Wealth in the Return

Chrissy Rhamy, Operations Associate | Aubrey Brown, CFP®, CRPC®, M.S. Wealth Management Advisor | May 25, 2023

If you find taxes confusing, then you are not alone. Albert Einstein once said, “the hardest thing in the world to understand is the income tax.” While we outline many useful tax details in our Key Financial Data Sheet and even observed the US history of taxes in a prior blog post, it is truly the IRS’ job to fully understand and enforce the tax code. We also find the tax return essential to our services and we like to receive a secure copy each year.

Within your tax return is a wealth of information that we utilize to support our two core competencies – financial planning and investment management. Our goal is to get to know your full financial picture so we can tailor our advice to your specific situation to increase overall tax-efficiency. While we prefer to analyze your full tax return, the following sections give us specific insights into how we can best serve you.

1040

The 1040 gives our team a summary of your full tax picture. Numbers on your 1040 that are of particular interest to our team are your Adjusted Gross Income (AGI) and your Taxable Income. Your Taxable Income, in conjunction with your Filing Status, help us determine your Marginal Federal Tax Bracket. Your tax bracket drives the types of securities we purchase for your taxable portfolio, like a Trust or individual account. For example, a person in a very high marginal tax bracket may benefit from tax-exempt municipal bonds. Alternatively, a person in a low tax bracket has less of a need for tax-free income and may benefit from an allocation to taxable corporate bonds. Weatherly always looks at the Taxable Equivalent Yield (TEY) to compare a taxable bond to a tax-exempt bond to determine which offers the most attractive after-tax return per client account.

Tax brackets are also useful within financial planning to determine if it is a good year for a Roth conversion. This strategy can take advantage of a low-income year by leveraging current lower income tax brackets to enhance after-tax returns over time. Since Roth assets can grow tax free, they often become a desirable source of funds in legacy planning for beneficiaries.

This first page is also useful when onboarding new clients. It provides our team with your full name, Social Security Number, address, and lists any dependents you claim. This information facilitates us in filling out new client paperwork and expedites the client onboarding process. We also track your tax preparer as listed at the bottom of form 1040, as we may need to contact them with any questions that may come up regarding your tax situation and various tax strategies. With your consent, we can also contact them to directly and securely send your tax forms to assist them in filing your return.

Schedule 1

Schedule 1 outlines any additional income you earned throughout the tax year as well as adjustments to your income. Our team appreciates having a full outline of your revenue streams and how much you receive. It can be overwhelming to have to keep track of this information independently, so it is often easier to send this summary to your advisor to give them some context on your cashflow. We can also model the income into a financial evaluation and build out various scenarios.

Schedule A

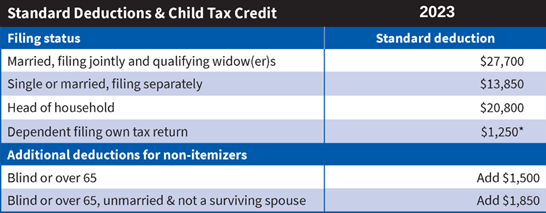

If you itemize your deductions, instead of taking the standard deduction, you will need to fill out a Schedule A. The Tax Cuts and Jobs Act (TCJA) in 2018 made significant changes to the deductions you can itemize. The main deductions are medical costs (that exceed 7.5% of AGI), state and local taxes (now capped at $10,000), mortgage interest and gifts to charities. The TCJA also significantly increased the standard deduction which dramatically reduced the amount of Americans itemizing their deductions. For the 2023 tax year, the standard deductions are mainly based on filing status but can also be affected by other factors. Please see the chart below for details:

Sourced from: https://www.weatherlyassetmgt.com/wp-content/uploads/2023/01/2023_KEY_FINANCIAL_DATA_CHART.pdf

Many of our clients itemize their deductions because their large donations to charities throughout the year frequently exceed the standard deduction. One of the strategies we utilize includes appreciated stock contributions to a Donor Advised Funds (DAF). If you have philanthropic goals, then our team can help evaluate timing and security selection for tax aware giving methods. Your generosity not only helps those in need but can decrease your taxable income for the year. It is important to note, if you do not itemize, your charitable contributions are not deductible but other strategies like Qualified Charitable Distributions (QCDs) may be an alternative.

Schedule C

If you are a sole proprietor, you should also have Schedule C included in your tax return. This form indicates any profit or loss your business experienced throughout the year. We use this to help us determine if it would be beneficial to take any gains or losses in your account to offset the profits or losses from your business. We can also incorporate the income streams and a future business sale into your financial evaluation. Seeing Schedule C typically leads into a conversation about retirement contributions and if a self-employed 401K or other retirement plan is appropriate.

Schedule D

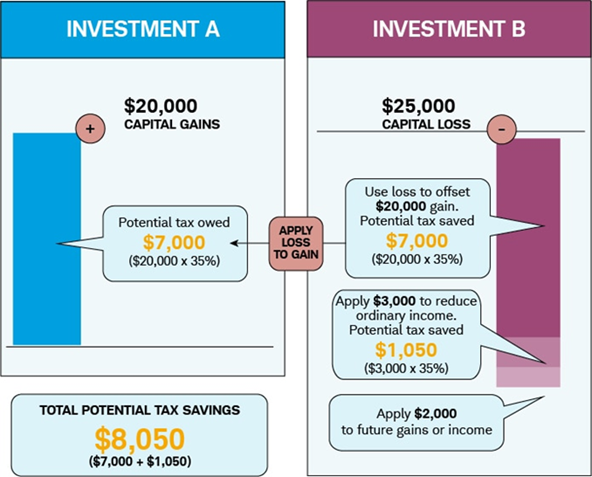

Schedule D reports capital gains and losses. Our team actively seeks to limit capital gains each year, through tax loss harvesting. This strategy includes taking losses (if available) to offset capital gains in taxable accounts. Occasionally, a client will have capital losses that exceed gains. In this instance you may deduct up to $3,000 ($1,500 if married filing separately) against ordinary income on your 1040 and carry forward the remaining losses to future years.

Sourced from: https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

In periods of extreme volatility, this strategy can be used proactively so unused losses can be used to offset future gains when the market recovers. This method along with other tactics are used to successfully reduce concentrated positions over time while limiting adverse tax consequences. As part of our ongoing investment management services, we actively seek to buy and sell securities with a tax conscious approach.

Schedule E

Many of our clients own rental properties, receive royalties, own S corporations, or receive income from estates and trusts. Schedule E is where the income and losses from those avenues are reported. Our advisors review this form to gain better understanding of your financial situation and can work different scenarios into financial evaluations.

1040-ES and Vouchers

These vouchers help our team plan out cash flows throughout the year. Understanding your cash needs allows our team to accumulate cash and send funds to your bank proactively to help cover quarterly tax estimated payments.

How Weatherly Can Help

The Weatherly team takes pride in our ability to create tax efficient strategies specific to each client so they can ultimately keep more money in their pockets. Each client not only has their own unique situation, but tax and estate laws can change. A current tax return allows us to identify any new planning opportunities for the year and assists in our tax conscious investment approach.

If you haven’t already done so, please send us your tax return by utilizing our secure portal or another secure method. If easier, feel free to connect us with your tax preparer and we can request the return directly from them. We work closely with many tax professionals to securely share tax documents and to collaborate on any tax planning initiatives.

As always, we welcome your questions and look forward to saving you money!

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.