The Keys to our Key Financial Data Sheet

Aubrey Brown, CFP®, CRPC®, M.S. Wealth Management Advisor | Brooke Boone Kelly, CFP®, MACC, Wealth Management Advisor, Partner | January 25, 2024

By now, we have all likely heard several New Year’s Resolution enthusiasts say, “New Year, New Me!” Per Forbes, one of the most popular 2024 New Year resolutions is improving finances. Since we certainly don’t want to see this resolution drop off, we are sharing our updated 2024 Key Financial Data Sheet to assist you in your financial goals today and all year long.

The 2024 Key Financial Data Sheet is a useful tool that highlights tax brackets, contribution limits, deductions, credits, exclusions and more. In reviewing the history of US taxes, you’ll find how complex our tax code has become over time and the importance of staying up to date with current tax law. In this blog post, we outline the Keys to our Key Financial Data Sheet and potential strategies to help fulfill 2024 resolutions and beyond.

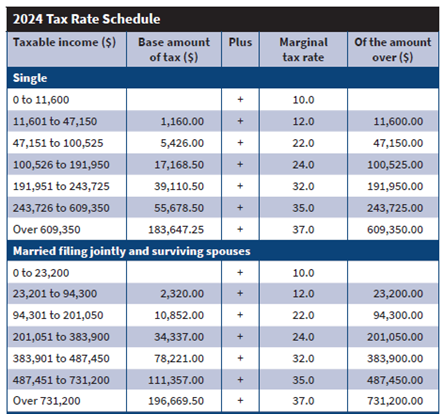

Personal Tax Brackets –

Federal Income Tax Brackets make up the bulk of the annual revenue collected by the IRS each year. Determining your filing status and marginal tax bracket is the first step in tax planning. The majority of US citizens file as Single or Married Filing Jointly (MFJ).

Source: Key Financial Data Sheet 2024

If you are single or considered unmarried, have a qualifying dependent and pay the bulk of the household bills then you may be a candidate for the Head of Household (HOH) filing status. These brackets and deductions are typically more favorable than the Single filing status.

Married Filing Separately (MFS) is also a filing status for married individuals. While some couples simply prefer to keep finances private, others choose to file separately for Federal and State tax benefits. While the tax code generally favors joint filers, in certain instances, it can behoove taxpayers to file separately such as to maximize deductions and/or limit certain liability risk.

Strategies to Consider –

- Roth Conversion – In low taxable income years, consider a Roth conversion strategy to maximize the lower tax rates.

- Engage a Tax Professional – they can help determine which filing status to use and can assist with various tax items.

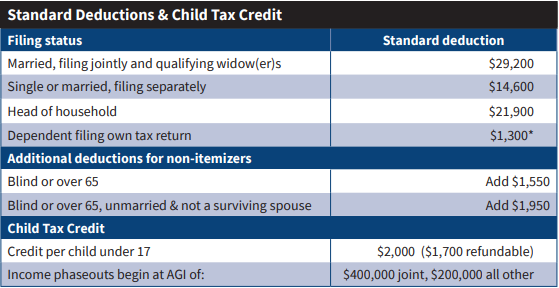

Standard Deductions & Child Tax Credits –

A common exercise takes place during tax season to determine if someone should itemize deductions or take the standard deduction. With the Tax Cuts and Jobs Act of 2017, the standard deduction nearly doubled, so the number of people that itemize deductions significantly declined. However, planning can be done with charitable giving to maximize deductions in certain years.

Source: Key Financial Data Sheet 2024

Strategies to Consider-

- Donor Advised Fund (DAF) – contributing to a DAF for individuals who itemize may provide a tax deduction as well as flexibility in granting to charities over time.

- Furthermore, a bunching strategy can be utilized or front loading a DAF in a high-income year can be even more effective.

- Qualified Charitable Distribution (QCD) – individuals over the age of 70.5 have a unique opportunity to give directly to charity from an IRA while excluding the distribution from taxable income. With the recent passage of Secure Act 2.0, the 2024 QCD limit is indexed for inflation ($105k) and also allows for a one-time donation of up to $53k to a Charitable Remainder Trust (CRT) or Charitable Gift Annuity (CGA).

- This strategy can help fulfill Required Minimum Distributions (RMD) for taxpayers who are at least age 73 and is a tax efficient way to facilitate charitable giving for those who take the standard deduction.

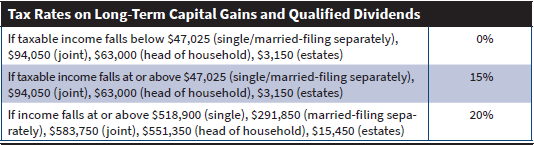

Capital Gains on Long-Term Capital Gains and Qualified Dividends

Weatherly’s investment philosophy focuses on Long-Term Federal Capital Gains and Qualified Dividend tax rates, specifically within taxable account types.

Source: Key Financial Data Sheet 2024

Strategies to Consider –

- Tax Loss Harvesting – this is part of Weatherly’s ongoing portfolio management services. As we review and rebalance portfolios throughout the year, we analyze prior year tax returns for loss carry forwards that may help reduce current year capital gains. When clients fall in the 15-20% Long Term Federal Capital Gains rate, our team attempts to offset realized gains with losses. This allows us to raise for cash flow needs and/or limit concentrated positions while limiting overall tax liability.

- Tax Gain Harvesting – those with low taxable income may fall within the 0% category and additional gains can be realized without incurring any capital gains tax.

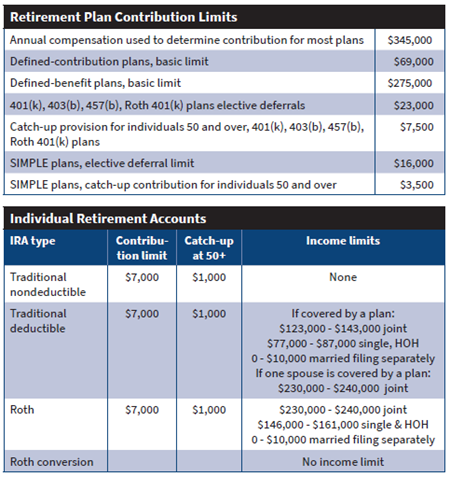

Retirement Contributions:

Source: Key Financial Data Sheet 2024

Taxpayers who are working and receive earned income may be able to contribute to an employer sponsored retirement plan like a 401K. They may also be eligible for a deductible IRA or Roth IRA contribution. Knowing the contribution limits above can allow an individual to maximize their retirement contributions which can reduce their overall taxable income for the year.

Strategies to Consider –

- Traditional vs Roth Contributions – for high earners, contributing to a tax deferred retirement plan would allow more money saved given their current high tax bracket. For those in low tax brackets, contributing to a Roth account could limit higher taxes in the future.

- Self-Employed 401K – can allow certain business owners to contribute as both an employee and employer to further maximize annual deferrals.

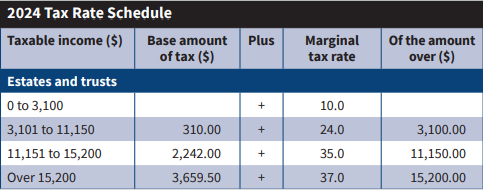

Estates, Trusts and Planning for the Future –

Estate planning has become a growing part of financial planning, due to the inevitable Great Wealth Transfer. Individuals and families often utilize trust documents to effectively transfer assets to their heirs. However, income tax rates on estates and certain trusts are the most dramatic as they reach the highest tax bracket the quickest.

Source: Key Financial Data Sheet 2024

While this is a major factor, it is not the only consideration when it comes to wealth transfer.

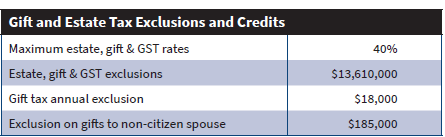

A question we get a lot is, what is the annual gift tax exclusion amount? For 2024, it is $18,000, which is an important figure as this is how much one person may gift to another person without needing to file a gift tax return (Form 709) and reduce their Estate Exclusion Amount.

Source: Key Financial Data Sheet 2024

Under current law, we are given a lifetime estate exclusion amount ($13.61M per person in 2024), which you can utilize while alive or at your time of death. For taxable estates/gifts over the exclusion amount would incur a 40% tax hit.

The tax Cuts and Jobs Act of 2017 made significant changes to the estate exclusion amount. This law more than doubled the exclusion amount until its sunsets January 1st, 2026 and reverts back to prior amounts (after adjusting for inflation). Without an extension from Congress, most analysts are predicting the estate exclusion amount will drop to $6M – $7M per person.

Strategies to Consider –

- Financial Plan – if gifting is of interest to you, it is important to first have a financial plan completed for your own financial situation. If your personal plan is successful, there are various estate planning/annual gifting opportunities to explore.

- Annual Gifting – a gift up to the annual exclusion amount would sidestep the need to file tax form 709 and would not reduce your lifetime estate exclusion amount.

- Consider gifting appreciating assets or funding an investment account.A 529 college savings plan can be superfunded by forward gifting up to 5 years worth of the annual exclusion amount in the current year.

- Our 5 Estate Planning Strategies to Consider blogpost highlights a few different strategies to consider with your team of professionals.

- Leverage the Current High Estate Exemption Amount – Gifting a high amount of assets to take advantage of the higher lifetime estate exclusion amount.

- Asset location and type of accounts should be considered to further enhance this strategy.

Engaging an estate planning attorney in tandem with your Weatherly advisor is vital to properly plan for your asset transfer.

How Weatherly Can Help-

Given the uniqueness of our tax code, Weatherly likes to gather your tax return to help identify planning opportunities. Based on our conversations with you and data we gather, we can then outline which strategies could be most impactful to you. With January 1st, 2026 right around the corner, it is a great time to revisit your estate plan and gifting goals prior to the revision of the estate exclusion amount.

Please reach out to schedule a call with your advisor to see how the Key Financial Data Sheet may improve your finances this year and the decades to come.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.