The Four Financial Basics: What You Can’t Afford NOT to Know…

Candise Holmlund, CFA, CFP®, TEP, AEP®, Senior Consultant, Partner | Brooke Boone, CFP®, MACC Wealth Management Associate Advisor | February 14, 2019

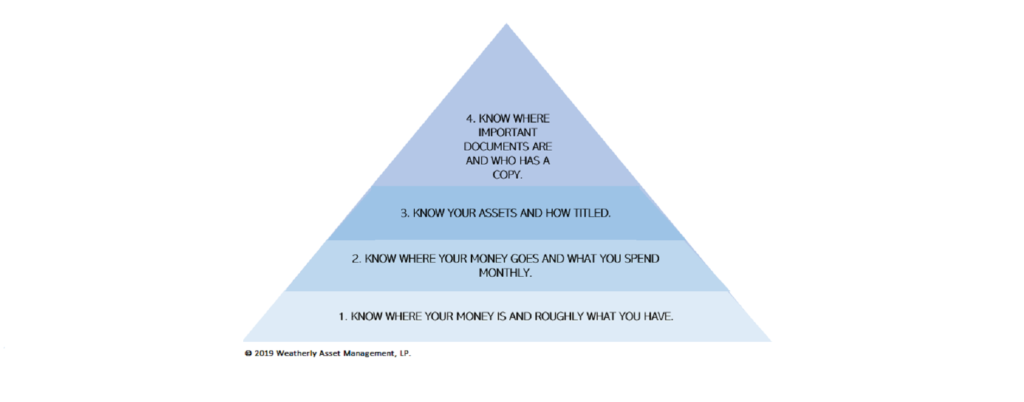

Over the course of working with clients for many years, we often get the question, “What are the most important financial elements you think we should know?” Although no two client situations are the same, clients often need a fundamental starting point to build their financial future upon. In the interest of starting the year off right, we want to highlight what we call “The Four Financial Basics” and important action items you can’t afford NOT to know for a healthy financial future.

“The Four Financial Basics” and considerations as you establish your financial base:

- Most importantly, know where your money is and roughly what you have.

Ask yourself the following questions:

- What are your sources of income and savings? What amount do you have of each?

- Income sources may include: pensions, social security, investment income, rental income, business income, salaries and wages, IRA distributions

- Where are your investment and retirement accounts held? How much do you have of each?

- Do you give to charity? Do you have a Donor Advised Fund (DAF) or another source you use?

- After considering these questions, Weatherly is able to provide guidance and strategies specific to your financial situation and to help maximize your after-tax income, savings, and investment.

- Know where your money goes and what you spend monthly.

- According to a recent Gallop study, approximately 67% of Americans do not keep a formal budget for their household spending (1). We recommend that clients track what they spend in various categories to avoid overspending. First add up the necessities, include housing costs, debt, other items such as car, insurance, utilities, savings. Then compare that to your income number to see what you have remaining. We have included a worksheet to help you track here.

- By gathering this information, we can better develop your financial plan and evaluate the amount of income you have left for discretionary spending on items such as: travel, entertainment, and hobbies to name a few- as well as better estimate what you will need throughout your life.

- Know Your Assets. How are they titled, where are they held?

- The title and type of asset determines how it is treated. A common example is your home- if you have a living trust, but your home is not in trust title, then your home will not be treated as being held in trust. This oversight may lead to a probate issue at death. Have you refinanced recently? Check your title is correct.

- Consider: Where is the title document for the asset? What does it say? Who has a copy of it? Have you developed a list so an executor would know where everything is?

- This exercise is akin to a good financial health checkup. Weatherly encourages clients to “Know Your Assets” to avoid unnecessary pitfalls, such as the probate example outlined above.

- Know where important documents are and who has a copy.

- Important documents typically include your durable power of attorney, durable power of attorney for health care, trusts, wills, list of assets, insurance policies, benefit information, and tax returns.

- Use a simple checklist to track the documents you have and who has access to them. Review this list: 1) at least annually, 2) when you acquire new assets, or 3) if there are changes in family status due to birth, marriage, death, and divorce to name a few. Weatherly is available to help complete your checklist and collaborate with your team of professionals- CPAs, estate planning attorneys, a trusted family member- to implement or obtain copies of these documents on your behalf.

- Provide the important documents and completed checklist to your executor, trusted professional, or keep a copy in a known place “in case of emergency”.

- Completing our Family Conversation Card with a family member or significant other, can serve as an evaluation and accountability tool that helps track your documents and progress. You can also utilize the card as way to educate and start the family conversation about wealth, family values, philanthropy, and financial goals and wishes.

- For more detailed, complex lists we recommend storing on a secure thumb drive that is password protected, or a cloud-based storage system- such as Dropbox, Keeper, or Amazon Drive-which is accessible from anywhere. Some if these data storage systems also have legacy options for data recovery.

So, how did you do? Do you generally know the Four Financial Basics? Excellent! Does your spouse… your executor or trusted family member?

Similar to the start of a new year, establishing your financial base can present a plethora of emotions, challenges, unknowns, some anxiety, and excitement. The Weatherly crew is here to assist you with the Four Financial Basics and provide guidance as you seek to put your financial house in order and plan for the future.

Resources:

Resources:

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.