Carolyn Taylor was included in Barron’s 2024 Top 100 Women Financial Advisors list. The full list can be viewed on Barron’s website. View the list here: https://www.barrons.com/advisor/report/top-financial-advisors/women?page=1.

The criteria for ranking reflects assets under management as of 03/31/2024, revenue that the advisors generate for their Firms, regulatory record, quality of the advisor’s practices, and philanthropic work. Investment performance is not an explicit criterion because the advisors’ clients pursue a wide range of goals. In many instances, the primary goal is asset preservation. The scoring system assigns a top score of 100 and rates the rest by comparing them with the top-ranked advisor. Carolyn was ranked 41st.

Carolyn Taylor was invited to participate in the nomination process via email solicitation from Barron’s and nominated by colleagues for inclusion in the list. For this year’s Top 100 Women Advisors ranking, 1,094 advisors submitted data. Barron’s uses a proprietary method to rank advisors based on the criteria above. Weatherly provides this data to Barron’s in the form of a survey response. Initial ranking is done by Barron’s; publicly available data is verified by Barron’s against SEC and FINRA reports. Barron’s then conducts the next level of ranking. Data that is not independently verified by Barron’s is then sent back to the Firm for verification. Barron’s then incorporates any required changes into the ranking and finalizes the list for editorial use and publishing.

No payment was required for nomination or inclusion in the ranking. No organizational memberships were required of the Firm or individuals. Ranking on this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

We’ve all heard the old cliché “Don’t put all your eggs in one basket,” and that couldn’t be more evident than in the realm of investing. In the field of investing, putting all your eggs in one basket is often referred to as “portfolio concentration,” and can be a very risky investment strategy that can leave your portfolio vulnerable. Portfolio diversification, on the other hand, is an investment strategy that aims to reduce overall portfolio risk by investing in various types of assets knowing that they will behave differently than each other. There are many ways to achieve diversification within your portfolio, from investing in stocks, bonds, real estate, cash, etc., each of which behaves differently over time depending on the underlying economic conditions. Achieving proper diversification in your portfolio is a time-tested and prudent investment strategy that can provide reduced risk and peace of mind.

There is one factor of a properly diversified portfolio that can often be overlooked by investors. “Home bias” is a common pitfall amongst investors in which they prefer their domestic assets rather than assets from outside their own country. Many reasons can explain this home bias, but one of the most common reasons is investors feel more comfortable investing in securities that they are more familiar with. Unfortunately, this bias is limiting investors in their ability to achieve proper diversification within their portfolios and oftentimes leaves them overly concentrated in their own country’s assets and their country’s dominant sectors. This blog will explore international investing and the role it plays in your portfolio. We will discuss the benefits, opportunities, and items to be aware of when considering adding an international allocation to your holdings.

Diversification Matters:

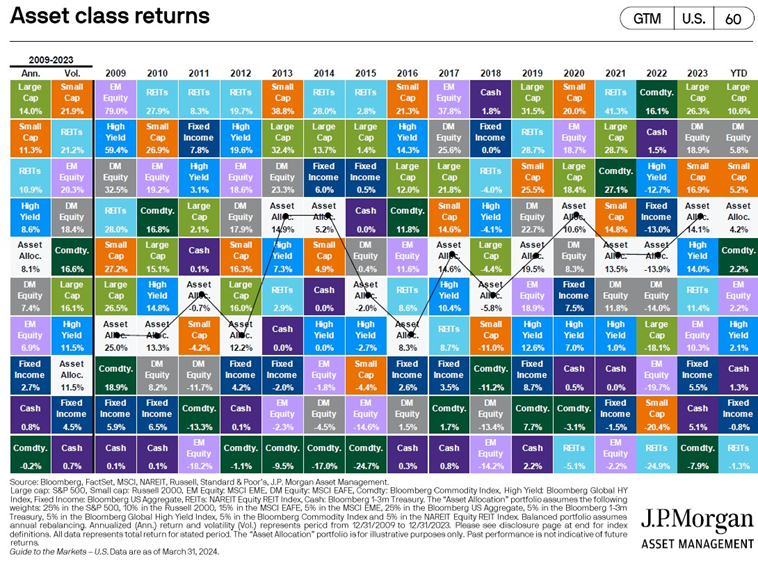

As we discussed above, diversification is a vital aspect of developing a resilient investment strategy that can assist you with achieving your financial goals while spreading your risk amongst various asset classes. Below is a helpful representation as to why diversification matters in an investment portfolio. Just as it is extremely hard to time the market, it is also a challenge to predict which asset class will outperform another in any given year. The below chart illustrates the performance of different asset classes in each calendar year from 2009 to the second quarter of 2024. What you’ll notice is asset classes perform differently from year to year, primarily due to underlying economic conditions. Diversification comes into play when you have exposure to various asset classes to ensure you reduce risk and smooth out your returns over time.

The logical question to ask next is how does diversification work in practice. The answer lies in the correlations of assets, the degree to which two assets move with each other. This is especially true when it comes to investing internationally and thinking globally rather than being laser-focused on domestic assets.

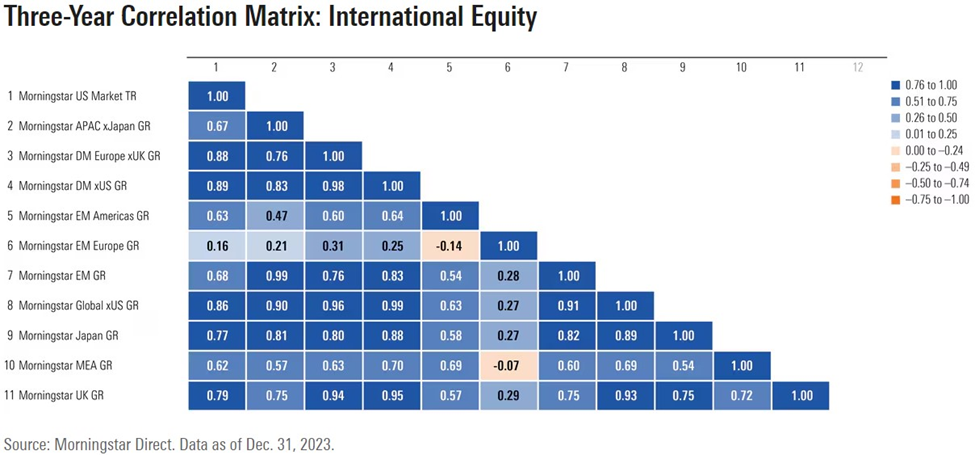

Below is a correlation matrix provided by MorningStar illustrating the degree to which international equities move with each other.

In the above chart, the darker the rectangle, the more highly correlated the assets are. As an example, the MorningStar US Market TR is highly correlated to the MorningStar Developed Market Europe xUK index at .88 but has a low correlation to the MorningStar Emerging Markets Europe index. To put it simply, when the US market moves in a certain direction, most of the time so do the developed markets of Europe. However, emerging markets in Europe are not highly correlated with the US market providing diversification benefits since those asset classes behave differently.

In recent years, the correlation between US equities and international equities has become more correlated as we have experienced a more globalized economy. However, historically this has not always been the case, and diversification benefits are still present within international markets.

Home Bias & Sector Comparison:

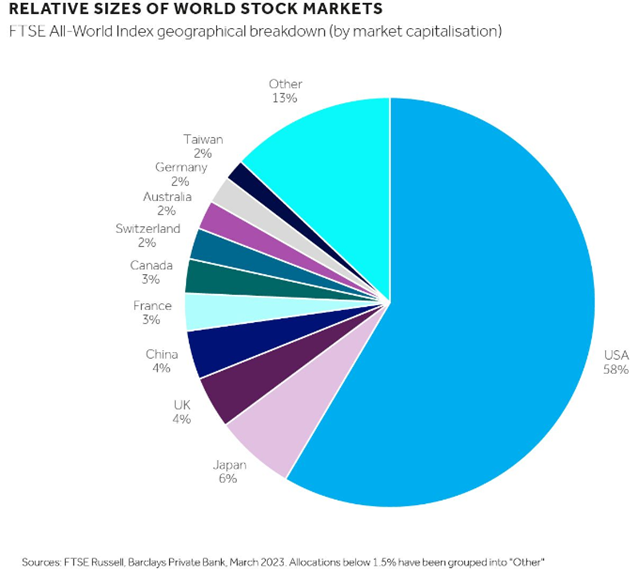

Investors often fall into the trap of preferring their own domestic assets and ignoring the larger global picture. As an example, according to Barclays in the United Kingdom, it is estimated that on average approximately 25% of portfolio allocations are in UK assets despite UK assets comprising only 4% of the global market index.

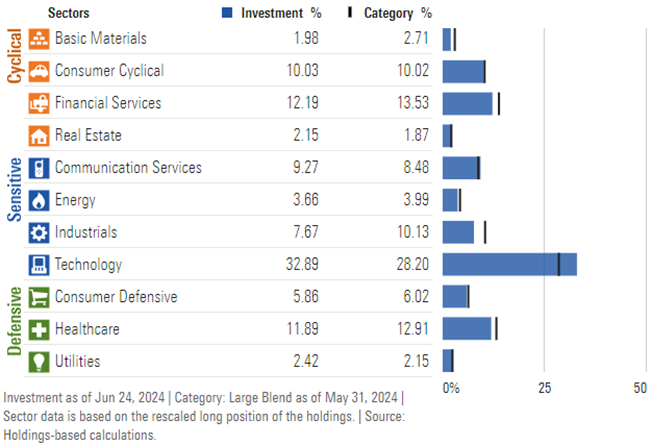

This example of home bias demonstrates an investor’s inability or apprehension to invest outside of their borders. This causes a few different problems and lack of diversification is chief among them. There is also another, more granular, issue with home bias that has to do with the composition of each country’s equity markets. For example, in the United States, roughly 32% of the S&P 500 is comprised of growth-oriented technology companies.

S&P 500 index sector weights as demonstrated by SPY

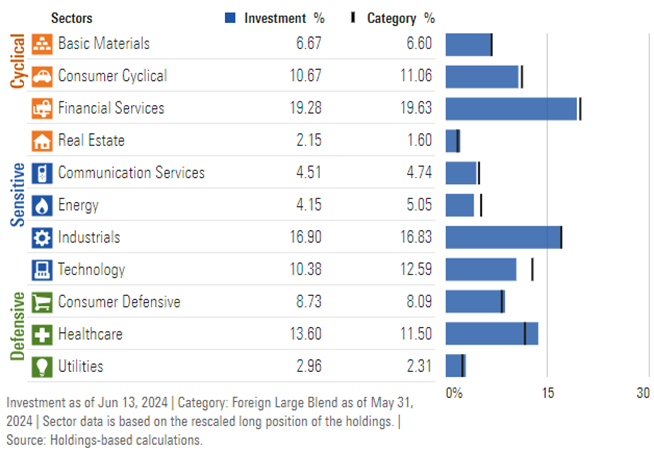

However, if we look at a broad-based international index as demonstrated by the MSCI EAFE, which is an index that tracks Europe, Australasia, and East Asia, we can see that the market composition is completely different. As demonstrated by the below chart, the sector composition for the MSCI EAFE is not as overly concentrated in any one sector to the degree the S&P 500 is. Additionally, the composition of this international index is more heavily tilted towards companies that would be considered value stocks as opposed to the US that is tilted heavier toward growth stocks.

MSCI EAFE index sector weights as demonstrated by EAFE

By having your portfolio heavily concentrated in your domestic markets, you may be missing opportunities and diversification benefits present from international exposures. As we can see from the index comparisons of the S&P 500 and the MSCI EAFE, there are concrete differences in each’s sector composition. Without some international exposure, you could be missing out on opportunities abroad in sectors that aren’t highly represented in your own domestic market and have too much exposure to a particular sector.

US vs. International Historical Performance:

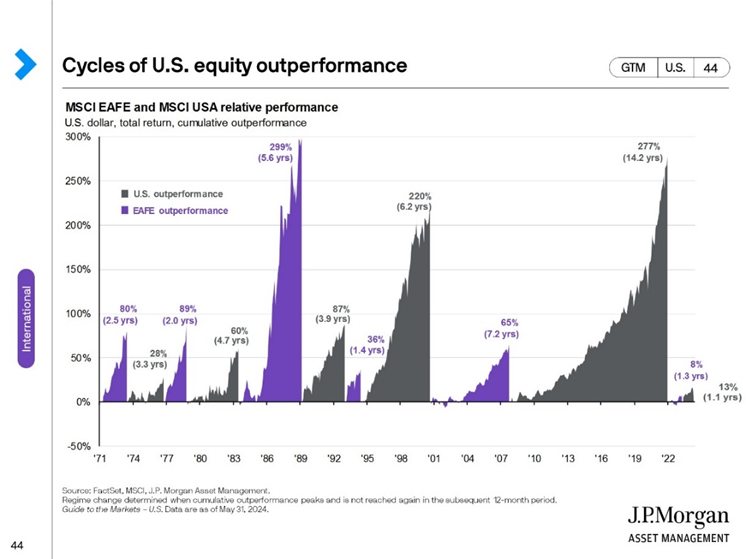

The performance of US vs. International equities are cyclical in nature. There are periods when International markets outperform their US counterparts and vice versa. The below chart shows an illustration of the various cycles of US vs. International performance and the corresponding years that outperformance lasted and the return differential.

As demonstrated by the above chart, in recent history, the US experienced the longest period of outperformance since 1971 at just over 14 years. However, there are periods when having international exposure in your portfolio would have been a real benefit. The most recent period of international outperformance came in 2022 when the MSCI EAFE beat the MSCI USA index for 1.3 years with a return differential of 8%. And again, just like it’s extremely difficult to time the market, predicting when the international vs. US pendulum swings is just as difficult. By having some international exposure, you may be able to participate in upside potential even if the US market is not doing well, demonstrating another benefit to a globally diversified portfolio.

International Valuation as of 2024

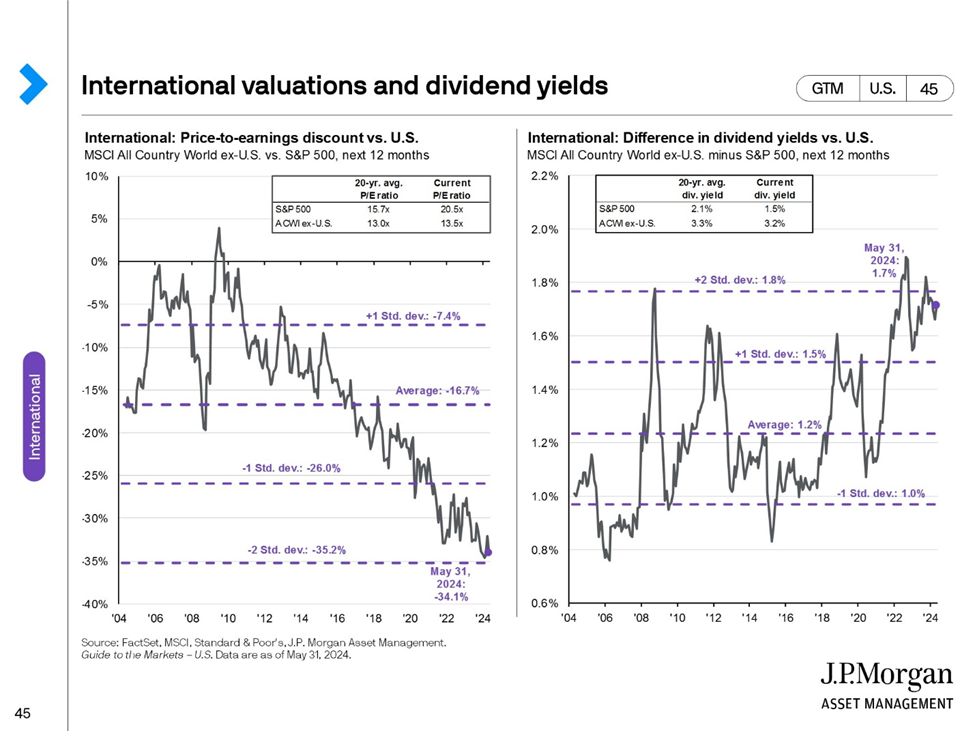

Another compelling reason to add international exposure to your portfolio stems from the current valuation differences between US equities and international equities. The below chart from JP Morgan demonstrates the differences in pricing as demonstrated by the price-to-earnings ratio (P/E). The P/E ratio is a measurement of a company’s current stock price to its earnings per share allowing for comparisons between companies, sectors, and even countries. Historically, the US market has demanded a higher P/E ratio due to the quality and growth of the companies within the S&P 500. However, at this point, international equities are cheap relative to historical averages, and the US is expensive relative to historical averages. Additionally, for income-seeking investors, international equities provide a higher dividend yield relative to their US counterparts making for an attractive investment given the valuation of US to international stocks.

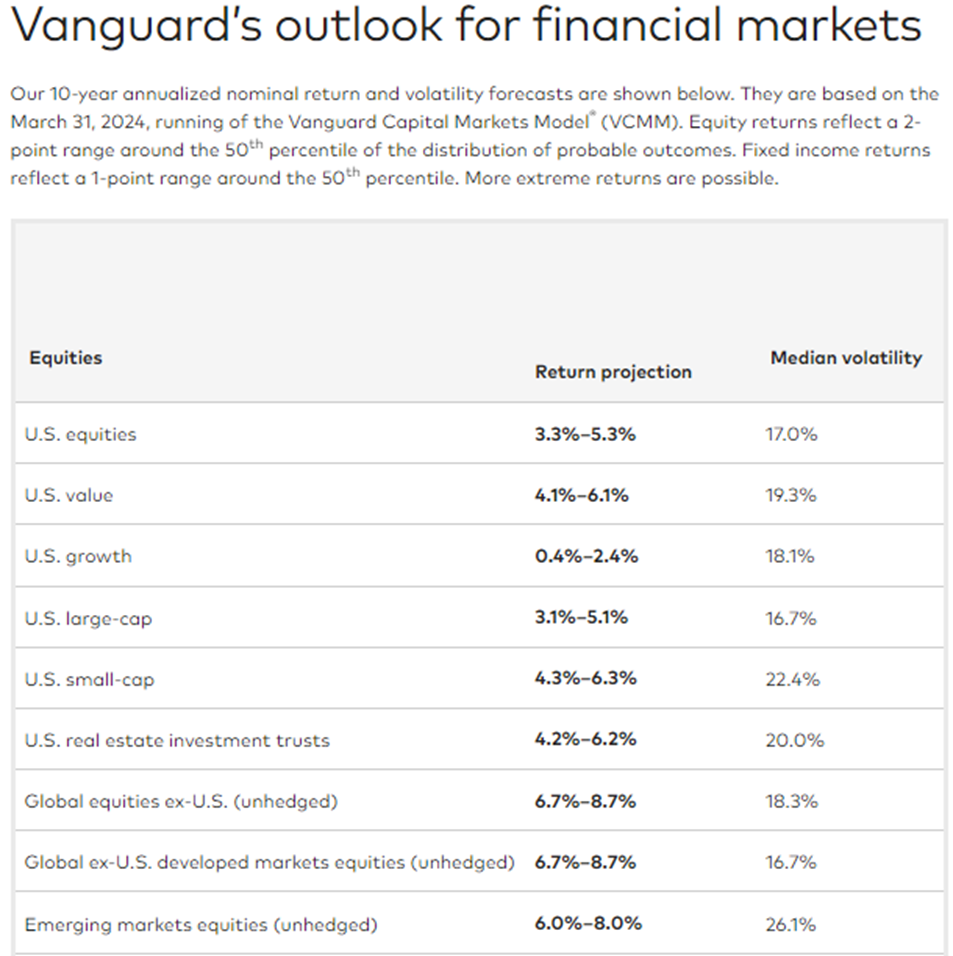

Additionally, several large asset managers such as Vanguard and Blackrock continue to argue for the inclusion of international equity given the long outperformance of the US market along with opportunities abroad. Vanguard also provides their forward 10-year return and volatility forecasts for various asset classes. Based on their research and models, they are forecasting international equities to outperform US equities over the next 10-years.

Challenges and Considerations

With every investment, there are inherent risks and challenges. Below we would like to outline a few to be aware of when considering investing internationally.

- Fees & Expenses: If you are a domestic US investor looking to invest internationally be aware that some mutual fund and ETF providers may have higher fees associated with their international offerings. This is due to different transaction costs in international markets along with the need to invest significant time and resources to understand international markets and recommended investments.

- Geo-political risks: Political, economic, and social dynamics vary from country to country and can be hard to understand and foresee for domestic investors. Additionally, differences in legal systems from country to country could cause potential issues for investors internationally.

- Currency: If you are a US-based investor looking to invest directly in international stocks, you would be required to exchange your dollars for foreign currency. This would bring in currency risk for the holding period as the value of each country’s currency appreciates or depreciates relative to the other. Generally, utilizing a vehicle like a fully hedged international ETF or mutual fund is the preferred route.

- Liquidity: Liquidity risk refers to the risk of not being able to sell your investment quickly and convert it to cash. This risk is present when investing directly in international markets, especially emerging markets. Here again, utilizing an ETF or mutual fund with ample liquidity is preferred if you want exposure to these asset classes.

Conclusion

Keeping a global perspective when constructing your diversified portfolio may help to reduce overall portfolio risks and help you take advantage of opportunities abroad. Countries vary in the composition of their markets and it’s important to consider this granular detail to understand the risks and opportunities you have exposure to. Although US equities have outperformed international in the recent past, it’s important to remember that this relationship is cyclical and it’s very hard to predict when international or US markets will outperform the other.

At Weatherly, we specialize in personalized financial planning and creating customized portfolios to meet the needs of our clients. As part of our portfolio construction, Weatherly has maintained an overweight to US equities over the last decade due to favorable economic conditions in the United States and the historic period of outperformance relative to international equities. However, within client portfolios, we retain exposure to international equity given all the reasons mentioned in this blog post.

Our team of experienced advisors are here to discuss your financial needs and goals. Through our financial planning and investment management services, we seek to offer you clarity and confidence on your financial journey.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

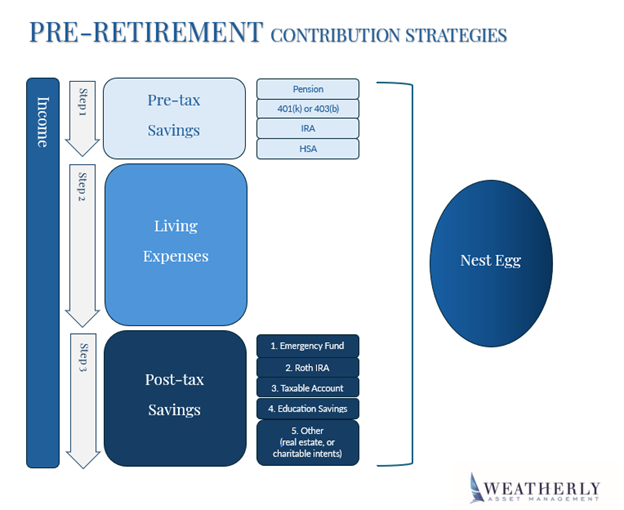

In the journey toward financial security, the intersection of saving and spending plays a pivotal role- irrespective of income or assets. This blog post delves into the significance of a well-structured budget and offers key insights for those saving for retirement or already retired. It emphasizes the crucial steps individuals should take to secure their financial future, including strategies for pre-retirement saving and post-retirement withdrawal. Understanding these principles is vital for anyone aiming to nurture and grow their nest egg effectively.

Saving Buckets Pre-Retirement

Step 1: Pay Yourself First

During your working years, it’s easy to overlook the importance of a detailed budget, relying instead on a regular paycheck to support your lifestyle. As careers progress and income increases, many people fall victim to lifestyle creep—spending more as they earn more without increasing their savings.

Fidelity advises aiming for a savings rate of 15% of your pre-tax pay, with the goal of saving enough to replace at least 45% of your pre-retirement income (Retirement Guidelines). While this is a recommended minimum, each household is different and retirement goals will vary. The motto “pay yourself first” is incredibly important. Setting up automatic, recurring savings to an employer-sponsored plan, such as a 401k or other pre-tax accounts like an IRA, ensures your income isn’t spent frivolously and helps reduce your taxable income. Depending on your employer, additional savings vehicles such as Health Savings Accounts (HSA) or Deferred Compensation plans may be available, allowing you to shield additional income from taxation and build your retirement nest egg. HSAs are particularly beneficial for healthcare savings, offering triple tax benefits: contributions are deductible, growth is tax-deferred, and qualified withdrawals are tax-free. Self-employed individuals have similar retirement options, which we explored in a previous blog post- Finding A Balance. Each of these plans have different annual contribution and income thresholds that can be found on the Key Financial Data chart.

Step 2: Understanding your Expenses

Once you’ve contributed to tax-deferred accounts, focus on managing your after-tax income for monthly living expenses and potential after-tax savings for investment accounts. Living expenses can often be broken down into two categories: non-discretionary and discretionary expenses. Non-discretionary represents expenses required to be paid, such as a mortgage, utilities, healthcare, or insurance. Discretionary expenses capture everything else that individuals or families spend to maintain their lifestyles. It’s common for people to mistakenly treat discretionary expenses as essential, such as multiple streaming services. Reviewing your monthly credit card statement can help identify unnecessary expenditures. Free online budgeting tools can categorize transactions, track spending, and provide insights into duplicative services. Taking the time to analyze your spending can uncover overlooked or frivolous expenses, enabling you to streamline your budget and optimize your savings.

Step 3: Prioritizing Post-Tax Savings Buckets

#1 Emergency Fund

First and foremost, we suggest clients save 3-6 months of expenses for unexpected events. Consider investing in liquid accounts like money market funds or high yield savings accounts.

#2 Roth IRA

Once the emergency fund has accumulated, look to tuck away money in a Roth IRA, if eligible. Roth accounts allow you to make after-tax contributions up to the annual contribution limit ($7,000 and additional $1,000 catch up contribution for those 50 and older in 2024). Roth accounts are attractive as the growth and qualified withdrawals are tax free for owners, beneficiaries, and are not subject to required minimum distributions.

Eligibility Requirements: To be eligible to contribute the maximum amount to a Roth IRA in 2024, your modified AGI must be less than $146K if single and $230K if married and filing jointly. Additionally, you or your spouse must have taxable compensation of at least your contribution amount. The income limits and contribution phase outs are further outlined on our blog post Keys to the Key Financial Data Chart.

#3 Taxable Accounts

Once an emergency fund has been established, contributions have been made to retirement

accounts (pre-tax and Roth), and HSAs are funded (if eligible), additional savings can be allocated to taxable accounts. Often this is in the form of taxable investment accounts- Trusts, Individual TODs (Transfer on Death), and Joint accounts. These accounts are attractive as there are no age-based restrictions and have favorable long-term capital gains rates for securities held for at least 1 year. On the other hand, portfolio income is taxed yearly.

Over time, maintaining a balance between funding retirement accounts and taxable accounts can provide greater flexibility in managing withdrawals and taxes. This mix ensures you have accessible funds for unexpected needs or opportunities while optimizing your overall tax burden throughout retirement.

When accumulated taxable accounts are in excess of needs, we began looking to educational accounts (#4) or charitable gift funds (#5). We will talk more about this below.

#4 Educational Accounts

Contributing to tax-advantaged education-savings accounts, such as 529s, can offer significant benefits to both you and the recipient. By leveraging the annual gift tax exemption amount ($18K per person, per individual for 2024), parents or grandparents can reduce their taxable estate while contributing to qualified educational expenses.

Funding Rules: In general, you can contribute up to $18,000 ($36,000 for married couples) per beneficiary per year without triggering federal gift taxes in 2024. However, special 529 rules allow you to front load five years of annual exclusions for a tax-free gift of up to $90,000 (joint taxpayers may fund $180,000). Refer to our blog post 5 Estate Planning Strategies for more information.

#5 Other

We include one last bucket as a catch-all for individual needs and goals. For those looking to diversify their net worth by investing in real estate, they can leverage funds from the taxable accounts. Investing in real estate can provide both rental income and potential appreciation in property value, which can be an effective way to build wealth and generate passive income.

Another common strategy we use with our clients who are charitably inclined is opening a Charitable Gift Fund. Donor-Advised Funds (DAFs) are a popular choice, allowing you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. This strategy provides flexibility in your charitable giving and can be a valuable tool for estate planning. Contributions to DAFs can also help reduce your taxable estate, which can be particularly beneficial for high-net-worth individuals. We go into more information here: WAM’s Guide to Giving.

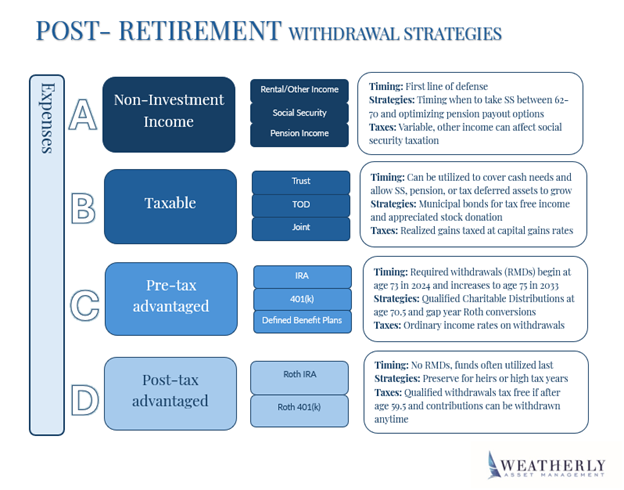

Post-Retirement Withdrawal Strategies

The shift from saving to spending in retirement can be challenging, underscoring the need for a comprehensive financial plan. We work with clients regularly on these plans and review withdrawal rates to maintain sustainable spending levels. It is important to customize your withdrawal strategy- focusing on tax efficiency while balancing factors such as age, income streams, assets, and estate goals. There is no universal approach, it is important to consider different income sources and account types over time for a more tailored strategy.

A. Non-Investment Income

If you have rental properties or other passive income streams, these should be your first line of defense for covering living expenses in retirement. Utilizing these sources can help preserve your investment portfolio, allowing it to continue to grow and support your financial needs in later years.

Two focused planning areas we often discuss with our clients revolve around Social Security and pension income. Deciding when to start collecting Social Security benefits can impact your retirement income. You can begin receiving benefits as early as age 62, but if able, delaying benefits until age 70 can significantly increase your monthly benefit. Evaluating your financial situation and life expectancy can help determine the optimal time to start Social Security. The same goes for pension payouts; to maximize its value, ensure payout options and survivor benefits are considered.

B. Taxable

Taxable accounts are generally the next step to tap into during retirement. These accounts offer favorable tax treatment on long-term capital gains or dividends and come with no age-related restrictions on withdrawals. By using funds from taxable accounts initially, you allow your tax-advantaged accounts more time to grow until RMD age.

C. Pre-Tax Advantaged Accounts

Starting in 2024, Required Minimum Distributions (RMDs) begin at age 73 and increase to 75 in 2033. Withdrawals from these accounts are taxed as ordinary income, which can significantly impact your tax bracket. Therefore, it’s crucial to strategize withdrawals to minimize tax liabilities. Understanding RMD rules and timing your withdrawals can help avoid hefty tax penalties and optimize your retirement income.

Withdrawal Restrictions: You can withdraw from these accounts without a penalty after reaching 59.5 years old. At age 70.5, you can make tax-free charitable donations directly from your IRA, which can satisfy your RMD (Required Minimum Distribution) requirements and reduce your taxable income. For more information on recent updates to Secure Act 2.0 read our recent blog Secure Act 2.0

D. Post-Tax Advantaged Accounts

Roth accounts are often saved for later in retirement or strategically leveraged by high earners due to their unique tax advantages. Unlike traditional retirement accounts, Clients over the age of 59.5 who have held their funds in a Roth account for at least five years can withdraw contributions and earnings tax-free. By delaying withdrawals from Roth accounts, individuals can allow their investments to grow tax-free for a longer period, maximizing their retirement savings. High-net-worth individuals may find Roth accounts advantageous for estate planning, as these accounts are not subject to required minimum distributions during the original owner’s lifetime. This feature allows for a more flexible and tax-efficient transfer of wealth to beneficiaries.

Conclusion

A well-structured contribution and withdrawal strategy is essential for a financially secure retirement. Prioritizing various income sources and understanding the tax implications of different account types optimizes retirement savings. We help many of our clients who are small business owners and executives prioritize income and wealth strategies through various personal and business transitions. There are many different planning opportunities available based upon various ages, life events, and individual’s personal situations that Weatherly can identify and plan for. Whether this involves running a full financial plan or isolating a particular scenario- we enjoy educating our clients and optimizing the right path forward.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

San Diego Business Journal included Weatherly Asset Management in the 2024 listing of Wealth Management Firms, published on April 22nd, 2024. Placed among the best in San Diego County, WAM lands the 18th spot of 43 firms in total, ranked by assets under management (AUM). The list of San Diego firms can be found here: https://images.sdbj.com/wp-content/uploads/2024/04/SDBJ-Wealth-Management-Rountable-Special-Report.pdf.

Eligibility requirements to participate included being a registered investment adviser with either the Securities Exchange Commission or the California Department of Corporations. The criteria by which Firms were ranked was based on assets managed in San Diego County for fiscal year 2023.

After receiving an email invitation from the Journal to participate in the list, Weatherly completed a brief online survey.

It is not the intent of the list to endorse the participants nor to imply a firm’s size or numerical rank indicates its quality. There was no fee to participate in the list ranking, and Weatherly was not required to advertise in, or subscribe to, the San Diego Business Journal.

No organizational memberships were required of the Firm or individuals. Inclusion in the ranking is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Past performance is not necessarily indicative of future results. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

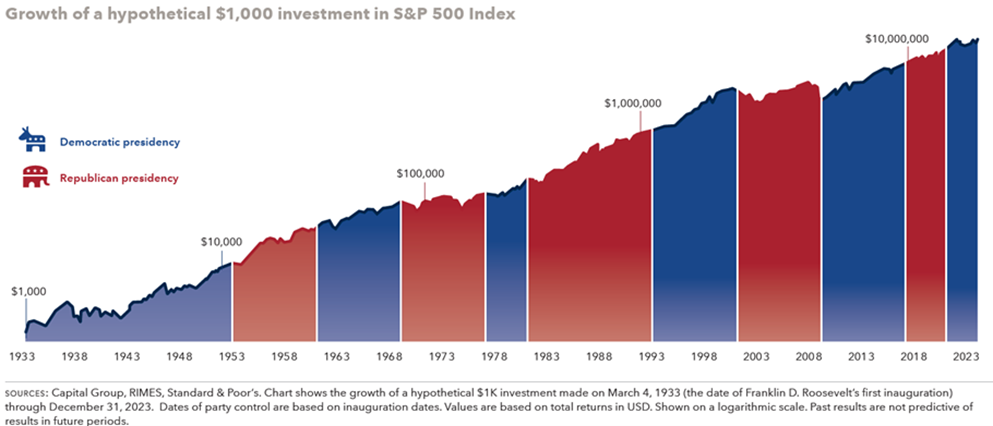

As the United States draws closer to the presidential election in November and the end of the current election cycle, many individuals may have questions and concerns about the intersection of financial markets and politics. However, when it comes to markets and your portfolio, how much impact do elections really have?

In this blog post, we review the history of US presidential elections and their impact on markets and explain why it’s important to remain disciplined and keep a long-term mentality when it comes to your portfolio and financial goals. We also touch on important financial planning considerations to think about as we head into the final stretch of the 2024 US presidential race.

Impact of Presidential Elections on Markets:

The gravity of elections is not to be understated, American policy and sentiment will change because of this year’s election. However, the impact on financial markets is not as material as people may assume. Since Franklin D. Roosevelt stepped into office in 1933, there have been eight democratic and seven republican presidents. A $1000 investment in the S&P 500, held through all 15 presidents, would have been worth over $21 million at the end of 2023. The returns generated by holding the S&P 500 regardless of election results have historically been far superior to any attempt to “time” the market based on which political party holds the White House. There appears to be little viability for an investment strategy that uses political party affiliation as a timing mechanism. The graphic below showcases the consistent upward climb of US stocks, regardless of the party in control, reiterating the importance of holding through short periods of volatility that may surface leading up to an election.

The insignificance of party affiliation on stock market returns can also be seen within the House and Senate. There is no statistical significance on stock market returns when the house and senate are both controlled by the same political party. According to Forbes, the stock market showcases the best-annualized returns when Congress is split. This is due to a natural balance of power that occurs in the legislative branch, where neither party can fully enforce their agenda resulting in a more natural development of the economy. To understand how politics have little effect on stock market outcomes, it is important to understand how financial assets derive their value.

Market returns are seldom guided by political idealizations. The impact election cycles have on markets is dwarfed by the effects of the current economic cycle and interest rates on stocks and bonds. The stock market tends to focus on the economic environment, a company’s financial health, cash flows, etc. to determine the viability of an investment. To increase success, companies primarily focus on their underlying business, market dynamics, and effective investment opportunities to keep the business healthy and viable. These decisions are made rationally and apolitically to best provide for the company and shareholders.

As we have demonstrated above, markets tend to be agnostic to the results of a US Presidential election in the long run. However, with increasing political discourse in the months leading up to an election it is not uncommon for markets to experience some form of volatility. With the constant news cycle, it may seem like the current political and economic backdrop is unprecedented, but it is important to keep in mind that uncertainty and controversy have surrounded every election. Therefore, it is vital to maintain a disciplined and long-term view of markets and your portfolio to avoid common pitfalls.

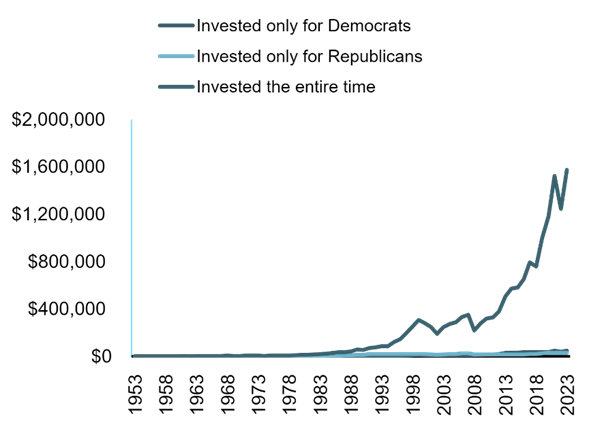

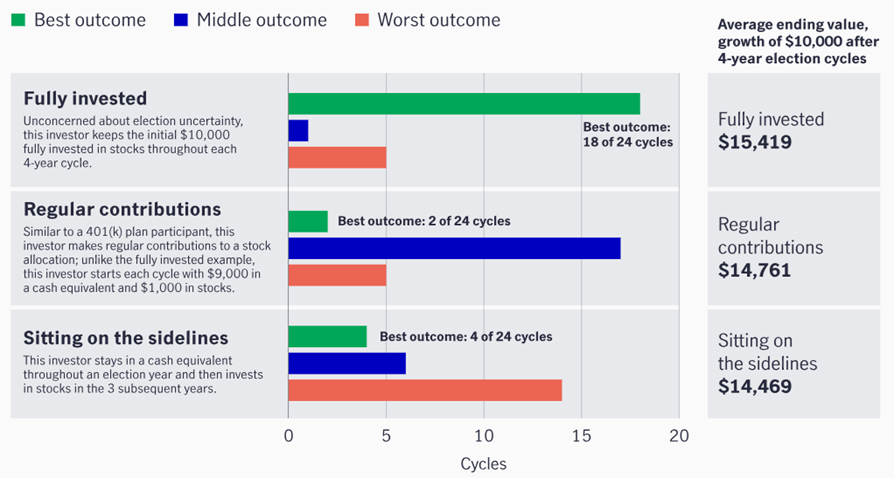

Staying Invested vs. Flight to Safety

Sitting on the sidelines of the market is a strategy that historically has not paid off. This is also true when it comes to election years. Data of the 23 election cycles since 1932 shows that a continuous investment, not based on election cycles, outperforms sitting on the sideline to avoid potential volatility. With an original investment of $10 thousand, the strategy that chose to stay uninvested on the sidelines until after the election results historically underperformed the strategy that was fully invested by over 6% for the four-year observation period. This example showcases how time and longevity in markets have historically outperformed strategies associated with political party affiliation.

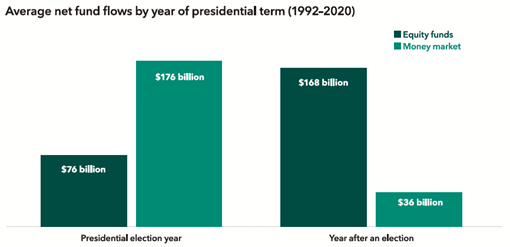

However, investor behavior seems to ignore the prudent strategy of “staying the course” during election years. Investor uncertainty around elections can be quantified by the large influxes of capital into money-market funds late in the election cycle. The last two years of an election cycle show a much larger inflow of assets into money markets than equity funds, displaying a retreat to safety by investors wanting to stay away from election-induced volatility. While cash can present as an attractive safety net, it is not a shelter needed for political volatility. Political idealizations that show up in markets tend to have short-lived ripple effects that are non-material when it comes to investment and financial planning.

As the data shows, the unwarranted retreat to safety comes at the cost of returns. When it comes to your financial success, it is more important to focus on time than timing. We see in the different graphics that a steady and continuous investment strategy performed the best throughout the emotion-based volatility seen during election cycles. Elections provide an opportunity for people to voice their opinions on hot-topic issues, causing panic among individual investors. The threat of new political ideas coming from the White House can cause people to fear for their future, thus positioning themselves on the stock market sideline when it is not needed. We believe that political discourse is important for the future development of our society. Without elections and the democratic process, people’s voices would be lost, drastically changing the core foundation the United States was founded on. However, it is important to keep political idealizations separate from your financial plan.

Financial Planning Considerations:

While we have seen that historically markets tend to focus on the broader economy rather than which party holds power, there are other topics to consider that are completely separate from financial markets. In 2017, the Tax Cuts and Jobs Act (TCJA) was passed which led to significant changes to our tax code. However, most of these revisions to the tax code are set to expire in 2025 if there are no updates to the legislation. Some of the items set to expire include the following:

- Estate Tax Exemption: The current estate tax exemption for 2024 is $13.61 million per person or $27.22 million per couple. This is set to expire in 2025 if there are no changes.

- Standard Deduction: The 2017 TCJA temporarily raised the standard deduction which is set to expire in 2025.

- Income Tax Rates: The TCJA decreased tax brackets across the board and will revert to pre-2018 levels in 2025.

For additional current tax information, you can reference our key data chart. Although these aspects of the tax code are set to expire in 2025, nothing is certain and there is a strong possibility that there will be further revisions to the tax code moving forward. However, with proper preparation and planning, there are opportunities present that you can take advantage of by consulting with an experienced group of financial professionals. Weatherly Asset Management has been having conversations with clients about the expiration of these tax laws and we continue to develop strategies to help our clients achieve their financial goals.

Staying the Course:

Historically speaking, markets have remained agnostic to the results of the US presidential election. In the period leading up to elections, it is not uncommon for markets to experience some form of volatility, but it is important to remember that in the long run what matters most is the underlying fundamentals of the economy. It is also important to keep in mind that uncertainty and controversy have been affiliated with every election cycle in US history, and that should not keep you from staying the course and maintaining a disciplined mindset when it comes to navigating markets.

We seek to offer peace of mind through professional investment management and holistic financial planning. Through our investment management services, we create customized portfolios to match your risk tolerance, time horizon, and financial goals by maintaining an appropriate, long-term asset allocation. Through our financial planning services, we take your financial picture and create a customized road map illustrating actions needed to achieve your financial goals. Within our financial planning services, we also create various “what-if” scenarios to address the changing landscape of your life, goals, and the broader economic and investment backdrop. Whether it’s creating portfolios, developing financial plans, or talking through your questions and concerns our group of experienced professionals are here to serve as your partner along your financial journey.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Carolyn Taylor was featured in the May 6th, 2024 issue of InvestmentNews with an interview highlighting her long and illustrious career in the financial services industry, specifically with Weatherly Asset Management LP. The interview is available in the digital edition of the magazine at https://digitaledition.investmentnews.com/?m=62585&i=821549&p=42&ver=html5.

In March of 2024, Carolyn was solicited by the InvestmentNews editorial coordinator as part of an interviewing campaign involving investment leaders. She was asked to participate in a 1:1 interview process that would cover a range of investment subjects, including market trends, investment strategies, emerging opportunities, and any other significant developments shaping the investment landscape. The 30-minute interview would be used to create a written article, which would be drafted and provided to Weatherly for review prior to post. Carolyn accepted the invitation, was provided a preliminary list of questions to prepare answers for prior to the interview and participated in the interview with the support of one of the other Partners at the firm, Kelli Burger. The list of questions and interview discussions focused on four areas, including 1. Career Journey and Milestones; 2. Achievements and Recognitions; 3. Industry Expertise and Vision; 4. Leadership and Firm’s Success.

After the interview, a draft was provided to Weatherly for review and any added disclosures. The “Staying Fresh Key to Longevity” was posted in the May 6, 2024 edition of InvestmentNews.

Weatherly Asset Management did not pay any fees to InvestmentNews to be included in the interview campaign and article publication. Weatherly was not required to advertise in or subscribe to InvestmentNews. As of the time of this disclosure, Weatherly did not elect to pay for reprints of the article.

Being featured in the article and publication is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the publication or the the appropriateness of advertising the content.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn Taylor was nominated for Shook Research’s 2024 Best-in-State Wealth Advisors list. She was invited to complete an online survey detailing information about her career, as well as Weatherly as a firm. Carolyn was named 5th out of the 154 named in the Southern California HNW category. In total, the list showcased over 8,500 wealth managers. The list was published on April 3rd, 2024 on Forbes.com at https://www.forbes.com/lists/best-in-state-wealth-advisors/?sh=78d8814d6ab9.

The 2024 Best-In-State ranking is based on data collected as of 06/30/23 and reflects Weatherly’s AUM of $1.1B.

Forbes America’s Top Wealth Advisors and Best-in-State Wealth Advisors ranking was developed by SHOOK Research and is based on in-person, virtual, and telephone due diligence meetings to measure best practices, client retention, industry experience, credentials, review of compliance records, firm nominations; and quantitative criteria, such as: assets under management and revenue generated for their firms. Investment performance is not a criterion because client objectives and risk tolerances vary, and advisors rarely have audited performance reports. SHOOK’s research and rankings provide opinions intended to help investors choose the right financial advisor and are not indicative of future performance or representative of any one client’s experience. Past performance is not an indication of future results. Neither Forbes nor SHOOK Research receive compensation in exchange for placement on the ranking. For more information, please see www.SHOOKresearch.com.SHOOK is a registered trademark of SHOOK Research, LLC. In total, 44,990 nominations were received and 23,876 advisors were invited to complete the online survey. Throughout the research process, 20,412 telephone interviews, 4,926 in-person interviews, and 1,507 web-based interviews were conducted. The ranking listed over 8,500 advisors, 154 of which were located in Southern California.

Basic Requirements to be considered for the “Forbes Best-in-State Wealth Advisors” included: 1) 7 years as an advisor; 2) minimum 1 year at current firm 3) advisor must be recommended, and nominated, by Firm, 4) completion of online survey; 5) over 50% of revenue/production must be with individuals; and 6) an acceptable compliance record. In addition to the above basic requirements, advisors were also judged on the following Quantitative figures: 1) weightings assigned for both revenue and production data; 2) assets under management—and quality of those assets—both custodied and a scrutinized look at assets held away (although individual numbers are used for ranking purposes, we publish the entire team’s assets); 3) client-related data, such as retention; 4) portfolio performance is not a factor (audited returns among advisors are rare, and differing client objectives provide varying returns). Qualitative considerations examined included but were not limited to: 1) telephone, virtual, and in-person meetings with advisors (telephone interviews are required; if an in-person meeting cannot be accomplished, exceptions are considered in which the interview will occur after a ranking has been published); 2) advisors that exhibit “best practices” within their practices and approach to working with clients; 3) compliance records and U4s; 4) advisors that provide a full client experience: service model; 5) telephone, virtual, and in-person meetings. Compliance records and U4s were also reviewed in detail as part of the selection process including: 1) infractions denied or closed with no action; 2) complaints that arose from a product, service or advice initiated by a previous advisor or another member or former member of team; 3) length of time since complaint; 4) complaints related to product failure not related to investment advice; 5) complaints that have been settled to appease a client who remained with the advisor for at least one year following settlement date; 6) complaints that were proven to be meritless; and 7) actions taken as a result of administrative error or failure by firm.

Weatherly Asset Management did not pay any fees to SHOOK to be nominated or included in the “Forbes Best-In- State Wealth Advisors” list and Weatherly was not required to advertise in, or subscribe to, Forbes. As of the time of this disclosure, Weatherly did not elect to pay for reprints of the list.

Inclusion in this ranking is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising the award.

SHOOK Disclosures

SHOOK is completely independent and objective and does not receive compensation from the advisors, firms, the media, or any other source in exchange for placement on a ranking. SHOOK is funded through conferences, publications and research partners. Since every investor has unique needs, investors must carefully choose the right advisor for their own situation and perform their own due diligence. Rankings are based on the opinions of SHOOK Research, LLC and not indicative of future performance or representative of any one client’s experience; the firm’s research and rankings provide opinions for how to choose the right financial advisor. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Remember, past performance is not an indication of future results.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

In our 30-year firm history and experience working with clients, every person has unique planning opportunities to explore and consider throughout their lifespan. As a female-founded and majority owned firm, women have organically become a growing client group we service. In this blog post, we outline various investment and financial planning opportunities for women to consider, broken out over five life phases, with many strategies that can apply to all individuals.

Phase 1: Laying the Groundwork- Young Professional Phase

Make the most of your early career to earn what you are worth, establish good money habits and harness the power of compounding returns.

Source

The transition into the workforce marks a critical time for establishing financial independence. Healthy habit formation in these early years coupled with a few small strategic decisions, can have a significant long-term benefit. Some unique planning and investment opportunities to consider in this phase include:

- Budgeting: the 50/30/20 rule serves as a basic, easy to remember tool- of your net income, budget 50% for essential living expenses/30% towards wants, or discretionary spending- such as gifts to philanthropy/ and 20% towards savings and debt repayment.

- Pay yourself first: While you may be balancing student loans or other debt from pre-career, it is key to establish a 3–6-month emergency fund as early as possible. A separate account such as a High Yield Savings account for a portion of your paycheck to go into can be a simple solution to pay yourself first and start building your nest egg.

- Retirement account contributions: Familiarize yourself with your employer’s retirement account options such as traditional 401Ks and Roth 401Ks. Often, employers will match contributions up to a certain percentage or dollar amount. Best practice is to at least contribute enough to get the company match. As you progress through the Young Professional Phase and debt balances are repaid, try to max out retirement plan contributions.

- Roth IRAs and tax- deductible contributions to IRAs: Roth IRAs can also be ideal vehicles for those early in their career as they allow for tax-free growth over time and future withdrawals are typically tax free if certain criteria are met. There are some rules outlined in our Young Adult Checklist and income limitations outlined in our Keys to our Key Financial Data Chart that can impact eligibility for Roth IRAs contributions. For those who may be ineligible for Roth IRA contributions, tax deductible IRA contributions could also be an attractive option to explore.

- Health Savings Accounts (HSAs): For those who have a High Deductible Health Insurance Plan, a Health Savings Account (HSA) can be a way to defer pre-tax dollars to be used on various future healthcare expenses.

- Investing Funds: Once contributions are made to employer retirement accounts, Roths, IRAs, or HSA accounts, be sure to invest the monies for potential long-term growth. In the event you save additional money beyond your emergency fund, retirement assets and HSA account, consider taxable brokerage accounts to save and invest additional monies.

For women, this stage is also about understanding and negotiating for fair pay, reflecting their worth in the workplace, which is essential for setting a strong financial trajectory.

Phase 2: Career Advancement- Focus Phase

This period is crucial for establishing a strong financial foundation, assets are the key to building wealth over time, choose what you want to do and do it well.

The second stage, or the “Focus” stage can be an ideal time for women to pursue entrepreneurial ventures or advance as an employee.

Women increasingly contribute to their growing economic influence- establishing successful businesses and acquiring stock options from publicly traded companies. Between 2020 and 2021, more than 49% of new businesses were started by women, up from 28% in 2019.

Some different opportunities for women in the Focus stage to consider, include:

- Mentorship: Regardless of the path, business is about people and connections. Seek out other women mentors on a similar career trajectory or on a path that you admire. Learn to establish connections and ask for advice.

- Entrepreneurs/Self Employed/Business Owners: For women who are self-employed or small business owners, decision making is limitless. We prioritize three key components to start on an entrepreneurial journey- business plans, business structure, and retirement accounts.

- Business Plan: an effective business plan can serve as a business roadmap and help with initial business funding. It can evolve overtime and drive your strategic planning, business growth, help manage finances, and strategize business exit or succession planning effectively.

- Business Structure: Sole-Proprietorships, Partnerships, S and C Corporations, and Limited Liability Companies (LLC) each have their own distinct tax implications, personal liability considerations, and operational complexities that we touch on in depth in the following blog post: From Start Up to Success: A Business Owners Journey

- Retirement Accounts: It is important to maximize after-tax income via retirement account. Some retirement plan vehicles to consider are Solo 401k, SIMPLE IRA, SEP IRA, Profit Sharing, or Defined Benefit Plans.

- Working Women: For women who work for small businesses, large corporations, or anything in between- education and understanding is key. Take the time to understand your entire employee compensation package as there is often more value than your base salary. This can include your base income, employer portion retirement contributions, healthcare benefits and employer paid premiums, bonus compensation, time off policies, life insurance policies and stock options. If you are granted stock options as a part of your compensation, there can be some complexities and unique tax implications, so it is important to consult with financial professionals for personalized advice.

Phase 3: Peak Earning Years and Asset Accumulation Phase

There is no one size fits all approach- focus on communication, clarity, and stability.

Often, women in this phase are in their peak earning years while balancing several responsibilities, from personal to partnering or parenting, while accumulating assets and managing finances. As women navigate this phase, it is important to think about your personal, financial and career goals with intention.

Some strategies we like to leverage are broken out here-

- Create an asset list: Create a list of your assets, which includes where they are held or custodied, the dollar amounts, title of each account, nature of the asset- community property or separate property, and key professionals to contact. In two party households, it is imperative for both partners to be engaged in financial decisions and knowledge transfer. This exercise not only helps educate both parties but can also serve as a resource in the event of an unexpected death or divorce. For two party or solo households, it can also be a starting point for planning opportunities, risk tolerance evaluation, and short- and long-term financial goals.

- Create an estate plan: Typically, all adults in this phase should have four basic estate planning documents: a trust, a will, power of attorney for healthcare, and power of attorney for finance. The asset list can be used to evaluate the need for community property trusts versus separate property trusts and which assets need to be retitled. It also creates the opportunity for self-employed women to create a personalized estate plan that intertwines with their business plan.

- Planning for Young Families: For women who have or plan to have families, there are some important steps to consider that we outline in our “Planning for Young Families” blog post.

- For women or a partner who decides to no longer work or stay at home, a Spousal IRA can also allow for maximized asset accumulation and growth.

Phase 4: Preparing for Retirement Phase

Make the most of your accumulated wealth and life experience to invest with confidence and purpose.

Approaching retirement, the focus shifts to maximizing employer benefits and solidifying income sources for a comfortable life post-career.

- Maximize Employer Benefits: Pre-departure from your employer, confirm which benefits may continue or may be portable to you. Some key considerations:

- Healthcare Insurance: Confirm if your healthcare insurance will continue or if you are eligible for COBRA. This is especially key if you are pre-Medicare age or rely on your current employer’s healthcare insurance coverage.

- Life Insurance: some employer sponsored life insurance plans may be portable meaning, you take over the policy and pay the premiums out of your own pocket. This may be an attractive opportunity to continue coverage versus securing a new life insurance policy.

- Stock Options or Equity Ownership: confirm if all shares- vested and nonvested- will remain intact or if any shares/ownership will be forfeited.

- Employer Retirement Plans and Pensions: some employer plans allow assets to be held within the employer, while others may require the assets rollover to an IRA, or others may allow you to choose. Additionally, pension plans typically have a wide range of pension income payout options- such as single life, joint survivor 100%, 25% or 50%- or lump sum. Evaluating the different options is key to maximizing retirement income, flexibility, and potential future investment growth.

- Roadmap to Retirement: Given women tend to our live men, it is prudent to understand the ins and outs of Social Security, Medicare, and other retirement income sources becomes crucial; benefit optimization is key. Drawing from your different buckets of assets, in tax efficient ways, can also help maximize assets and help address longevity. Our Roadmap to Retirement Blog highlight several of these considerations in greater detail.

Phase 5: Successful Wealth Transfer Phase

Balance any desire to leave a legacy with a realistic plan for converting your savings into income, make your intentions clear and organize your assets.

By the end of this decade, a 2020 study found, women are set to control much of the $30 trillion in financial assets that Baby Boomer’s currently possess. Whether due to asset accumulation in working years, inheritance due to death or divorce, or longevity- women are gaining more economic power than previous generations. These circumstances coupled with women longevity, necessitates careful guidance from your team of professionals to ensure proper estate administration in the event of death or divorce.

- Planning for Successful Wealth Transfers: It is also key to revisit and keep estate plans and IRA beneficiaries up to date. A key question worth asking is what legacy do I want to leave behind for my family and/or to philanthropy? From there, there are some different strategies to consider such as annual tax-exempt gifting to individuals ($18K/person in 2024), and Donor Advised Funds (DAFs) and Qualified Charitable Distributions (QCDs) for tax efficient philanthropic giving.

Conclusion

In recent years, an unmistakable shift in the landscape of wealth accumulation and transfer has occurred, with women emerging as key drivers and beneficiaries. Weatherly stands at the intersection of these life stages, offering tailored advice, educational resources, and a supportive community to navigate the financial nuances each phase presents.

If this guide resonates with you or reminds you of someone in your life who could benefit from our services, we invite you to reach out. Together, we can build a financial plan that not only meets but anticipates your needs through every phase of life, ensuring a future of independence, security, and peace of mind.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Carolyn Taylor was listed as one of 50 honorees for the 2024 San Diego Business Journal 50 Women of Influence Over 50 award in the April 1, 2024 weekly Journal. The San Diego Business Journal (“Journal”) recognized 50 dynamic women business leaders over 50 who have contributed significantly to San Diego’s workplaces and communities.

The San Diego Business Journal solicited nominations via email invitation to their mailing lists and via the paper journal circulation. Members of the Weatherly team nominated Carolyn Taylor. Not all nominees were named honorees.

Nominees and honorees were asked to provide a profile on the nominee’s specific career and accomplishments. Weatherly supplied the information for the nomination by completing the Journal’s questionnaire.

Weatherly was not required to make payments or purchases to nominate, be nominated, be considered, or included on the list related to the award. No organizational memberships were required of the Firm or individuals. The advertisement of nomination for the award is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the award, nominations for the award, or the appropriateness of related advertising.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Many of Weatherly’s clients have generated their wealth through starting and growing businesses. Whether serial entrepreneurs or strategic purchasers of existing companies, there are few things more rewarding than seeing a company flourish under your stewardship. Planning for one’s own financial success often brings its own level of challenges; however, business owners must balance both the success of their personal and business simultaneously. Business owners often divert much of their attention and energy to running the business so that their personal financial situation can take a back seat. In this blog, we’ll focus on many of the topics we discuss with clients as they navigate the growth, maturity and exit stages of their business.

Business Structure

One of the most consequential aspects of starting a business is choosing the type of structure. There are five most common business structures including Sole-Proprietorships, Partnerships, S-Corporations, C-Corporations, and Limited Liability Companies (LLC). The choice of business structure dictates how you are taxed, personal liability of debts or negligence, ease of raising capital and adding new owners.

Sole-Proprietorships are single person businesses that do not form a separate business entity. This is the easiest, and cheapest, structure but has several drawbacks. First, because the business isn’t separate, you can be held liable for any debts or business issues you run into. It can also be more challenging raising outside money for your business because you can’t issue stock and banks may want a more formal business structure before lending money. It is common for thriving Sole-Proprietorship to change to a different structure as they mature. Sole-Proprietorship’s are taxed on the owner’s personal tax return.

Partnerships are businesses with 2 or more owners that are categorized as two different types. Limited Partnerships (LP) have one General Partner who takes on the liability, and one or more Limited Partners who are exempt from the liabilities. The second type is Limited Liability Partnerships (LLP) where each partner is responsible for certain liabilities but is not responsible for the actions of the other partners. Taxes for partnerships generally flow through to the Partners’ personal tax returns. LP’s may also be coupled with an S- Corp for additional asset protection.

S-Corporations are used to avoid corporate taxes and allow certain profits and losses to flow to the personal tax return of the owners. This structure requires filing approval with the IRS and state (note that some states don’t recognize S-Corps, so you’d be treated like a C-Corp). As such, Corporations are more expensive to operate than other businesses and require specific record-keeping and reporting. You can issue stock in your Corporation to attract employees or raise capital through outside investors. Corporations also provide more protection for owners because the entity itself is liable for debts and lawsuits.

Limited Liability Companies (LLC) allow you to separate your business from your personal assets and protect things like your house and savings from lawsuits or bankruptcy. LLC’s require formation in a specific state and sometimes have to be dissolved and reformed as the business changes. LLC members typically enjoy profits and losses flowing to their personal tax return but must file self-employment tax. People looking for tax advantages and significant personal liability protection often use LLCs before stepping up to the more complicated Corporation status.

C-Corporations have many of the same expenses, reporting requirements and S-Corps but differ in the way they are taxed. Corporation profits are taxed at special tax rates, and there can be instances of “double taxation” when profits are taxed and then dividends are issued and taxed at the investor or ownership level. C-Corps don’t have the specific eligibility requirements of S-Corps so are far more common. This type of business is best for larger or higher risk business with the goal of adding more shareholders or eventually filing a public offering.

Business Life Cycle

Once you define your business structure, operating the business can take many shapes. Managing of income, expenses and cash flow is paramount to the growth of your business and what you eventually expect to earn from your hard work. Early on in business, we see two typical scenarios. First, fledgling businesses aren’t generating enough cash flow to pay large salaries so an owner will keep their annual take-home pay low to reinvest into the business for growth. For younger entrepreneurs, this can be financially stressful so they often seek capital from outsiders by giving investors a minority stake in the business in return for capital to live and/or grow the business. The second scenario is when the owner(s) have ample personal liquidity so they make the deliberate decision to keep their take-home low to enhance the valuation of the company. Having the majority stake in any scenario can lead to large windfalls down the road when the business is sold in part or in whole.

After the business has demonstrated market relevancy and profitability, ownership has the luxury to strategize their take-home via salary, bonus, guaranteed partner pay, and distributing profits or dividends. It is important to work with your tax experts to find out what choice is the best for your personal tax situation and for the business. Finding a happy medium is where your business’ tax advisor and finance team earns their merit. This is a common stage for our existing clients as they are generating enough income to increase their savings in retirement accounts (Solo 401k, 401k, Defined Benefit Plans, Profit Sharing Plans) or simply adding money to their family trust account for a future goal like retirement.

Finally, after much of the hard work is done, the decision to exit the business can create a significant amount of angst for owners. How will I support my lifestyle? How will the sale be taxed? How many years is my payout? What if the new owner destroys what I’ve built? These are all valid questions, and our job is to work with your trusted advisors (CPAs and Attorneys) to quantify the payout and build a financial plan with the qualitative desires you envision for your retirement. Or in many cases, your retirement might be short-lived, and you end up consulting or building another business! Whatever path you choose, our planning exercises can give peace of mind and a framework for success.

Savings

As we mentioned at the beginning of this blog, business owners can become overtly focused on the success of their business that they can lose sight of their own retirement savings along with the opportunity to maximize their after tax income. Depending on the structure of the business, owners typically have a few different retirement vehicles they can employ to help save for their future retirement such as 401k, profit sharing, or defined benefit plans.

Self-employed 401k’s – also referred to as a Solo 401k, provide the opportunity to save via employee and employer contributions depending on the level of income generated each year. A SEP IRA is a similar vehicle that business owners often hear about but has slightly more restrictive contribution limits on the employer side.

While the Self-Employed 401k is a great place to start saving for many business owners, those with higher incomes may have the opportunity to save further by establishing a Profit-Sharing Plan and/or Defined Benefit Plan. While the plans can allow for additional savings, there are rules and requirements depending on the number and type of employees that make up the business. Profit Sharing plans allow the employer to make contributions at their discretion allowing for flexibility while also providing employees with a share of the company’s profits.

Defined Benefit Plans have annual contribution requirements and are more suited for mature businesses with steady profits. Weatherly works closely with both the client’s tax professional and Third-Party Administrators (TPA) to help establish and contribute to these plans on a yearly basis. You can find a link to our Key Data Chart for updated contribution limits.

Protection

All of the planning and energy that goes into running a business and saving for one’s retirement would be all for nothing if it wasn’t properly insured. It’s imperative that both the individual and business have adequate protection in the case of litigation or succession planning. While the structure of the business may provide a level of protection, it is not enough by itself to ensure a smooth transition and resolution should an event arise. We highly recommend that a client reviews their personal property and casualty and umbrella coverage on a yearly basis or anytime there is a material life change. Life insurance also plays a critical role to protect a family should something happen to an income earner and can also serve as a valuable vehicle in estate liquidity and help heirs avoid selling real assets to cover any estate tax liability.

On the business side the list is extensive and holding the proper type and level of insurance can vary from General Liability, Key Person, Errors and Omission, and Cyber insurance. There are numerous additional policies that may be needed depending on the type and structure of your business that should be carefully reviewed with an insurance professional.

Exit Strategies and Retirement Planning

The transition from running a business day in and day out towards retirement is often multi-faceted and often difficult for many business owners to adjust to. Including but not limited to a change of daily responsibilities, no longer receiving a paycheck, or structuring the sale of the business may be a multi-year endeavor. Weatherly helps guide clients through this transition by first taking inventory of the client’s personal situation and running a holistic retirement plan encompassing every aspect of their financial life. This is an ideal time to get a business valuation and sale projection to be paired with a review of the net worth.

This helps ensure that first and foremost the client is at a position where they can comfortably step away from the business and enjoy the lifestyle, they’ve often spent decades building towards. The intersection of a client’s retirement goals, cash flows, level and types of assets will provide various opportunities as we plan their next stage of life.

Given the uncertain nature of selling a business from timing to structure, Weatherly is often involved in conversations with the client’s other trusted professionals such as attorneys and tax professionals. There are many different paths a business owner may take such as an outright or partial interest sale, installment, transfer of ownership to family members, and any combination of the above. These pose numerous scenarios that will impact a client’s retirement, tax, and estate that need to be accounted for. This is an important time to ensure that both your business structure/succession plan aligns with your personal estate planning.

For these reasons Weatherly will model out various scenarios depending on the client’s ultimate goals to help allow the client to weigh the pros and cons of each scenario on their personal and financial situation. Sales of businesses often are accompanied by a significant tax burden to the owners and is often paired with philanthropic strategies that help support the causes closest to the client and the implied tax implications. Common approaches here are vehicles such as Donor Advised Funds (DAF) and Charitable Trusts.

Summary

As a fellow small business coming up on its 30th year anniversary, Weatherly has helped guide clients and their businesses through all phases of the life cycle from structuring to the ultimate exit. Through continuous transparency and communication, we help provide business owners a unique insight of the intersection between their personal and professional lives and welcome the opportunity to help plan for your future success.

https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.