How to Have Successful Conversations Around Wealth Transfer

Ryan Richardson, CFP®, Senior Wealth Management Advisor | Brooke Boone Kelly, CFP®, MACC, Wealth Management Advisor, Partner | July 27, 2023

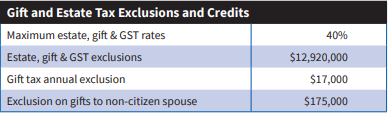

The much anticipated “Great Wealth Transfer” is looming on the horizon. Over the next few decades, an estimated $30 to $68 trillion will be passed down from baby boomers to their Gen X and millennial children (source: Forbes). Additionally, the current federal estate tax exemption is $12.92 million per person, or just shy of $26 million per couple. However, this high exemption is set to sunset at the end of 2025, reverting to an estimated $7 million per person, or $14 million per couple, depending on inflation (source: Fidelity).

As the Great Wealth Transfer and the estate exemption change approach, now is the time to prepare. The best first step is to review your financial plan with your trusted advisors to ensure you have a nest egg to last your lifetime. It’s equally important to review your will, trusts, power of attorney designations, and beneficiary selections and initiate conversations with your successor trustee(s)/executors.

Planning early and having ongoing conversations with your financial professionals and successors can help ensure your assets and personal values are transferred smoothly. Here are some key conversation topics and steps to take when starting dialogues about money, estate planning, and your legacy.

Where to Begin?

Many individuals put off important money conversations with their successors because they aren’t sure where to start. Begin with the big picture—the Who, the Where, the What, and the How. This provides a good starting point to educate your successor trustee and/or your executor without divulging specific financial details or monetary values.

The Who?

- Who Are Your Key Professionals: Share information about your team of professionals, such as your financial advisor, attorney, and accountant. Provide their contact information and explain how to access important documents if needed. This simple list can help your executor know who to reach out to for guidance and support. Our Weatherly Client Information Release Authorization Letter (CIRAL) can act as a template for this exercise.

- Who Are Your Designated Beneficiaries: Review who the designated beneficiaries are on your accounts, insurance policies, and retirement plans. This information is crucial for the smooth transfer of assets after your passing. Make it a point to have an annual check-in with your key professionals, as we know beneficiaries and wishes can change along with updates to tax and estate law.

- Who are your Executors/Successor Trustees: This role is crucial to the overall administration of your estate and may impact family dynamics. Explore options such as responsible individuals, family or friends, private fiduciaries, or corporate trustees to manage estate distributions down the road. Evaluate the pros and cons of a professional trustee to relieve family members or friends of distribution duties. Once this decision is made, make an effort to have a conversation with your chosen successor.

The Where?

- Where Are Your Assets Custodied: Identify where your assets are currently held or custodied. If you have a safety deposit box, note its location and provide details about accessing it when necessary

The What?

- What Are Your Assets and How Are They Titled: Without revealing specific market values, give an overview of your assets, including both liquid and non-liquid assets. Explain the nature of each asset and how they are titled (jointly owned, held in a trust, individually owned, retirement vs nonretirement assets, etc.).

And the How?

- How to Have the Money Conversation: Lean into your team of professionals to help navigate the conversation. Weatherly often facilitates the initial conversation to introduce successors to big-picture concepts about your estate without divulging market values. We also act as a resource for ongoing money conversations as your needs and situation evolve.

Express Your Wishes, Family Values, and Charitable Intentions

Depending on your unique situation and desire to incorporate your next generation or heirs, some families hold meetings to discuss values around wealth and philanthropy and set shared goals for social impact and creating a legacy.

We often see charitably inclined individuals utilize Donor Advised Funds (DAF) to hone in on charitable values and build a legacy via grants to causes they care about. This process can be as formal as a meeting with all individuals to discuss charities they care about or as informal as giving each person a certain dollar amount to grant to a charity of their choosing year over year. The key is to find what works for you and make it your own.

Gifting to the Next Generation: Empowering the Future with Smart Choices

Another effective way to empower your successors with financial responsibility is through annual gifting. As of 2023, the annual gift exclusion amount is $17,000 per person- meaning you can gift up to $17,000 to each individual without incurring gift tax.

Weatherly is happy to review your own personal financial plan to help determine what gifting amount may be appropriate and subsequently help set up investment accounts for your heirs. By involving a financial advisor, the next generation gains access to valuable resources and professional guidance to make informed financial decisions.

For 5 additional Estate Planning Strategies to Consider, please read our past blog post on the subject.

How WAM Can help?

Starting these in-depth conversations now can help ensure you and your successors are unified in handling the complex transition of resources and responsibilities successfully. The Weatherly team is here to help start the conversation without overwhelming your successors with intricate financial information. We can further assist you by creating an open and supportive forum to discuss your estate, financial planning and focus conversations on how you can thoughtfully prepare for the future while making a positive impact together.

As always, we welcome your questions, calls and the opportunity to schedule a conversation with you and your next generation or beneficiaries.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.