your overall compensation, those awards need to be considered when it comes to your overall investment assets. Decisions regarding selling the shares and holding the shares, and the timing associated with that, can have major implications to your overall portfolio and asset allocation. There may come a point in time where you have been awarded a sizeable amount of company stock which could expose your portfolio to concentration risk and lack of diversification. Our portfolio managers at Weatherly have extensive experience and strategies for navigating your stock awards in the context of your overall financial situation.

- How do my stock awards affect my overall financial plan?: Each client is unique with their own financial situation and goals. At Weatherly one of our core pillars is customized holistic financial planning. Our team of financial planners can incorporate your equity compensation package into your overall financial plan to understand how your stock awards can potentially impact your financial situation. Oftentimes times we run various scenarios providing our clients with different options they can take in order to ultimately achieve their goals and aspirations.

Our team of dedicated advisors at Weatherly are here to answer your questions and ensure that you are making informed decisions regarding your equity compensation package. We are here to understand your specific needs and circumstances to ensure that your financial goals and aspirations can become a reality.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Weatherly Asset Management, L.P. was listed as a finalist for the 2023 San Diego Business Journal Best Places to Work award. The San Diego Business Journal (“Journal”) recognized outstanding companies whose benefits, policies and practices are among the best in the region. There were 100 winners overall, and the list was segmented by employer size categories: 1) Small Employer Category (15-49 US Employees); 2) Medium Employer Category (50-249 US Employees); 3) Large Employer Category (250-1,999 US Employees); and 4) Mega Employer Category (2,000 or more US Employees). Of the 30 employers in the Small Employer Category, Weatherly was ranked number 9. Not all nominees were named winners.

The San Diego Business Journal solicited nominations via email invitation to their mailing lists and via the paper journal circulation. The submission process included a two-part survey to get a thorough assessment of each employer. Part 1 consisted of an employer assessment and part 2 consisted of an employee feedback survey. Surveys were conducted online. Both the employer and employee data sets are combined to determine the best workplaces.

Weatherly was not required to make payments or purchases to nominate, be nominated, be considered, or included on the list related to the award. No organizational memberships were required of the Firm or individuals. The advertisement of nomination for the award is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the award, nominations for the award, or the appropriateness of related advertising.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507 Carolyn@weatherlyassetmgt.com

For those in or approaching retirement, cash flow and healthcare planning remain a top priority, and understanding the resources available is essential to developing a successful financial plan. Social Security (SS) benefits help retirees supplement cash flows and in turn, the withdrawal rate on their portfolio. Social Security can also provide benefits for individuals that cannot work due to disability or injury. Individuals become eligible for SS benefits by having 10 years of work history in which payroll taxes are collected and may draw on their retirement benefits beginning at age 62. While this is the most common way to meet SS eligibility requirements, there are a few alternatives to obtain benefits that we’ll expand on later.

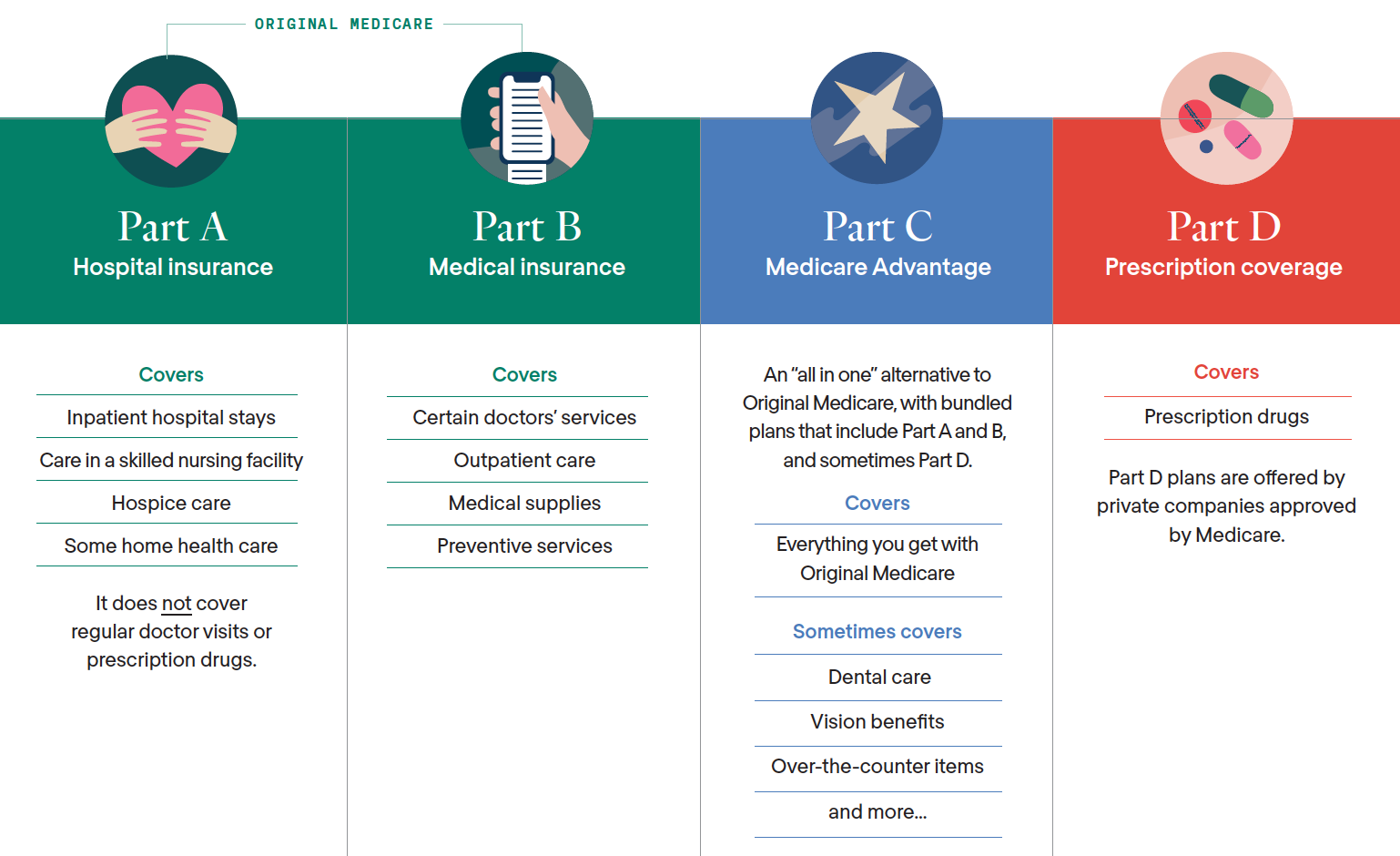

Medicare is another program offered by the federal government, providing healthcare coverage for those aged 65 or older and individuals with disabilities. The Medicare program features four parts, Part A-D, each providing a different aspect of coverage. Eligibility for Medicare coverage is determined by one’s eligibility for Social Security and enrolling in Medicare can begin three months prior to an individual turning 65 and will be automatically enrolled in Medicare Part A & B.

Social Security

Social Security benefits are primarily based upon the age at which benefits begin and the individual’s historical wages. Taxation of SS benefits can range between 0%- 85% and is based upon the individual/couple’s income each year. For those not yet receiving benefits you can look up projected benefits on SSA website here. Individuals that do not qualify for their own retirement benefit or have minimal earnings history may still be entitled to receive benefits.

Access to Benefits

- A non-working spouse may be eligible for spousal benefits up to 50% of their partner’s full retirement age (FRA) if age requirements are met.

- Divorced individuals may be entitled to 50% of their former partner’s benefit if married for at least 10 years, divorced for more than 2 years, and are unmarried.

- Surviving spouses may receive reduced benefits beginning at age 60 while retaining the ability to claim their own benefit at a later date, if eligible. Surviving spouses are also entitled to receive their former spouses benefit if higher than their own.

- Minor children may be entitled to a percentage of their parent’s benefits in certain circumstances.

- Individuals may be eligible for Disability and Supplemental Social Security benefits depending on needs, income and resources.

Before filing for Social Security benefits, it’s important to take inventory of your cash flow and needs to supplement income. According to the Social Security Administration, Social Security makes up 33% of an individual’s post-retirement monthly income. One of the biggest questions with Social Security is when to take it, however, there is no one-size-fits-all answer and ultimately depends on each individual/couple’s financial situation. This highlights the need for proper planning that incorporates a cost-benefit analysis on the timing to collect benefits. Individuals are entitled to an 8% simple increase in benefits for each year benefits are delayed past their FRA up to age 70. Weatherly can help highlight the pros and cons as to whether claiming benefits prior to or after obtaining their FRA is beneficial.

SS benefits are funded through the Social Security Trust that is overseen by the federal government. The future of Social Security has been a contested topic as recent projections have the fund being depleted in 2033. To help address this shortfall it is likely that changes will need to be made with regards to taxation of earnings, extending the FRA or reduction in benefits. Weatherly understands the importance of Social Security, and our ultimate goal is to maximize benefits for you.

Medicare

Healthcare expenses during retirement can become one of the largest costs and highlights the need for proper planning. Medicare provides healthcare coverage for individuals starting at age 65 along with additional coverage for those with extenuating health circumstances. Medicare covers a variety of care needs such as prescription drugs, in-patient treatment, out-patient treatment, and various types of hospital care.

While employed an individuals’ healthcare coverage is often provided through their employer and retiring before age 65 can create a lapse in coverage if COBRA or alternative insurance is unavailable. Certain life events may qualify an individual for a Special Enrollment Period (SEP) such as losing health coverage, having a child and getting married to name a few. A lapse in healthcare coverage can be supplemented by public marketplace insurance, private insurance, COBRA, or spousal coverage.

Medicare coverage is broken up into four parts, A-D. Parts A & B cover hospital visits, routine check-ups, and medical equipment, among other things. You are not automatically enrolled in parts C & D which provide different types of coverage. Part D provides prescription drug coverage in addition to what is already provided. Part C, known as Medicare Advantage, is an additional option that can enhance your Medicare coverage. Medicare Advantage allows you to utilize a private company for health coverage and these plans usually come bundled with parts A, B and D.

Source: HiOscar.com

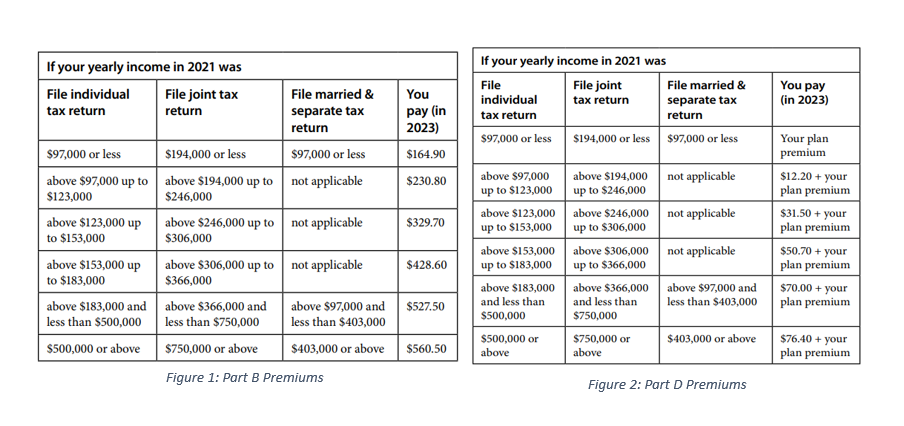

Premiums for the different parts of Medicare are based upon your taxable income and subject to a 2-year lookback.

Important Considerations

Social Security and Medicare can be a confusing process to navigate. Weatherly is here to help guide you through your unique situation and we’ve outlined a few common considerations to be aware of.

Spousal Benefits: It is not uncommon to see spouses, especially ex-spouses, not realize the full benefit they are entitled to. As a spouse, you can claim a Social Security benefit based on your own earnings record or collect a spousal benefit in the amount up to 50% of your spouse’s Social Security benefit, but not both. You are automatically entitled to receive whichever amount is higher.

Windfall Elimination Period: The Windall Elimination Period can reduce Social Security benefits for individuals participating in pension that did not pay SS taxes. WEP can reduce benefits by up to 50%.

Registration Window: The registration window for Medicare begins three months leading up to your 65th birthday and three months following. It is important to register in the window to avoid late penalties.

IRMAA Premiums: Single filers with income above $97,000 and joint filers with income above $194,000 are subject to increased premiums for Part B & D.

Returning to Work: A decision to return to work may not always be financially motivated. It is key to understand the implications of how returning to work can affect your Social Security benefits that are currently being received. For those individuals, they may experience a withholding of benefits prior to their FRA but will be recaptured once FRA is reached. Before returning to work, we recommend reaching out to SSA to understand the implications for your benefits.

Wrap Up

Social Security and Medicare are essential aspects of post-retirement income and healthcare coverage. Weatherly can help analyze the options available to you and ultimately what is most beneficial for your unique situation. This analysis expands beyond a breakeven analysis of total benefits received to include, but not limited to, cash flow needs, health history, family longevity, and type of portfolio assets available. Roth conversions during gap years may provide an opportunity to help reduce taxes over time and enhance legacy planning for those beneficiaries. Your trusted Weatherly advisors are here to educate and guide you through these complexities to help achieve the goals for you and your family.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

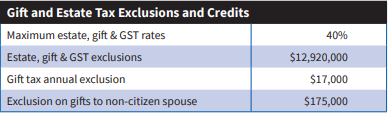

The much anticipated “Great Wealth Transfer” is looming on the horizon. Over the next few decades, an estimated $30 to $68 trillion will be passed down from baby boomers to their Gen X and millennial children (source: Forbes). Additionally, the current federal estate tax exemption is $12.92 million per person, or just shy of $26 million per couple. However, this high exemption is set to sunset at the end of 2025, reverting to an estimated $7 million per person, or $14 million per couple, depending on inflation (source: Fidelity).

As the Great Wealth Transfer and the estate exemption change approach, now is the time to prepare. The best first step is to review your financial plan with your trusted advisors to ensure you have a nest egg to last your lifetime. It’s equally important to review your will, trusts, power of attorney designations, and beneficiary selections and initiate conversations with your successor trustee(s)/executors.

Planning early and having ongoing conversations with your financial professionals and successors can help ensure your assets and personal values are transferred smoothly. Here are some key conversation topics and steps to take when starting dialogues about money, estate planning, and your legacy.

Where to Begin?

Many individuals put off important money conversations with their successors because they aren’t sure where to start. Begin with the big picture—the Who, the Where, the What, and the How. This provides a good starting point to educate your successor trustee and/or your executor without divulging specific financial details or monetary values.

The Who?

- Who Are Your Key Professionals: Share information about your team of professionals, such as your financial advisor, attorney, and accountant. Provide their contact information and explain how to access important documents if needed. This simple list can help your executor know who to reach out to for guidance and support. Our Weatherly Client Information Release Authorization Letter (CIRAL) can act as a template for this exercise.

- Who Are Your Designated Beneficiaries: Review who the designated beneficiaries are on your accounts, insurance policies, and retirement plans. This information is crucial for the smooth transfer of assets after your passing. Make it a point to have an annual check-in with your key professionals, as we know beneficiaries and wishes can change along with updates to tax and estate law.

- Who are your Executors/Successor Trustees: This role is crucial to the overall administration of your estate and may impact family dynamics. Explore options such as responsible individuals, family or friends, private fiduciaries, or corporate trustees to manage estate distributions down the road. Evaluate the pros and cons of a professional trustee to relieve family members or friends of distribution duties. Once this decision is made, make an effort to have a conversation with your chosen successor.

The Where?

- Where Are Your Assets Custodied: Identify where your assets are currently held or custodied. If you have a safety deposit box, note its location and provide details about accessing it when necessary

The What?

- What Are Your Assets and How Are They Titled: Without revealing specific market values, give an overview of your assets, including both liquid and non-liquid assets. Explain the nature of each asset and how they are titled (jointly owned, held in a trust, individually owned, retirement vs nonretirement assets, etc.).

And the How?

- How to Have the Money Conversation: Lean into your team of professionals to help navigate the conversation. Weatherly often facilitates the initial conversation to introduce successors to big-picture concepts about your estate without divulging market values. We also act as a resource for ongoing money conversations as your needs and situation evolve.

Express Your Wishes, Family Values, and Charitable Intentions

Depending on your unique situation and desire to incorporate your next generation or heirs, some families hold meetings to discuss values around wealth and philanthropy and set shared goals for social impact and creating a legacy.

We often see charitably inclined individuals utilize Donor Advised Funds (DAF) to hone in on charitable values and build a legacy via grants to causes they care about. This process can be as formal as a meeting with all individuals to discuss charities they care about or as informal as giving each person a certain dollar amount to grant to a charity of their choosing year over year. The key is to find what works for you and make it your own.

Gifting to the Next Generation: Empowering the Future with Smart Choices

Another effective way to empower your successors with financial responsibility is through annual gifting. As of 2023, the annual gift exclusion amount is $17,000 per person- meaning you can gift up to $17,000 to each individual without incurring gift tax.

Weatherly is happy to review your own personal financial plan to help determine what gifting amount may be appropriate and subsequently help set up investment accounts for your heirs. By involving a financial advisor, the next generation gains access to valuable resources and professional guidance to make informed financial decisions.

For 5 additional Estate Planning Strategies to Consider, please read our past blog post on the subject.

How WAM Can help?

Starting these in-depth conversations now can help ensure you and your successors are unified in handling the complex transition of resources and responsibilities successfully. The Weatherly team is here to help start the conversation without overwhelming your successors with intricate financial information. We can further assist you by creating an open and supportive forum to discuss your estate, financial planning and focus conversations on how you can thoughtfully prepare for the future while making a positive impact together.

As always, we welcome your questions, calls and the opportunity to schedule a conversation with you and your next generation or beneficiaries.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Weatherly Asset Management, L.P. was included in the Financial Advisor’s Magazine 2023 RIA Survey and Ranking List. This list is the publication’s 17th annual ranking of independent advisory firms. The list and article are available to view in the print version of the July 2023 issue and online here.

The ranking was based on 2022 year end discretionary and non-discretionary AUM reported on ADV. To be eligible for the ranking, firms must be independent registered investment advisors and file their own ADV statement with the SEC, and provide financial planning and related services to individual clients. Firms must have at least $50 million in assets under management as of December 31, 2022. Corporate RIA firms and investment advisor representatives (IARs) were not eligible for this survey.

The list was segmented by asset categories: 1) $1 billion and over; 2) $500 million to <$1billion; 3) $250 million to <$500 million; 4) $150 million to <$250 million; and 5) $50 million to <$150 million. Within each of the asset category segments, firms were ranked by 2022 year end discretionary and non-discretionary AUM. The comprehensive list consisted of 521 firms. Weatherly was ranked 305 overall.

Weatherly received an email invitation to participate in FA’s annual nation-wide RIA ranking survey. Weatherly completed the survey, which in addition to AUM, focused on services offered by the firm; service fee structure; anticipated changes to the business in the next 5 years; staffing and recruiting; operations and strategy. The survey review included information provided by Weatherly, as well as public data available through the firm’s ADV filing.

No payment was required for participating in the survey. Weatherly elected to pay for a custom digital license to use the award logo on our website.

No organizational memberships were required of the Firm or individuals. Ranking on this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507 Carolyn@weatherlyassetmgt.com

Kelli Burger, Brent Armstrong, and Brooke Boone Kelly were listed as honorees for the 2023 San Diego Business Journal 40 Business Leaders under 40 award. The San Diego Business Journal (“Journal”) recognized 40 dynamic business leaders under 40 who have contributed significantly to San Diego’s workplaces and communities.

The San Diego Business Journal solicited nominations via email invitation to their mailing lists and via the paper journal circulation. Members of the Weatherly team nominated Kelli Burger, Brent Armstrong, and Brooke Boone Kelly. Not all nominees were named honorees.

Nominees were asked to provide a profile on the nominee’s specific career and accomplishments. Weatherly supplied the information for the nomination by completing the Journal’s questionnaire.

Weatherly was not required to make payments or purchases to nominate, be nominated, be considered, or included on the list related to the award. No organizational memberships were required of the Firm or individuals. The advertisement of nomination for the award is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the award, nominations for the award, or the appropriateness of related advertising.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507