10 Questions to Ask Your Financial Advisor

Yoshi Brownlee, Client Experience & Marketing Associate | Carolyn Taylor, President & Founding Partner | June 15, 2023

Making decisions about your financial life can be daunting and difficult no matter the stage, but the choices you make now can have a major positive impact over time. Whether you are just thinking about getting started with professional financial advice, actively interviewing candidates or even heading into a quarterly review with your current advisor, discussing the right topics can offer you great peace of mind.

At Weatherly, we encourage open dialogues and value honest communication at every stage of our relationships with our current and prospective clients, their families, and their trusted professionals. We sat down and created a comprehensive list of questions that not only covered the basics, but also looked beyond at the relationships we build and the extent of the work we accomplish together. These questions are not only useful in the “due diligence” phase of interviewing, but impactful to review at least annually with your Weatherly advisor.

- Are you a Fiduciary and what does that mean?

A Fiduciary is a term in the financial services industry that refers to a financial advisor that serves under fiduciary duty, meaning that the advisors have pledged to make recommendations or collaborate with you on solutions with your best interest in mind, not for their own personal gain or financial benefit. You can learn more about our commitment to our fiduciary duty and view our regulatory filings on our ADV, Compliance and Disclosures page.

- Who is your custodian?

Weatherly primarily uses Fidelity Investments, but also works with Charles Schwab, and National Advisors Trust Company as custodians for client accounts. This separation of RIA (Registered Investment Advisor) and custodian is in place to protect the investor from loss or misuse of funds due to the Investment Advisers Act of 1940 as well as subsequent updates in 2009 by the Securities and Exchange Commission in the aftermath of Bernie Madoff’s Ponzi Scheme. A benefit of this distinction for clients is “side by side” reporting. As a client, you receive reporting directly from Weatherly focusing on investment performance and separate reports from your custodian, allowing you to cross-reference for additional transparency on account activity.

The importance of choosing the right custodian to work with is paramount to both your experience as a client and the safety of your assets. High quality custodians will be protected through SIPC insurance and even go above and beyond for investors by providing additional coverage, like the expanded comfort that Fidelity offers through Excess of SIPC insurance. In addition to annual reviews, Weatherly performs ongoing due diligence on third parties, including custodians, their insurance, and areas of potential risk. Weatherly prides itself on extensive vetting of our custodians to ensure the highest level of service for our clients.

- How do you make money?

Our comprehensive list of services is extensive, but Weatherly’s two core competencies are investment management and financial planning. Using these two pillars as a foundation, our team works with you and your trusted team of professionals on all aspects of your financial life from customized portfolio management to business, estate, retirement, and tax planning. For this holistic service approach, Weatherly charges a fee based on Assets Under Management (AUM,) 1% for equities and .5% for fixed income. We do not charge hourly fees for planning or other advice; our services are covered by your quarterly fee. For more information on our services and fees, you can review our Firm’s Form CRS.

- Who is your ideal client, do I fit in?

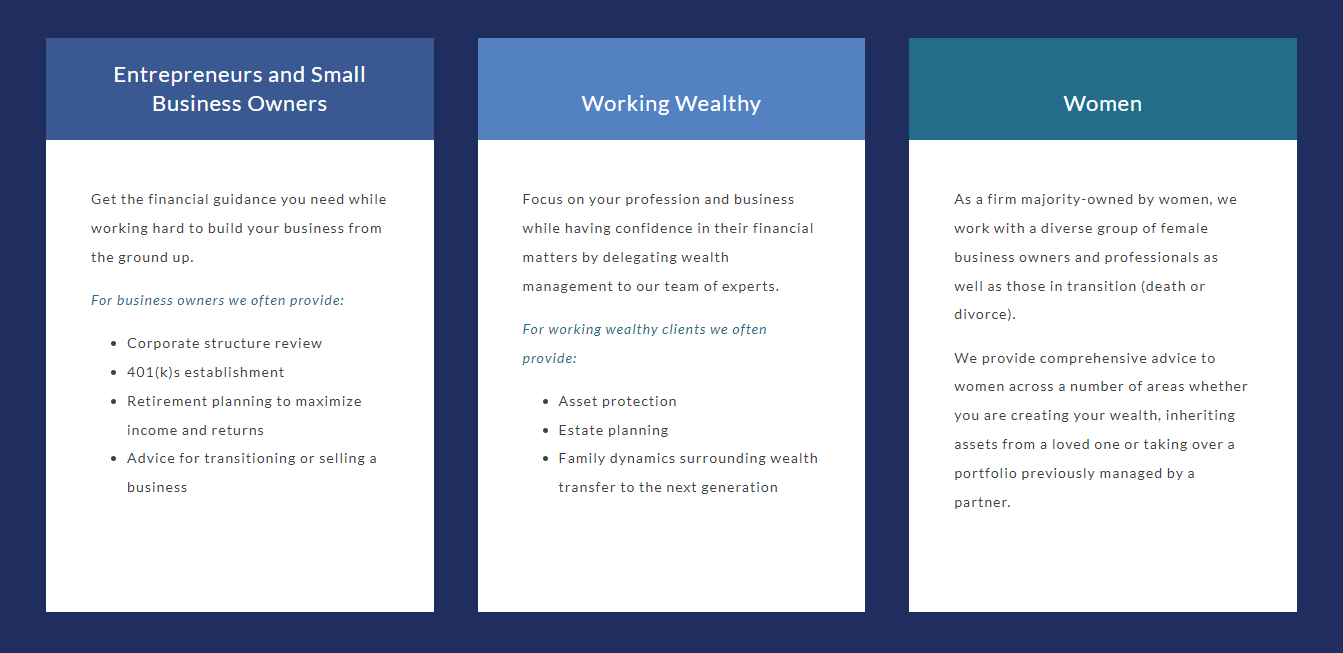

While we do not limit ourselves to these categories, organically over time our client base grew into three main groups with whom we feel we do our best work. Our three niches are Entrepreneurs and Small Business Owners, the Working Wealthy and Women. Each of these groups presents unique planning opportunities and their own unique complexities.

For an in-depth case study on the first of these groups, check out the first installment of our Weatherly Client Series.

- How often will I hear from you if I become a client?

Weatherly aims to have full reviews with clients quarterly, though we do not limit conversations to this cadence. Our team-based approach ensures that you always have access to a professional familiar with your financial picture via phone, email or dropping by the office. Depending on each individual client’s situation, we may look to increase the frequency of communication beyond quarterly. New client relationships often require a higher volume of conversation as we get to know your full financial picture, align, and implement our efforts to achieve your goals through our core competencies of investments and financial planning.

Also, life changes such as job transitions, business succession and opportunities, new children, the loss of a family member, marriage or divorce are all catalysts for more frequent communication. These events are impactful in all facets of life, but our advisors are here to lean on throughout these changes and ensure your financial world evolves to support your current situation.

- What are you and your team’s qualifications?

Under Carolyn’s leadership, Weatherly’s partners’ and team members’ commitment to education is top tier amongst local and national averages, enabling best-in-class continuity of client service. 100% of Weatherly’s staff has a minimum of a bachelor’s degree, with several team members holding post-graduate degrees. In addition, our team consists of multiple CFPs, a certified CPA, and multiple team members with industry-related subject matter specific credentials. All investment and planning-focused team members hold either a Series 65 or Series 7 license*. We lead by design in our industry for focusing on perpetual innovation, technology, mentoring, and human capital development.

Our team fosters a culture of education and evolution by prioritizing asking questions, sharing knowledge and ongoing collaboration with our clients, each other, and centers of influence in our professional community. You can read more about each team member, their background, and their qualifications on Our Team page.

- What is your investment philosophy and how do you pick positions?

Weatherly’s investment strategy focuses primarily on individual equity and fixed income securities and may use ETFs (Exchange Traded Funds) or no-load mutual funds for diversification in select sectors. We take a thematic approach to security selection, first identifying areas of potential through ongoing research and collaboration of our investment committee, then drilling down to determine specific companies where we see opportunity or risk. Our focus on individual securities lends itself to reducing overall fees a client pays in the form of expense ratios. Client portfolios typically include a mix of growth and dividend paying stocks, both domestic and international. For fixed income, we monitor yield curves for areas of opportunity and will deploy capital to maximize after-tax return while managing duration and credit risk. Fixed income investments may include Treasuries, Agencies, CDs, investment grade municipal and corporate bonds. Each client portfolio is managed to target asset allocation guidelines with flexibility to deviate plus or minus 10%.

Beyond general asset allocation guidelines, our security selection for each individual account and family aims to incorporate factors like retirement time horizon, withdrawal needs, saving rate, tax implications and business and community goals. These variables, among others, work in conjunction with your financial plan, which is monitored and adjusted as your situation evolves. Our goal is to determine the most attractive after-tax, after-fee return for you and your family, and let that factor into security selection, achieving solid long-term returns while also adapting to your risk tolerance and ongoing needs.

- How do you collaborate with my trusted professionals?

Weatherly works closely with a client’s team of professionals on all aspects of their financial life. Our team approaches planning and investment management with a broad and encompassing lens, considering estate, business, tax planning and much more. We view having a team of experts working on your behalf as essential. If you do not already have professionals in place, Weatherly taps into its network of highly qualified COIs to provide referrals that would be the best fit for your individual situation.

Given the breadth of information we gather and the intimate relationship we have with each client, our advisors are often the catalyst in development of specific strategies and can help further refine questions or simply talk through an issue before heading to your CPA (Certified Public Accountant) or attorney. We always recommend getting guidance from your trusted professionals, but it can be helpful to workshop scenarios with an advisor prior, to achieve total alignment as we work towards your goals.

- How can you help me stay on track with my goals?

Our planning model begins with a Dialogue for Impact. We believe that the value of our advice is driven by the amount we can learn about your individual situation. We appreciate the interconnectedness of life and livelihood and the dynamic nature of planning beyond just your finances. We begin with a comprehensive financial plan, considering your current situation as well as your future goals and run through multiple scenarios to determine the best options. Through quarterly update conversations with you (along with your family, and your trusted professionals as needed) we adapt the plan, provide recommendations, and implement solutions to ensure the health of your plan.

In line with planning, our team provides best practices and works directly with you, often one-on-one, setting up and maintaining healthy cybersecurity habits. Protecting your personal data is our priority, and our team employs elevated technology like our secure Weatherly portal to ensure your privacy. Our client service team is skilled in both teaching and technology to guide you along this journey.

As with most aspects of our service, we favor a comprehensive approach to planning for impact. Incorporating the next generation into ongoing dialogues can set you up for success as you age and ensure your goals and wishes are met even after your passing.

- How do you work with the next generation?

We consider working with the next generation to be a vital part of our long-term relationship and what we build together for clients as their advisor. Spanning our professional financial advice across generations can be one of the most impactful gifts you can give to both your loved ones, and your own peace of mind. Whether you are contributing to a 529 or UTMA account, helping a first-time home buyer or even ensuring clarity of your wishes in the event of a health crisis or your passing, our team is here to help.

To assist with this, as part of our onboarding, Weatherly has each client fill out what we call a CIRAL (Client Information Release Authorization Letter). This document helps our team support you and your loved ones in times of transition by indicating your team of trusted professionals, family members, and emergency contact and giving Weatherly permission to communicate with them on your behalf if it is in your best interest to do so.

Final Thoughts

Armed with these questions, you can enter a discussion with your advisor at Weatherly knowing that you will have all the answers you require on your side and the knowledge that you have us in your corner through all of life’s evolutions. Change is constant, but you can rest assured with Weatherly as a resource to help you outline optimal choices, detail benefits and drawbacks and help you make informed decisions as you enter new stages of life. Our team utilizes data, tax and legal guidance and innovative technology to ensure your path forward is the right one for you, your family, business, and community.

If you are still deciding to seek professional financial advice, it can feel like a big decision, yet considering these options can help ensure you are aligned with your chosen team. At Weatherly, we aim to inspire that confidence and foster transparency and alignment through the work we do with each of our clients so they may go on to achieve a positive impact on their families, businesses, and communities.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

*updated 2024