Inflation, The Fed & Your Portfolio

Ryan Richardson, CFP®, Wealth Management Associate Advisor | Aubrey Brown, CFP®, CRPC®, M.S. Wealth Management Associate Advisor | June 24, 2021

From airline tickets and car prices to gasoline and commodities, consumers and investors have experienced pockets of inflation as the U.S. economy continues to recover from the COVID-19 pandemic. We saw the May Consumer Price Index (CPI) numbers reflecting the largest month-over-month gain since 2008, and subsequently the Federal Reserve began talking about potential changes to monetary policy and their expectations for increasing inflation. As we turn to the Federal Reserve for guidance, let’s look at the role the Fed plays and the key points made during the most recent Federal Open Market Committee (FOMC) meeting, specifically a deep dive into inflation and what that means for investors.

The Federal Reserve:

The Federal Reserve (Fed) is the central banking system of the United States and is used to promote a strong economy. The Fed uses monetary policy to support their primary goals:

- Maximum Employment

- Price Stability

The Fed hopes to maintain consistent price stability as they set their long-term annual inflation rate target to 2%. A modest inflation rate is generally viewed as healthy for the economy as it can coincide with wage growth and maintain consumer demand; alternatively, deflating prices (deflation) or hyperinflation can stress the economy. While moderate increases in price is the ultimate inflation goal, the Fed’s most common levers to pull include:

- Open Market Operations –

- Buy/sell securities in the open market to help control liquidity.

- Setting the Discount Rate –

- Short-term interest rates the Fed uses to charge commercial banks. This has a spillover effect on all interest rates.

- Adjusting reserve requirements-

- Amount of cash banks need to hold

Recent FedSpeak and New Challenges:

As evidenced by the recent Fed meeting, uncertainty is still present despite Federal Reserve Chairman Jerome Powell communicating that the recent bounce in inflation is transitory – or not permanent. The Fed is experiencing new challenges with the recent record-breaking Government spending, higher tax proposals, and pent-up consumer demand due to the pandemic. Even with soaring unemployment last year, we saw the household savings rate increase during global shutdowns. We now find Americans excited to spend and make up for the lost opportunities last year – particularly in travel, dining and experiences. The higher demand and lost production time with factory shutdowns has also caused supply chain constraints in several industries such as autos, lumber, and chips/semiconductors leading to higher prices. This was captured in the latest inflation report, with Fed officials signaling higher expectations for inflation, as well as an earlier time frame for interest rate hikes. The FOMC hinted at two hikes in late 2023 on the recent dot plot projection versus the previous projection of no rate hikes in 2023, in fact, 7 members expected a rate rise in 2022. If higher inflation numbers continue to roll in, the Federal Reserve may be forced to lift rates earlier than they anticipated to achieve its mandate of maintaining price stability and moving towards full employment.

Inflation and How It’s Measured:

Simply put, inflation is the rise in price of goods over a period of time. Or viewed differently, a decrease in purchasing power of a currency for the same good. An example, is a loaf of bread costing 22 cents in 1960, today costs $2.12 or more. This price increase is inflation. However, we indulge in more than just bread, so economists look to inflation indexes for a broader representation. The Fed views price stability as moderate inflation

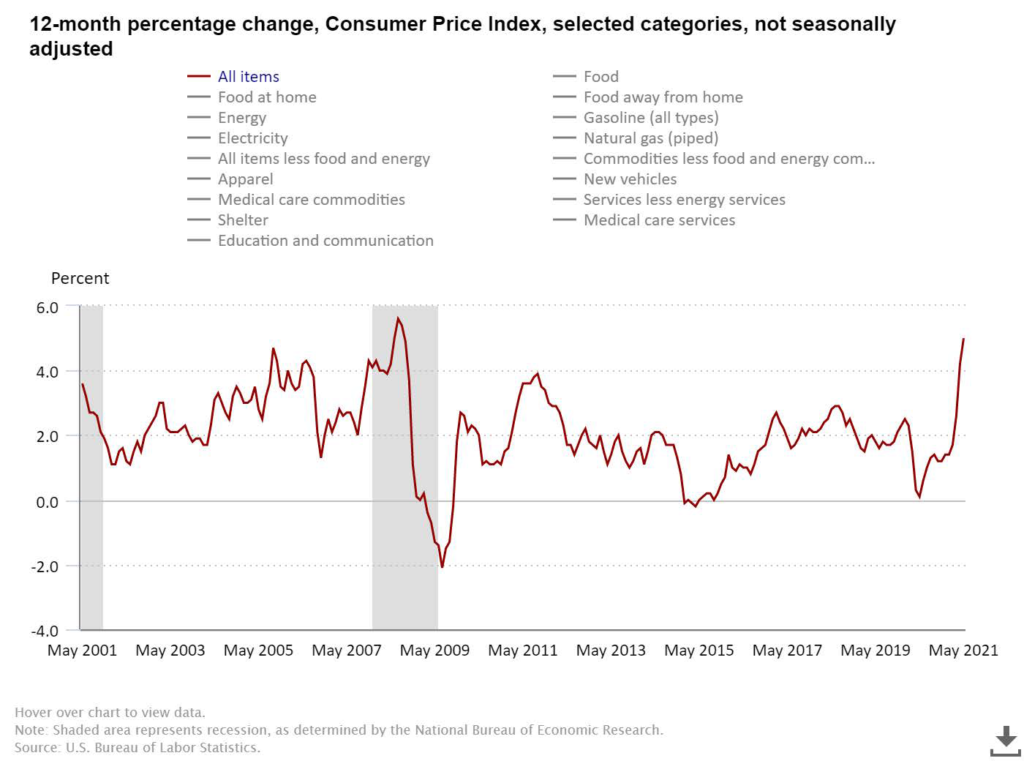

The Consumer Price Index (CPI) is the most recognized way of measuring inflation in the US and is reported monthly by the Bureau of Labor Statistics (BLS). The index is calculated by analyzing the price of a basket of goods and services. This basket includes eight categories: food/beverages, housing, clothing, transportation, medical care, recreation, education/communication and other goods and services. The aggregate change in price of the basket is known as the inflation rate and can be used for Cost-of-Living Adjustments (COLA) in Social Security or applicable pensions.

A Quick Look Back in History:

The BLS has a record of CPI dating all the way back to 1913. When going back this far, the average annual inflation rate is slightly over 3.10%*. This is in part due to greater volatility in prices. Within the last few decades, inflation has become much more stable as the Federal Reserve has had better oversight and control of monetary policy. Additionally, globalization, new technology and supply chain success has aided in keeping the price of goods low. In fact, inflation over the last decade is much lower than the historical average as it has been around 1.76%**.

Inflation Today and Where It’s Headed:

Inflation talks have taken over news headlines, Fed meetings and conversations with neighbors. And this should come as no surprise. When comparing to the prior year, the February inflation rate was up 1.7% and then April and May inflation rates rose to 4.2% and 5.0%, respectively. This dramatic jump can be attributed to the surge in demand for inputs and consumer goods as the U.S economy began to recover and grow at a larger than expected rate with gross domestic product (GDP) forecasts coming in at 7% versus 6.5% previously. Categories such as autos, airfares, and gas are seeing the biggest price increases as a temporary reopening demand surge.

Chart Sourced From: https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

Impact on Portfolios:

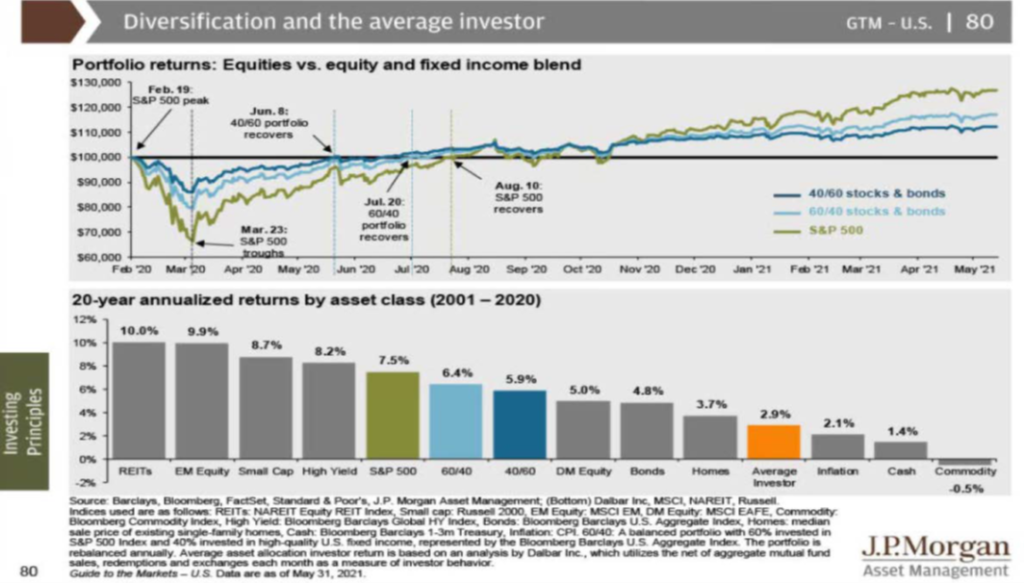

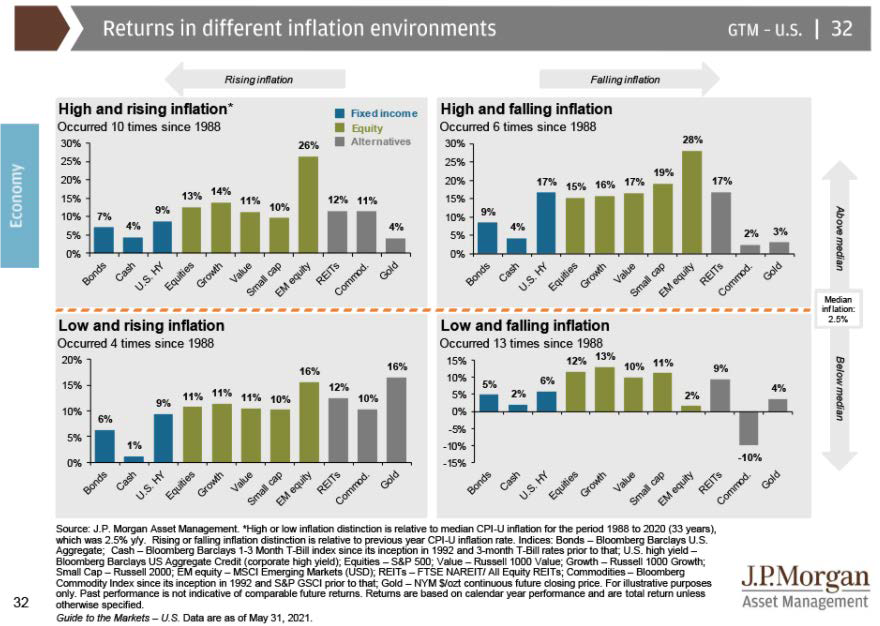

Whether inflation is here to stay or just a minor blip on the radar, it serves as a great time to review your asset allocation with your advisor. We believe a well-diversified portfolio tailored to your risk appetite is still appropriate to participate in market growth while limiting some downside risk. As discussed in our previous blog , it is also important to discuss concentrated positions with your advisor to evaluate risk in specific holdings or asset classes. Let’s take a look at how different asset classes may be affected by inflation:

Chart Sourced From: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

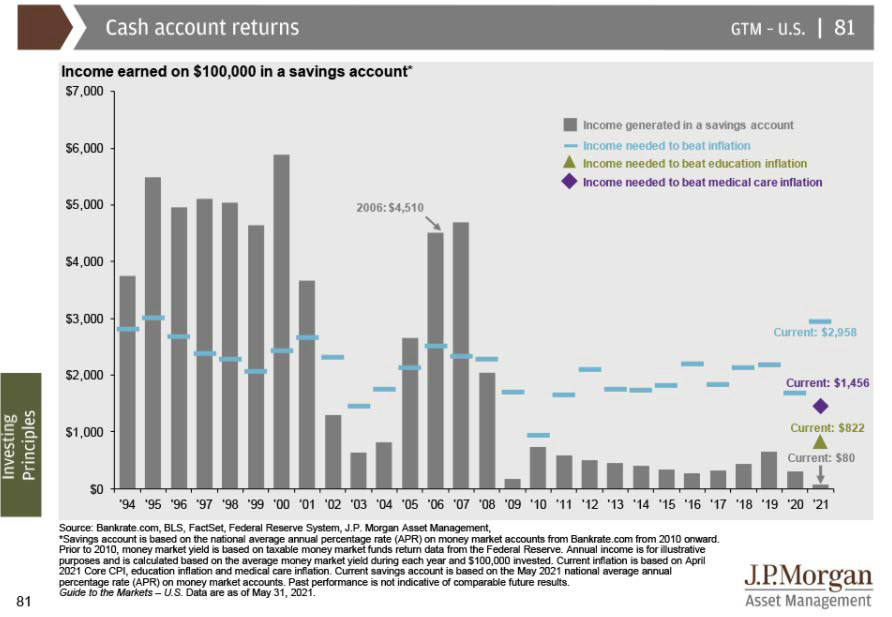

- Cash – is most vulnerable to inflation. While we still encourage holding an emergency fund and some cash for opportunities, the excessive cash held in a checking/saving account will lose purchasing power due to high inflation and little to no interest being earned. Cash enhanced short-term funds can be considered as a potential alternative as they yield higher returns while preserving liquidity.

Chart Sourced From: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

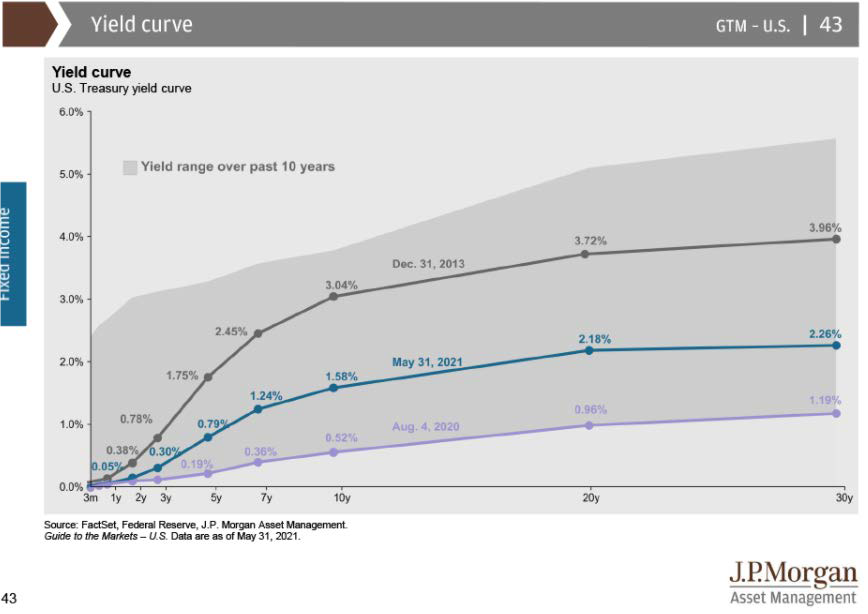

- Fixed Income – High Inflation can have a negative impact on real returns. Because of this the Fed will typically lift interest rates to combat higher inflation. When interest rates increase, bond prices typically fall. The idea is that bond investors may offload their current bond holdings on the secondary market and then purchase new bonds with a higher yield. Longer term and low-quality debt are most susceptible in this scenario. However, these interest rate changes do not impact the return of principal you receive at bond maturity. Treasury Inflation-Protected Securities (TIPS) provide protection against inflation by growing with CPI until maturity. Interest rates may be lower than other debt instruments given the attractive feature of increasing principal with inflation.

Chart Sourced From: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

- Equities – Stocks tend to be the best performing asset class with rising inflation. Since businesses are raising their prices, the benefits often flow through and benefit investors. Companies that require little capital, such as technology companies and communication services tend to do well in inflationary environments. Also, companies with a competitive advantage with high barriers of entry and strong consumer loyalty tend to well in this environment. However, high inflation and interest rate changes often increase volatility in the stock market. Equities undergo additional pressure as higher yields cause investors to reevaluate the risk/return relationship and may seek to invest in debt that pays some more in interest.

- Real Assets – Real estate and other tangible assets like commodities tend to do well in inflationary times. Historically, as inflation rises so does property values. This allows landlords to charge more for rent or homeowners to cash in more when they sell their property. Also, those who carry a fixed rate mortgage benefit from inflation since their monthly payment and outstanding debt does not grow.

Chart Sourced From: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

How WAM Can Help:

With inflation concerns and potential interest rate hikes on the horizon, we believe now is a great time to review your asset allocation with your advisors. Please reach out to our team and schedule a call to ensure your portfolio is positioned in accordance with your risk profile and the changing environment.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.