Why You Should Medi-Care About Social Security

Stone Churby, M.S., Wealth Management Associate | Chase Hayhurst, CFP®, Senior Wealth Management Advisor | August 24, 2023

For those in or approaching retirement, cash flow and healthcare planning remain a top priority, and understanding the resources available is essential to developing a successful financial plan. Social Security (SS) benefits help retirees supplement cash flows and in turn, the withdrawal rate on their portfolio. Social Security can also provide benefits for individuals that cannot work due to disability or injury. Individuals become eligible for SS benefits by having 10 years of work history in which payroll taxes are collected and may draw on their retirement benefits beginning at age 62. While this is the most common way to meet SS eligibility requirements, there are a few alternatives to obtain benefits that we’ll expand on later.

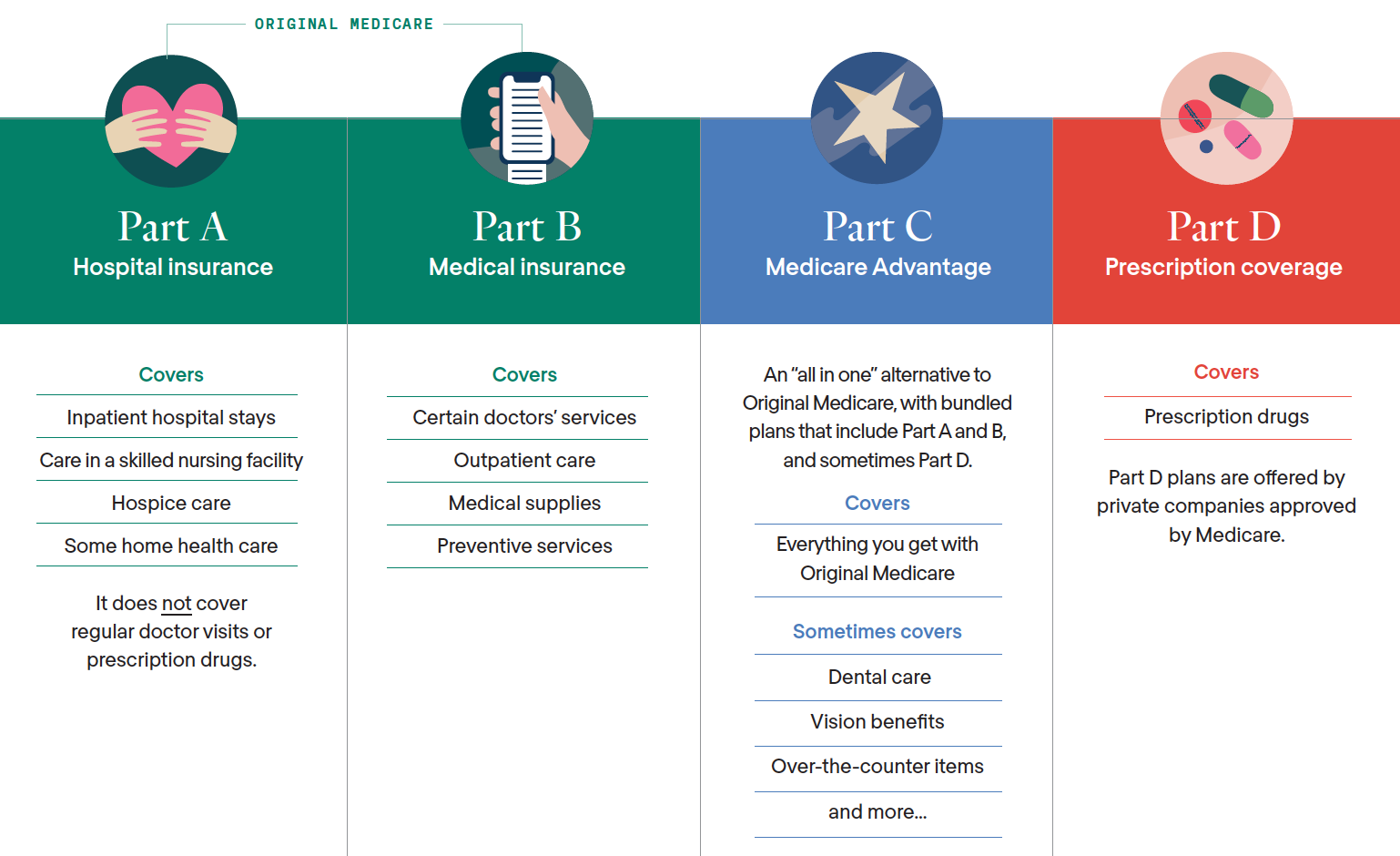

Medicare is another program offered by the federal government, providing healthcare coverage for those aged 65 or older and individuals with disabilities. The Medicare program features four parts, Part A-D, each providing a different aspect of coverage. Eligibility for Medicare coverage is determined by one’s eligibility for Social Security and enrolling in Medicare can begin three months prior to an individual turning 65 and will be automatically enrolled in Medicare Part A & B.

Social Security

Social Security benefits are primarily based upon the age at which benefits begin and the individual’s historical wages. Taxation of SS benefits can range between 0%- 85% and is based upon the individual/couple’s income each year. For those not yet receiving benefits you can look up projected benefits on SSA website here. Individuals that do not qualify for their own retirement benefit or have minimal earnings history may still be entitled to receive benefits.

Access to Benefits

- A non-working spouse may be eligible for spousal benefits up to 50% of their partner’s full retirement age (FRA) if age requirements are met.

- Divorced individuals may be entitled to 50% of their former partner’s benefit if married for at least 10 years, divorced for more than 2 years, and are unmarried.

- Surviving spouses may receive reduced benefits beginning at age 60 while retaining the ability to claim their own benefit at a later date, if eligible. Surviving spouses are also entitled to receive their former spouses benefit if higher than their own.

- Minor children may be entitled to a percentage of their parent’s benefits in certain circumstances.

- Individuals may be eligible for Disability and Supplemental Social Security benefits depending on needs, income and resources.

Before filing for Social Security benefits, it’s important to take inventory of your cash flow and needs to supplement income. According to the Social Security Administration, Social Security makes up 33% of an individual’s post-retirement monthly income. One of the biggest questions with Social Security is when to take it, however, there is no one-size-fits-all answer and ultimately depends on each individual/couple’s financial situation. This highlights the need for proper planning that incorporates a cost-benefit analysis on the timing to collect benefits. Individuals are entitled to an 8% simple increase in benefits for each year benefits are delayed past their FRA up to age 70. Weatherly can help highlight the pros and cons as to whether claiming benefits prior to or after obtaining their FRA is beneficial.

SS benefits are funded through the Social Security Trust that is overseen by the federal government. The future of Social Security has been a contested topic as recent projections have the fund being depleted in 2033. To help address this shortfall it is likely that changes will need to be made with regards to taxation of earnings, extending the FRA or reduction in benefits. Weatherly understands the importance of Social Security, and our ultimate goal is to maximize benefits for you.

Medicare

Healthcare expenses during retirement can become one of the largest costs and highlights the need for proper planning. Medicare provides healthcare coverage for individuals starting at age 65 along with additional coverage for those with extenuating health circumstances. Medicare covers a variety of care needs such as prescription drugs, in-patient treatment, out-patient treatment, and various types of hospital care.

While employed an individuals’ healthcare coverage is often provided through their employer and retiring before age 65 can create a lapse in coverage if COBRA or alternative insurance is unavailable. Certain life events may qualify an individual for a Special Enrollment Period (SEP) such as losing health coverage, having a child and getting married to name a few. A lapse in healthcare coverage can be supplemented by public marketplace insurance, private insurance, COBRA, or spousal coverage.

Medicare coverage is broken up into four parts, A-D. Parts A & B cover hospital visits, routine check-ups, and medical equipment, among other things. You are not automatically enrolled in parts C & D which provide different types of coverage. Part D provides prescription drug coverage in addition to what is already provided. Part C, known as Medicare Advantage, is an additional option that can enhance your Medicare coverage. Medicare Advantage allows you to utilize a private company for health coverage and these plans usually come bundled with parts A, B and D.

Source: HiOscar.com

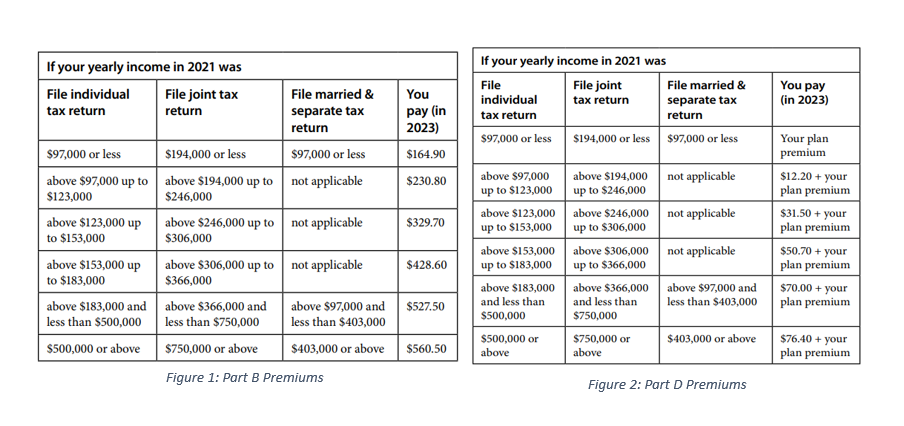

Premiums for the different parts of Medicare are based upon your taxable income and subject to a 2-year lookback.

Important Considerations

Social Security and Medicare can be a confusing process to navigate. Weatherly is here to help guide you through your unique situation and we’ve outlined a few common considerations to be aware of.

Spousal Benefits: It is not uncommon to see spouses, especially ex-spouses, not realize the full benefit they are entitled to. As a spouse, you can claim a Social Security benefit based on your own earnings record or collect a spousal benefit in the amount up to 50% of your spouse’s Social Security benefit, but not both. You are automatically entitled to receive whichever amount is higher.

Windfall Elimination Period: The Windall Elimination Period can reduce Social Security benefits for individuals participating in pension that did not pay SS taxes. WEP can reduce benefits by up to 50%.

Registration Window: The registration window for Medicare begins three months leading up to your 65th birthday and three months following. It is important to register in the window to avoid late penalties.

IRMAA Premiums: Single filers with income above $97,000 and joint filers with income above $194,000 are subject to increased premiums for Part B & D.

Returning to Work: A decision to return to work may not always be financially motivated. It is key to understand the implications of how returning to work can affect your Social Security benefits that are currently being received. For those individuals, they may experience a withholding of benefits prior to their FRA but will be recaptured once FRA is reached. Before returning to work, we recommend reaching out to SSA to understand the implications for your benefits.

Wrap Up

Social Security and Medicare are essential aspects of post-retirement income and healthcare coverage. Weatherly can help analyze the options available to you and ultimately what is most beneficial for your unique situation. This analysis expands beyond a breakeven analysis of total benefits received to include, but not limited to, cash flow needs, health history, family longevity, and type of portfolio assets available. Roth conversions during gap years may provide an opportunity to help reduce taxes over time and enhance legacy planning for those beneficiaries. Your trusted Weatherly advisors are here to educate and guide you through these complexities to help achieve the goals for you and your family.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.