Unlocking Your Options: Understanding Equity Compensation Plans

Marty Rascon, Wealth Management Associate Advisor | Brent Armstrong, CFP® Wealth Management Advisor, Partner | September 21, 2023

Why is Equity Compensation Used?

In today’s competitive landscape companies of all sizes, both private and public, look for innovative ways to attract top talent. One of the most common ways in which companies entice employees to join their teams is through a special form of payment called equity compensation, colloquially referred to as stock options or stock awards. Equity compensation is defined as a form of non-cash compensation that awards an employee with stock (equity) in their company allowing them to participate in the ownership of their firm.

From a company’s perspective, equity compensation can provide many benefits such as:

- Attracting talent

- Retaining employees

- Performance motivations

- Conserving cash

There are also many benefits that equity compensation packages can provide an employee:

- Ownership Stake

- Alignment of Interests

- Potential wealth accumulation

- Potential tax benefits

While there are many benefits to receiving an equity compensation package, they can often be very complex and affect an individual’s financial plan from many different angles. Below we highlight the main types of equity compensation packages, their nuances, and important considerations for each.

The Types of Equity Compensation

There are many forms that equity compensation packages can take. The most common forms of equity awards are stock options, which can take the form of incentive stock options (ISOs) and non-qualified stock options (NQSOs), and restricted stock units (RSUs). Each vehicle carries its own nuances and mechanics that are important to consider for anyone’s financial plan.

Stock Options

Whether you are granted ISOs or NQSOs it is important to understand the mechanics in which stock options operate. Stock options allow the recipient the right, but not the obligation, to purchase company shares at a pre-determined price often referred to as the grant price or strike price. Since there is a pre-determined price options will only have value if the value of the company is higher than the grant price. If that is the case, an employee has the option to purchase company stock at a discount which can potentially provide enormous financial benefits.

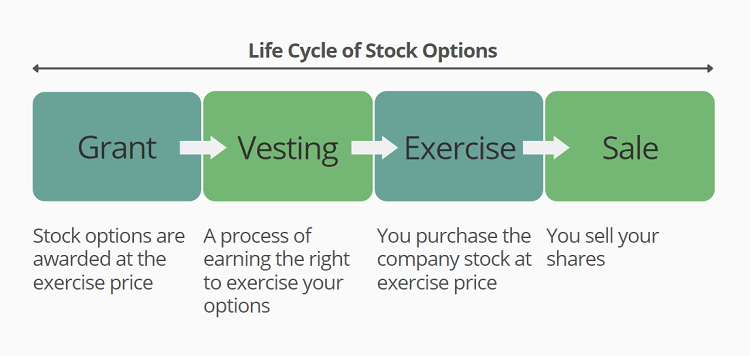

It is important to note that stock options are a formal contract between employer and employee with specific rules and stipulations. The contract will clearly define the vesting schedule, the grant date and price, rules surrounding when an employee can exercise the options, and more. Below is a general outline of the stock option lifecycle.

Also, within the contract the company will define which type of option they are granting the employee, an incentive stock option (ISO) or a non-qualified stock option (NQSO). The type of option offered to an employee can have a major impact on their overall financial plan and decision-making.

Incentive Stock Options (ISOs):

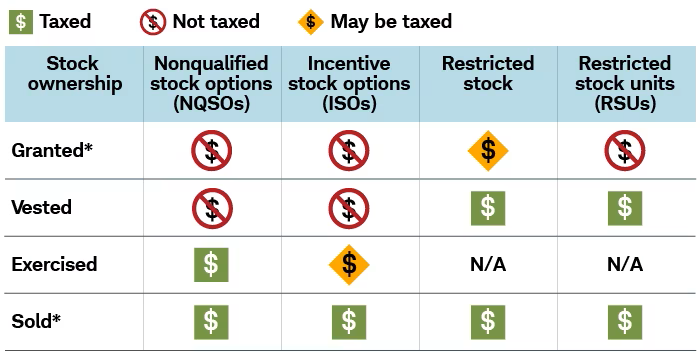

Incentive or Statutory Stock Options can provide the opportunity for preferential tax treatment if certain requirements are met. This benefit can potentially provide enormous savings as gains are taxed at capital gains rates rather than ordinary income tax rates. With an ISO package, there are items to consider before you exercise or sell the stock.

Important considerations with ISOs:

- Holding Period Requirements & Taxation: To receive the preferred tax treatment with ISOs, an individual cannot sell their stock within 2 years of the grant date and the stock must be held for at least one year after exercise. If an individual sells their ISO shares before meeting the required holding period, this is referred to as a disqualifying disposition and any gains will be taxed as ordinary income rather than long-term capital gains. Visit Weatherly’s Key Financial Data Chart for 2023 for a more detailed breakdown of tax rates and capital gains rates.

- Alternative Minimum Tax (AMT): Although ISOs offer preferential tax treatment, it is important to mention that an AMT adjustment may be necessary upon exercising options. With ISOs you may need to file an AMT adjustment on the “bargain element”, the difference between the fair market value of the options and what you paid for the stock (the grant price/strike price).

- $100,000 Per Year Limitation: Per the Internal Revenue Code 422(d), the fair market value of stock exercised in any calendar year cannot exceed $100,000. Anything in excess of $100,000 will be treated as a non-qualified stock options (NQSOs).

- Estate Planning: Generally, an individual is not allowed to transfer or gift ISOs during their lifetime, and if they do, that could potentially disqualify them as ISOs which forfeits the tax benefits. However, ISOs can be transferred upon an individual’s passing to their heirs or beneficiaries through their estate.

Non-Qualified Stock Options (NQSOs):

Non-Qualified Stock Options are the most common form of stock option offered in equity compensation packages. NQSOs are much simpler in nature relative to ISOs, they have straightforward tax events and are not subject to the same stringent rules. The major difference between NQSOs and ISOs revolves around taxation because gains from NQSOs are taxed as ordinary income rather than long-term capital gains rates.

Important considerations for NQSOs:

- Tax Implications: When you exercise NQSOs the difference between the grant price and the fair market value of the stock is treated as ordinary income. With NQSOs, you will owe taxes in the year you decide to exercise your options.

- Holding Period: Once exercised, depending on the length of time you hold onto your company stock you may be subject to either short-term or long-term capital gains rates.

- Timing of Exercise: Since taxes are owed in the year you exercise your options, it is important to consider your entire financial situation in order to minimize your tax liabilities. Weatherly often works with our clients’ tax team in order to ensure that our clients are utilizing their stock options optimally.

- Estate Planning: NQSOs are generally more flexible when it comes to gifting to heirs, family members, or other individuals than ISOs. During an individual’s lifetime, subject to rules from the employer, NQSOs can be easily gifted or transferred to family members, heirs, or beneficiaries.

How to Exercise Stock Options:

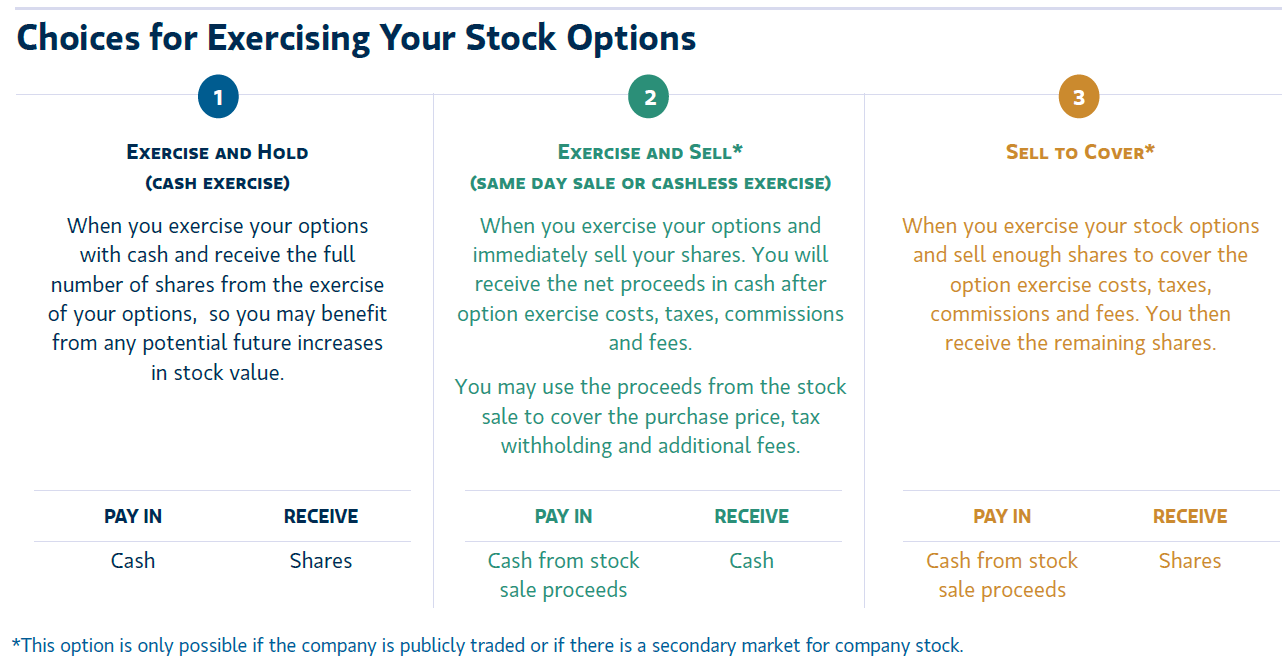

Both ISOs and NQSOs can potentially provide significant financial benefits to employees based on the ability to purchase company shares at a pre-determined price which would ideally be lower than the market value when exercised. When preparing to exercise options, it is important to keep in mind any specific blackout periods imposed by your company that dictate when and when you cannot exercise or trade company stock. Most importantly, with stock options, the employee is responsible for funding the purchase of their shares, and oftentimes this can mean a significant outlay of cash. Our team at Weatherly can assist you in navigating your choices when it comes to exercising your options. We can walk you through your options and tailor the advice to your specific situation considering cash flow needs, investment assets, and financial goals to ensure that you make a well-informed decision. Below we highlight the most common strategies when it comes to handling stock options:

Sourced from: https://www.morganstanley.com/cs/pdf/NQSO-Basics.pdf

Restricted Stock Units (RSUs):

Restricted stock units are another common form of equity compensation offered by companies. With this form of compensation, a company will provide an employee with a specified number of shares at a future date. Like stock options discussed above RSUs are granted under a vesting schedule for a specified period of time or can be tied to performance metrics. Unlike stock options, RSUs are delivered outright meaning that there is no choice granted to the employee with regards to receiving shares. RSUs are converted to stock and awarded on a set series of dates during a vesting period, and once delivered the employee can then decide whether to hold or sell the shares.

Important considerations for RSUs:

- Taxation: With RSUs, you are taxed when the shares are delivered on the specified vesting date. Taxation is based on the market value of the shares received and is treated as ordinary income. Typically, a company will withhold a certain amount of shares for tax purposes, and you will receive the net amount of shares thereafter.

- Holding Period: Once the shares are received the employee has the decision to either sell the shares immediately and receive cash or hold the shares as part of their investment portfolio. If shares are sold immediately there will likely be minimal to non-existent capital gain considerations. If shares are held then any increase in the fair market value from the time shares are received to when they are ultimately sold will be subject to either short or long-term capital gains taxes.

- Estate Planning: While RSUs are subject to vesting, they cannot be transferred or gifted to heirs or beneficiaries. Once vested and shares are delivered to an individual, they can be included as part of an estate plan and pass through to heirs and beneficiaries according to an individual’s estate planning documents.

Important Considerations for Your Financial Plan:

At Weatherly we have a team of dedicated professionals with deep knowledge and experience in the world of equity compensation packages and how to utilize them optimally to accomplish a client’s financial goals. We often work with our clients outside financial team of tax advisors and estate planners to coordinate the various moving pieces when it comes to receiving RSUs or exercising and managing stock options. From a financial planning perspective there are several factors to consider if you have an equity compensation package.

- What do I own?: Often times equity compensation packages may include a combination of ISOs, NQSOs, or RSUs. It is important to identify the various types of vehicles that are provided to you by your employer because there are various implications for your personal financial situation. Our team at Weatherly will request all the documentation associated with your equity compensation package to understand your benefits to begin implementing a plan appropriate for you.

- When do I pay taxes?: With the various vehicles available in an equity compensation package it can be very confusing to keep track of all the various tax implications and the timing of when taxes are owed. Our team of financial advisors often consults with your tax professionals to ensure that all parties are on the same page. We want to ensure that you have a clear picture of how exercising your options or receiving your RSUs will affect your tax liability.

- How does my equity compensation package affect my overall portfolio?: If you are receiving stock awards as part of your overall compensation, those awards need to be considered when it comes to your overall investment assets. Decisions regarding selling the shares and holding the shares, and the timing associated with that, can have major implications to your overall portfolio and asset allocation. There may come a point in time where you have been awarded a sizeable amount of company stock which could expose your portfolio to concentration risk and lack of diversification. Our portfolio managers at Weatherly have extensive experience and strategies for navigating your stock awards in the context of your overall financial situation.

- How do my stock awards affect my overall financial plan?: Each client is unique with their own financial situation and goals. At Weatherly one of our core pillars is customized holistic financial planning. Our team of financial planners can incorporate your equity compensation package into your overall financial plan to understand how your stock awards can potentially impact your financial situation. Oftentimes times we run various scenarios providing our clients with different options they can take in order to ultimately achieve their goals and aspirations.

Our team of dedicated advisors at Weatherly are here to answer your questions and ensure that you are making informed decisions regarding your equity compensation package. We are here to understand your specific needs and circumstances to ensure that your financial goals and aspirations can become a reality.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.