The Bull Market Turns 9, What’s Next?

Cole Hansen, Wealth Management Associate Advisor | Brooke Boone, CFP®, MACC, Wealth Management Associate | August 30, 2018

The Bull Market Turns Nine, What’s Next?

The media and investment community have recently focused attention on the length of the current U.S. bull market with great speculation on sustainability of positive returns. The Post Crisis Bull Run is now the longest bull market in history as of August 22, 2018. However, in our view market outlook should not be based solely on length but rather formed through a well-researched understanding of fundamental macroeconomic indicators, US consumer health, corporate valuations, and the geopolitical landscape.

Context

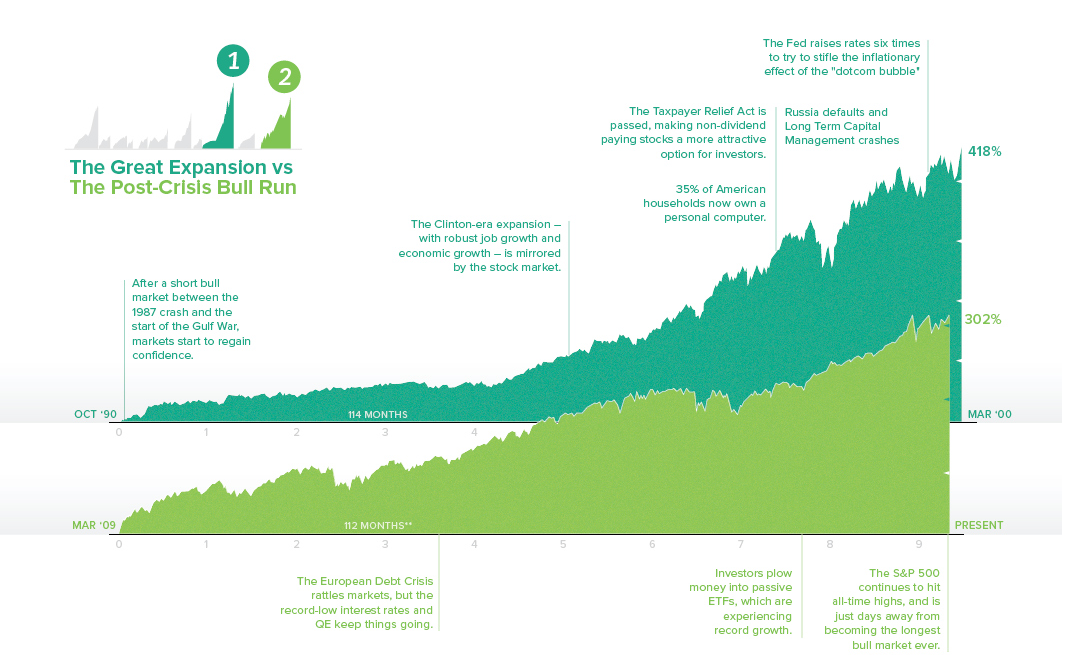

The Great Expansion, now the second longest bull market, lasted approximately 114 months, from October 1990 to March 2000. During the 114 months period, the S&P returned 418%.

The Post Crisis Bull Run, from March 2009 to present, returned 302% on the S&P 500. In both 2011 and 2015 the market corrected due to concerns regarding the European debt crisis and global debt levels. In both cases, the market rallied and continued its upward trend.

*All figures are as of June 30, 20181

What is best? A long term view

Portfolio management and appropriate overall strategy is an ongoing and iterative process. We strive to collaborate with our clients to ensure changes to your individual situation are incorporated with our outlook to best address opportunities and risks. A steady hand and focus on the long term are key to our client’s success. JP Morgan completed a study that illustrates the importance of a consistent investment approach through volatility and the precarious challenge timing the markets. For further information, reference this link.

Weatherly takes a long term fundamental view to best position client portfolios in all market environments. Many market participants don’t know that strategic asset allocation is the primary driver of portfolio returns. A Financial Analysts Journal study found that active asset allocation accounts for approximately 93% of investment performance2. Our team analyzes markets with a top down and bottom up approach within a macroeconomic framework. We deploy tactical asset allocation decisions to make incremental changes that are consistent with each client’s unique goals, risk/return profile, and our economic outlook.

Where We’ve Been and Where We Are Now

In 2018, we have seen a disparity in investment performance across sectors. The technology sector has led the way returning approximately 21% year to date vs the S&P 500 returning 10.4% YTD. There has specifically been a tilt towards Facebook, Apple, Amazon, Netflix, and Google, commonly referred to as FAANG in 2018.

It is also important to highlight a few economic indicators to fully understand the current business cycle and 2018 market.

- U.S. Employment Rate: In May of 2018, we saw the unemployment rate reach an 18 year low of 3.8% (and 3.9% in July 2018), which suggests that we are at full employment levels. Wage growth, however, has remained low at a 2.7% rate year over year.

- Inflation Target: the early stages of inflation rising is a bullish or positive indicator for the economy as demand for products has grown and prices are increasing. The Federal Open Market Committee’s (FOMC) target inflation rate is 2% and the current annualized U.S. inflation rate is 2.9% as of July 2018.

- Interest Rates: Given the uptick in inflation, we’ve seen the Federal Reserve methodically raise short-term rates with plans to continue at the next FOMC meetings in a response to rising inflation.

- Gross Domestic Product (GDP): known as the output of a country’s economy. We have continued to see steady GDP growth with an annualized growth rate of 4.1% as of June 30, 2018. Approximately 70% of the GDP growth is due to consumer discretionary spending, which suggests that consumers are spending money, a positive economic indicator.

- Corporate Earnings: In Q1 2018, we saw corporate profits increase by 8.7% (or $153 billion) to an all-time high mainly due to the decrease in corporate tax rates to 21% from 35% under the Tax Cut and Jobs Act. The increase in corporate earnings has enabled corporations to invest funds in stock buyback programs and implementation of or increasing their dividend payouts.3

These indicators suggest that the economy is healthy, consumer spending remains steady, and we are in the late expansionary period of the business cycle. Weatherly has implemented specific strategies to position client portfolios for the current market environment, but recognize how far certain asset classes have appreciated, and are working to position clients for additional volatility in the coming years.

Strategies Implemented in 2018

- Tactical Asset Allocation and Options Strategy- Based on each client’s unique goals and risk/ return profile, Weatherly has begun to proactively shift client portfolios to asset allocation neutral in response to the rise in equities as we potentially near the end of the bull market. Our tactical asset allocation approach is two- fold. First, we have shaved down stocks that have appreciated significantly. Second, we have rotated out of specific sectors that may be negatively impacted by the current economic environment. For clients with concentrated positions, we have also utilized our covered call options strategy to reduce single stock exposure and opportunistically increase income in portfolios. Reference our covered call write-up here for further details.

- Fixed Income Strategy- The current flattening of the yield curve makes short term debt instruments attractive as investors can capture a reasonable rate of return, while reducing exposure to interest rate risk, credit risk, and inflation rate risk. Given these factors, we have proactively put funds to work in short to intermediate-term corporate and municipal bonds with maturities of 1-7 years.

- Collaborate with Your Designated Professional Advisors- We also work directly with clients’ designated professional advisors- CPAs, attorneys, other financial advisors – on tax loss harvesting strategies and giving strategies via Donor Advised Funds (DAFs) and/or Qualified Charitable Distributions (QCDs) via client’s IRA Minimum Required Distribution (MRD). These strategies can also reduce equity exposure in portfolios.

- Tax Loss Harvesting- At the end of the third and fourth quarters, we work directly with clients and their CPAs on tax loss harvesting for clients that may have a large tax bill following a high-income tax year or realizing large capital gain. This strategy involves selling securities at a loss, which allows the client to reduce capital gains tax and offset up to $3,000 of ordinary income.

- Giving Strategies- With large unrealized capital gains in client accounts, Weatherly has incorporated Donor Advised Funds (DAFS) and Qualified Charitable Distributions (QCDs) to strategically shave down these positions in client accounts. Given the unique tax implications of contributing via a DAF vs a QCD, Weatherly consults your CPAs and team of professionals to determine the appropriate giving strategies and vehicles for 2018. Please reference of Charitable Giving blog post and this link for further information on DAFs and QCDs.

Weatherly has proactively put these strategies into action based on each client’s risk-return profile and unique financial goals. Please feel free to contact us to discuss our strategy, market outlook, and your specific situation in more detail.

References

- https://www.businessinsider.com/heres-what-the-longest-bull-runs-of-the-modern-era-have-looked-like-2018-6

- http://www.grbestpractices.org/sites/grbestpractices.org/files/Determinants%20of%20Portfolio%20Performance%20II%20An%20Update.pdf

- https://tradingeconomics.com/united-states/corporate-profits

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.