The Ins and Outs of Asset Allocation

Chase Hayhurst, CFP®, Wealth Management Advisor | Aubrey Brown, CFP®, CRPC®, M.S. Wealth Management Associate Advisor | September 1, 2022

Whether you’re new to investing or have decades of experience in financial markets, having an asset allocation aligned with your goals and risk tolerance remains one of the most important decisions investors can make. Having an appropriate asset allocation aims to balance the risk and reward, through diversification across asset classes and types. There is no one size fits all when it comes to determining an asset allocation for every investor, however it will ultimately have a larger impact on portfolio returns than security selection. In this blog post we will explore what factors to consider, importance of diversification, how an investor’s asset allocation may change over time, and various ways the Weatherly team can help you achieve your goals.

An investor’s allocation will determine how their portfolio will be appropriated across different asset classes commonly classified as equities, fixed income, and cash. Additional assets classes of importance can include alternatives such as real estate, commodities, or collectibles. Each of these different asset classes carry a different set of risk and return characteristics highlighting the necessity of setting an allocation that aligned with the investor’s overall goals.

There are several factors to consider when determining an appropriate asset allocation, including:

Time Horizon

An investor should review each of their goals to determine the amount of time until the funds will ultimately be needed. With short time horizons, within a few years, a sudden market decline may significantly decrease the original investment preventing the individual to reach their goal or recoup losses. Therefore, it’s often recommended to allocate more funds into historically safer assets such as money markets, high yield savings accounts, CDs, and other short-term high-quality fixed income securities. While the returns on these assets are low, the investor’s principle is more protected.

Conversely, longer time horizons such as saving for retirement may be decades away and can afford the investor to have a more aggressive allocation with a larger exposure to riskier assets such as stocks, equity funds, or alternatives. While stocks have more implied risk than cash or high-quality fixed income, they historically have provided greater returns over the long run, helping investors ultimately reach their financial goals.

Risk Tolerance

This refers to the degree of risk an investor is willing to endure in times of market volatility. An investor with an aggressive allocation may be willing to lose a greater share of their original investment to achieve potentially higher rates of return while a conservative investor may prioritize capital preservation and guaranteed returns.

https://www.brightstart.com/risk-tolerance-questionnaire/

While it’s important to consider both your time horizon and risk tolerance when determining an appropriate asset allocation, they might not always align. For instance, your ability to emotionally endure losses could exceed your ability to withstand them given your financial situation. Alternatively, some investors are very risk averse even if they have a significant level of assets.

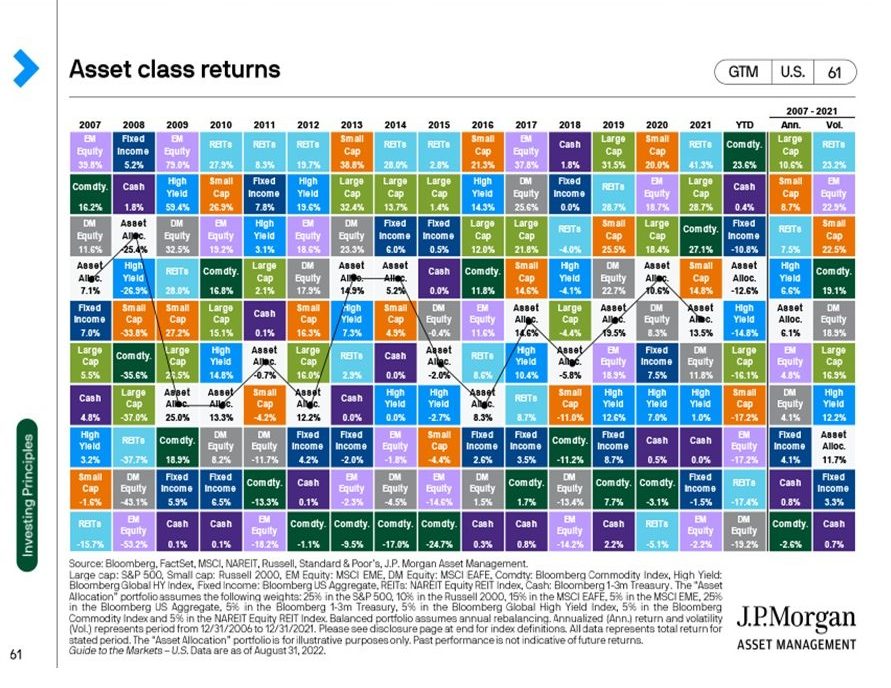

The balance between risk and reward should be top of mind for investors and diversification remains a key driver. The chart below breaks down historical performance and volatility of different asset classes over time. The balanced portfolio represented by the white box highlights how diversification can help reduce risk in the portfolio and enhance returns.

Chart sourced from: JP Morgan Guide to the Markets – August 2022, Page 61

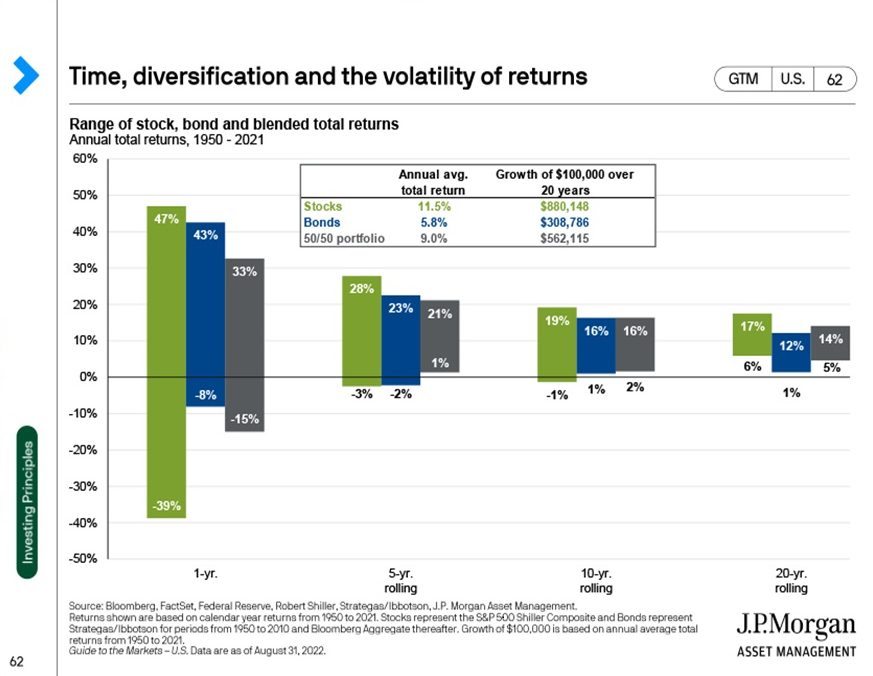

The slide below represents the importance of an investor understanding both their personal goals and the time horizon associated. Short time periods may experience greater volatility but over the long term returns typically return to the mean.

Chart sourced from: JP Morgan Guide to the Markets – August 2022, Page 62

Total Asset Allocation

Asset Allocation is the main driver of returns and should not only be reviewed on the account level but also as it relates to net worth. This can include alternative investments such as real estate, business interests, commodities, collectibles or other assets that are held outside a traditional investment account. Any concentration in these other asset types should be considered when determining the asset allocations at the account level. For example, if a client has a large position in a startup business, they may have a more conservative approach in their investment accounts to help balance total risk they are subject to. Total asset allocation can even impact individual positions in a portfolio. For example, an investor who has a large chunk of their net worth tied to real estate, may rethink investing in a residential Real Estate Investment Trust (REIT) to limit concentration to the real estate industry. Similarly, concentration in a employer stock due to stock options may impact overall investment strategy and portfolio risk. Reviewing total allocation can sometimes improve concentration concerns found in a specific account.

Asset Allocation Per Account

Although asset allocation can be viewed on an aggregate basis, it should also be reviewed on an account basis. Retirement accounts often have a tax deferral component, and benefit from long-term accumulation. Therefore, retirement accounts may favor a higher equity allocation until Required Minimum Distributions (RMDs) begin at age 72 or the client becomes reliant on income from this type of account. If possible, cash flows are taken from non-retirement accounts first, so a more conservative allocation is generally used for these accounts. Tailoring asset allocation this way can help maximize tax efficient returns over time. Additionally, there are planning opportunities that may span across multiple generations and thus require a different allocation than the individuals establishing the accounts. This can especially be seen in a Roth IRA given tax treatment and no mandatory withdrawals while the account owner is alive. A more aggressive asset allocation to this account can capture a longer period of tax-free growth and enhance a future inheritance for beneficiary or loved one.

When to Review Asset Allocation

It should also be noted that asset allocation may evolve over time as new goals develop and life happens. For example, a large liquidity event may cause investors to increase or decrease their asset allocation as their priorities may have changed. Also, investors generally shift to a more conservative allocation to reduce near term risk if they anticipate upcoming cash flow needs from a portfolio. Some examples of this could include a home purchase, looming child education expenses, large medical costs or beginning retirement. This same type of progression can be seen in target date funds which utilizes passive investing to automatically adjust asset allocation to be more conservative as a certain goal approaches.

Periods of volatility can also cause investors to review their asset allocation. During a down market, investors tend to reevaluate the amount of risk they were originally taking. If they are comfortable with the volatility, then it may be an opportune time to rebalance the portfolio by bringing the equity allocation back up to help reinflate the portfolio faster. This is often forgotten during periods of exuberance in the stock market, but it may be appropriate to rebalance the portfolio to fixed income to limit overall concentration to equities. During these periods of volatility, an active management investment style tends to benefit clients. Being able to quickly reevaluate risk profiles, allow for gains to be taken or a portfolio to be repositioned. Financial Planning can be helpful in determining the amount of risk needed to take to fulfil various goals.

How Can WAM Help

Whether you’re a new or an existing Weatherly client, we pride ourselves on open dialogue to ensure we understand each client’s needs and goals both for the short and long term to determine an appropriate asset allocation. You’ll often find a question we always ask on the front end is if there are any upcoming liquidity needs. This allows us to properly align the portfolio while also exploring areas of opportunities to reduce risk. We review current and target asset allocations several times a year to ensure the appropriate amount of risk is being taken to achieve goals and meet cash flow needs. If periods of volatility cause concern, then we revisit the target asset allocation with the client and implement adjustments, if necessary. We lean on our financial planning capabilities that help clients bring together their financial picture into a holistic and consolidated view to prioritize goals based on importance and timing. We encourage you to reach out to your trusted advisor with any questions about how life changes can impact your allocation, risk mitigation, or any other questions.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.