The Gift of Financial Advice

Marty Rascon, Wealth Management Associate Advisor | Ryan Richardson, CFP®, Senior Wealth Management Advisor | December 20, 2022

When it comes to life, few gifts are more valuable than financial advice. As young professionals and their families navigate the complexities of today’s world, financial planning is essential in helping them reach various milestones in life. Whether they are just beginning their career, starting a family, or beginning to plan for retirement, a financial advisor can be an invaluable asset.

“Industry studies estimate that financial advice can add between 1.5% and 4% per year to account growth over extended periods.” Source: Fidelity

For young professionals and new families just getting started, having an advisor who takes a holistic approach to your situation can add tremendous value and have a long-term impact. A good financial advisor will help create a plan that considers income, expenses, and long-term goals, to optimize cash flow. In addition, they will help identify areas where money can be saved or invested for long-term objectives, like retirement or college savings plans for children. An experienced financial planner can also guide clients through the nuances of tax mitigation strategies and estate planning considerations.

In this blog post, we will discuss these topics in more detail alongside the benefits of working with an experienced wealth management advisor on the journey to financial success.

Cash Flow Optimization:

For young professionals and families, financial planning can be one of the most intimidating aspects of life. One of the critical steps in achieving your financial goals is to understand how to optimize cash flow between discretionary and non-discretionary spending, 401K contributions, and 529 college savings plans. This can help provide clarity around how to achieve financial goals in the short term and long term.

Non-Discretionary vs. Discretionary Spending

When it comes to allocating a paycheck, there are several factors to consider. First, it is vital to set aside money for essential expenses such as rent or mortgage payments, insurance premiums, utilities, food, gas/transportation, and other necessary living costs. Additionally, it is prudent to establish an emergency fund with at least three to six months’ worth of expenses. These items should take precedence over any other form of spending or saving.

Retirement Contributions

After assessing the difference between non-discretionary and discretionary spending it is essential to think strategically about how the remaining funds should be allocated between retirement savings (401k) and college savings (529), as applicable. Through dialogue with a WAM advisor, we can offer tailored advice on what you should prioritize based on your individual goals.

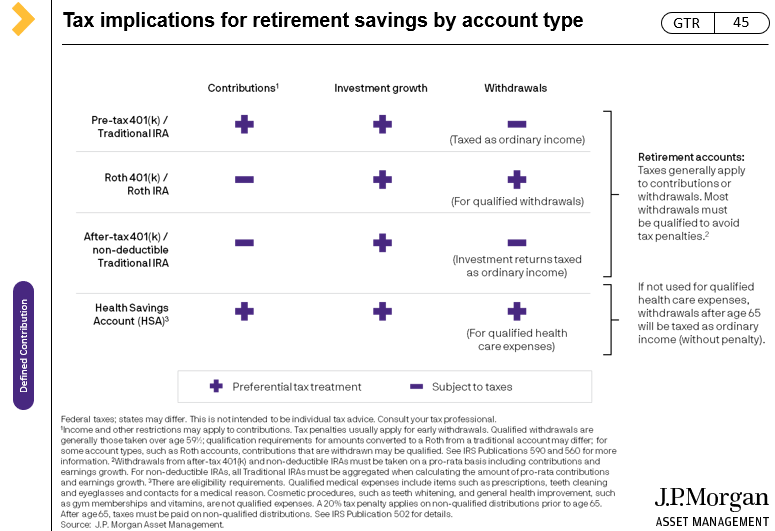

Contributing to a 401K is often a great idea because of its tax advantages and investment options available through employer plans. Often, 401K plans come in two forms: a Traditional or a Roth option. Traditional 401K contributions are made before taxes, which offers a tax deduction today, and grow tax-free until funds are withdrawn in retirement. Conversely, the Roth option consists of after-tax contributions, with no tax deduction today, but no taxes are owed upon withdrawal during retirement.

Source: JP Morgan Guide to Retirement (page 45)

Additionally, by working with one of our advisors, we can assist in recommending an appropriate asset allocation strategy for your retirement funds, based on your risk tolerance and investment goals. Another benefit of participating in a company’s 401K plan is that many employers will match contributions up to a certain amount – this provides an excellent incentive to save more and get the maximum benefits from the plan.

College Savings Plans

Regarding college savings plans, 529s are the most popular vehicles due to their tax advantaged nature. Contributions to these plans are made with after-tax dollars, but the earnings grow tax-free and can be withdrawn tax-free when used for qualified higher education expenses. Additionally, many states offer tax deductions or credits for contributions to a 529 plan, making it an even more attractive option for millennials looking to optimize their cash flow. The WAM team can help facilitate the establishment of 529 accounts to ease the burden of increasing educational costs.

Tax Mitigation Strategies:

Young professionals face unique financial challenges, and it is important to understand the best strategies for managing their money. One of the most important financial strategies for millennials is tax mitigation. Tax mitigation strategies include utilizing a Roth IRA, taking full advantage of their mortgage, and utilizing other applicable tax credits/deductions.

Roth IRA

In addition to the benefits above, if you have a Roth IRA for more than five years, there are no taxes or penalties when withdrawing earnings for a first-time home purchase, up to $10,000.

Tax Loss Harvesting

Tax loss harvesting is an effective way for investors to reduce their taxable income by selling investments at a loss in order to offset any realized gains from appreciating investments. In a year characterized by stock market losses, you may find that there are few opportunities to offset gains in your investment accounts. If that is the case, you can still utilize the lax loss carry-forward which will allow you to offset capital gains in future years. Alternatively, the IRS allows an individual to use $3,000 of capital losses per year to offset ordinary income. This technique can assist in tax mitigation throughout your lifetime if used properly.

Mortgage Deductions

Mortgage interest payments are deductible from your taxable income when filing taxes which can significantly reduce liability owed. This deduction applies to both primary residences (purchased or refinanced) as well as second homes such as vacation properties or rental properties that may generate rental income or be used for recreational use. If your home was purchased after December 15th, 2017 you are allowed to deduct interest on the first $750,000 of the mortgage. Additionally, if you have a HELOC you may deduct up to a max of $100,000 in interest.

Child Tax Credit

The Child Tax Credit is available for parents who have dependent children under the age of 17 living with them full time in the United States. The Child Tax Credit can be claimed up to $2,000 per qualifying dependent with half being refundable if certain criteria are met such as adjusted gross income (AGI). Additionally, if AGI exceeds certain thresholds, then this credit may be reduced or phased out completely.

Charitable Contributions

In a recent study conducted by Fidelity Charitable, they found that approximately 74% of millennials consider themselves philanthropists. With the future of philanthropy in the hands of the next generation, please refer to WAM’s Guide to Giving to learn about the most tax-efficient ways to maximize charitable contributions to influence the world in a positive way.

Estate Planning:

Millennials are the largest generation in the United States, and it is important for them to start planning for their future. An estate plan is one of the best ways to ensure their wishes are followed and their assets are handled appropriately in the event of their death or incapacity. A comprehensive estate plan should include a trust, will, power of attorney, and health care power of attorney.

Trust

A trust is an important document to have in an estate plan. It can be used to protect assets, provide for minor children, and manage assets in the event of incapacity or death. Assets that are listed within the trust will avoid probate court, saving your family members valuable time and expenses. There are several types of trusts all with varying implications.

Will

A will is another important part of an estate plan. It allows a person to designate beneficiaries, provide instructions for how and when beneficiaries receive assets, and can name guardians for minor children.

Power of Attorney/Health Care Power of Attorney

A power of attorney and health care power of attorney are also important documents to have in an estate plan. A power of attorney allows a person to appoint someone to manage their finances and legal affairs in the event of their incapacity. While a health care power of attorney is a document that allows an individual to designate someone to carry out their health care directives in the event of incapacity.

These four essential documents are important because they allow you to specify what you want to happen to your property and assets after you pass away. These documents can also help to protect your loved ones and ensure that your wishes are carried out according to your specifications. Without these documents, your property and assets may be distributed according to state law, which may not be in line with your wishes. Additionally, estate planning documents can help minimize taxes and other expenses and can provide guidance to your loved ones during a difficult time.

Why Work with a Weatherly Advisor:

Younger investors are looking for ways to manage their cash flow, make sound investment decisions, and protect their wealth. Working with our experienced professionals at Weatherly can help achieve these goals efficiently.

Advisors can help young professionals optimize their budget, save and invest, and provide tailored advice on tax mitigation strategies, such as understanding deductions and knowing which tax credits apply in different scenarios. Financial advisors can also help young families create realistic estate plans that prioritize their goals while minimizing the potential impact of taxes or other liabilities.

Learn more about our services and how our customized approach may benefit you or your family:

https://www.weatherlyassetmgt.com/our-services/

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.