The Wide World of Commodities

Marty Rascon, CFA, Wealth Management Associate Advisor | Brooke Boone Kelly, CFP®, MACC, Wealth Management Advisor, Partner | September 11, 2025

Every time you fill up your gas tank, flip on the light switch, or check your email on your smartphone you are directly interacting with the world of commodities. Commodities are the essential raw goods and materials that are the center of virtually every aspect of our daily lives. But what exactly constitutes a commodity and why do they play such a crucial role in our everyday lives and in the global economy? In this blog post, we introduce the world of commodities by defining the major categories, providing historical background, and exploring the current state of the market to better understand the dynamics impacting everyday life.

Defining Commodities:

Within the world of commodities, there are three main broad categories which include agriculture, energy, and metals. Within each category we can dive deeper into subcategories that we probably interact with daily. Below we provide some examples of items that make up each category, but please note this is not an exhaustive list:

Agricultural Commodities:

Agricultural commodities are the raw materials primarily derived from farming, ranching, or other agricultural activities. These items are produced for trade or consumption and are often inputs to other goods and products. Some examples of agricultural items include:

- Seed Oils: canola oil, soybean oil, olive oil

- Cereal Grains: wheat, corn, rice, oats

- Livestock: cattle, poultry, pork

- Dairy: milk, butter, cheese

- Soft Commodities: cocoa, coffee, sugar

Energy:

Energy commodities consist of fuels and natural resources used to produce energy and power transportation, industry, and various aspects of modern day-to-day life. Energy is perhaps one of the most important commodities because the cost of energy directly affects the cost of virtually everything we consume from groceries, consumer electronics, clothes and more. This type of commodity can be broadly defined using two categories – renewable and non-renewable energy. Some examples include:

- Non-Renewable Energy: natural gas: coal, nuclear energy, petroleum products

- Renewable Energy: solar, geothermal, wind, hydropower

Metals:

Metals are another important category of the commodities sector and consist of raw materials harvested from the Earth that serve a variety of purposes from industrial production, construction, and as inputs to electronic devices. This sector has become more important recently with the focus on electric vehicles and the rise of AI which has in turn increased demand for what are referred to as rare earth metals. Metals can be divided into two broad categories:

- Precious Metals: gold, silver, platinum, iridium

- Industrial Metals: copper, aluminum, nickel, lead, rare earth metals

With the importance commodities play in our everyday lives, it is important to reflect on the impact commodities have had on the human experience historically, which can help us better understand today’s world.

History:

Agricultural Commodities:

The human species is and for much of our history we have operated as nomadic hunter gatherers – scavenging in the wild for various plants and animals while rarely staying in one place. The earliest signs of agricultural production dates to 11,000 BCE when a slow transition away from the hunter gather lifestyle took place and is believed to have occurred independently in areas such as northern China, Central America, and the Fertile Crescent. By 6,000 BCE most animals that we are familiar with today had been domesticated and used as livestock, and by 5,000 BCE there was evidence of farming on all the continents except for Australia.

Agricultural production was largely localized at the beginning, but as time progressed early civilizations began venturing out to discover other parts of the world and trade amongst each other. Early signs of agricultural trade can be seen through Mesopotamia and Ancient Egypt, Mediterranean civilizations such as the Phoenicians and Greece, and even amongst ancient Polynesians and Pacific Islanders over vast distances. More formalized agricultural markets were later developed by the Romans and Medieval England, especially for grains. The discovery of North America led to a whole new world of agricultural products in abundance such as maize (corn), tobacco, peppers, pineapple, papaya, avocados, cacao (chocolate) and more. With the discovery of these new crops, conflicts arose amongst the great powers of the time, namely England, Spain, Portugal, and France.

Jumping forward in history, a transformative period took place in the United States that would dramatically change the commodities markets with the establishment of the Chicago Board of Trade (CBOT) in 1848. With the CBOT, the first futures contracts for crops were established. These contracts allowed farmers and merchants to establish predictable prices for their crops and hedge against price risk. Futures contracts would go on to include a wide variety of products and would help establish a more predictable and stable global trade environment, a system that we use to this very day. Lastly, during the 20th century came technological advancements that boosted the production of agriculture worldwide, especially with the invention of fertilizers, and would lead to lower prices and increased food security worldwide.

Image Source: https://blog.ampglobal.com/history-of-futures

Energy/Oil Production:

Energy production as we know it today is a relatively new phenomenon in the context of human history. It was not until the 18th century, with the invention of the steam engine, that modern energy use as we know it today was created. At the time, coal was the primary input for energy production, which would lead to radical changes in transportation and help pave the way for the industrial revolution. As time went on coal became an environmental concern and alternative sources of energy were sought out, leading to the eventual shift from coal to oil.

The first evidence of oil discovery goes back to 600 BCE in China where oil was transported in pipelines made of bamboo. However, real commercial use of the substance originated in the United States in the mid 1800’s and early 1900’s with the discovery of oil in Pennsylvania and later in Texas with the first formal oil well being established by the Rock Oil Company in Titusville, Pennsylvania. Petroleum would prove to be much more flexible and adaptable than coal and other forms of oils such as whale oil. As technology advanced with the invention of cars and the light bulb, oil became the preferred energy source and demand exploded. During World War I, oil would become one of the most valuable commodities in the world, proving itself not only as an important source of energy but as a critical military asset, incentivizing regions around the world to develop their own supplies.

One of the most transformative moments for the oil industry came in 1938 with the discovery of oil in Saudi Arabia and surrounding areas. At the onset of the discovery, colonial powers such as England attempted to assert control of oil production in the region but were eventually pushed out for both economic and geopolitical reasons, leading to home countries taking control of production. To signify their authority, in 1960 the Organization of the Petroleum Exporting Countries, or OPEC, was established and includes countries such as Iran, Iraq, Kuwait, Saudi Arabia and others. OPEC was established to coordinate oil production between the member countries and to this day collectively influences oil prices and continues to be a major geo-political player.

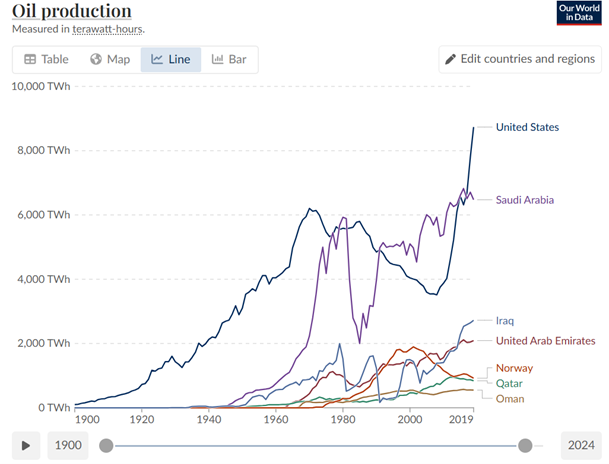

In terms of oil production, historically speaking, the United States has been the dominant producer for decades but over the years other countries such as Saudi Arabia have competed for the lead.

Chart Source: https://ektinteractive.com/history-of-oil/

Although oil remains the dominant source of energy, new sources of energy harvesting have been coming online in recent years as technology has advanced. Examples include solar, wind, hydropower, and geothermal power. Additionally, although not necessarily new, recent developments such as the rise of artificial intelligence has breathed new life into nuclear energy production as a form of clean energy.

Metals:

Metals have played an integral role in human history so much so that entire eras are associated with them, for example, the stone age, bronze age, and iron age. One of the first metals discovered and used by humans around 9000 BCE was copper. Metals such as gold, silver, tin, lead, and iron were also used in pre-historic times. At first, metals were primarily used as tools for farming, in pottery, and as weapons but as time went on and metal working techniques advanced, they became integral in constructing structures and fortifications. Additionally, precious metals such as gold and silver were widely used as currency and stores of value which continues to this day. In fact, the first evidence of precious metals being used as currency go back to 600 BCE in modern day Turkey with round coins made of silver. While gold and silver remain widely recognized as some of the most valuable metals around, in today’s industrial world, there is perhaps no metal more important that steel which is the bedrock of modern-day society and is one of the most traded commodities.

The evolution of the steel industry traces its roots back to Ancient India and China where rudimentary steel making began. India and China are also responsible for beginning what would later become a global industry by initiating trade in the ancient world with evidence of steel swords in Damascus having originated in India, and Romans referring to China as the best source of steel in the world. Early on, much of the demand for steel was driven by warfare with imperial armies in Greece, Persia, Rome, and China prioritizing the metal for its strong and durable properties.

For many centuries, steel was considered a luxury or a niche metal, but that all changed as the 18th and 19th century saw rise to the industrial revolution with steel being preferred for various products and structures from tools, pipes, and bridges. Later, new techniques were established in England that would allow for the mass production of steel at competitive prices, giving rise to skyscrapers and transitioning ships from iron. England was the predominant producer of steel in the world until the late 19th century when America overtook them largely attributed to Andrew Carnegie and the Carnegie Steel Company. During the 20th century with the outbreak of World War I and World War II, steel would become a critical military asset used in the production of a wide variety of equipment, especially tanks. Following the end of World War II, steel production would pivot from military applications to consumer products and infrastructure. Steel would also bring nations together in economic alliances with a famous example occurring in the 1950’s with the establishment of the European Coal and Steel Community (ECSC) which at the time included West Germany, France, and Italy. The ECSC was developed to promote free movement of products within Europe and would set the stage for the eventual creation of the European Union.

The steel industry would go on to evolve dramatically in terms of production. According to the World Steel Organization, in 1967 the US, Western Europe, and Japan accounted for 61.9% of global steel production. However, with the rise of emerging economies, by 2000 the share of steel production in the US, Europe, and Japan fell to 43.8% and by 2011, emerging economies accounted for 70% of steel production with China representing 45% of production globally. This shift was mainly due to these emerging economies industrializing and building out infrastructure and is expected to continue with increased development in Southeast Asia, the Middle East, and North Africa.

Image Source: https://www.ironworkers477.org/news-details/webview/history/single/16722

The history of commodities provides us with the context we need to understand where commodities come from, how markets have evolved, and helps us to understand the world around us. The state of the commodities markets is continually evolving, and we will explore general trends to be aware of moving forward.

Commodity Trends in 2025:

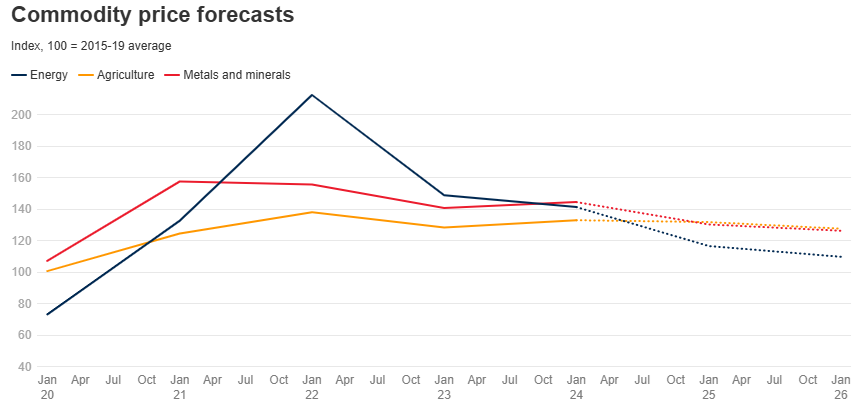

There is no shortage of news revolving around trade negotiations, geopolitical tensions, and changing market dynamics in 2025. Given these changing dynamics it is important to highlight new trends and forecasts within the world of commodities. Within this section we explore these changes as provided by the April 2025 Commodity Markets Outlook developed by the World Bank Group. Please note these outlooks do not necessarily reflect Weatherly’s views.

Chart Source: https://blogs.worldbank.org/en/developmenttalk/the-commodity-markets-outlook-in-eight-charts1

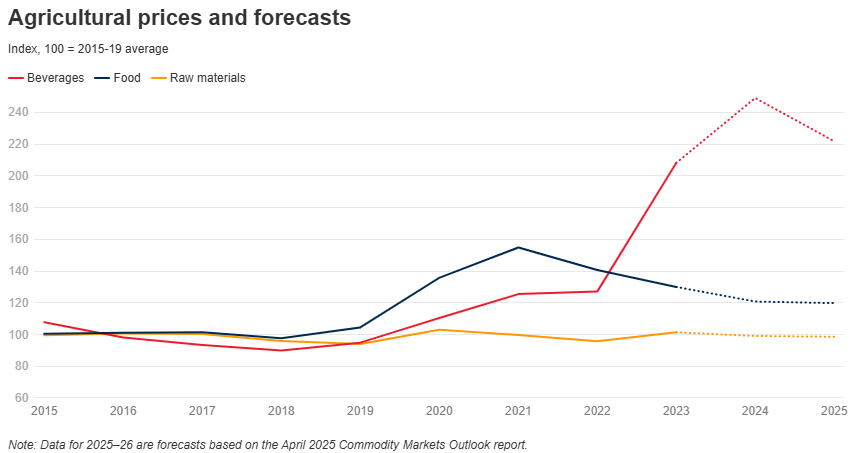

Agriculture:

Agricultural commodity prices are mostly expected to fall in 2025 and 2026 stemming from a variety of factors. First, there is ample supply and improving harvests amongst items such as maize (corn), wheat, rice, and soybeans with easing trade restrictions, for example with rice exports from India. However, items such as cocoa and coffee have seen their prices increase mainly due to the impacts of weather in areas such as Brazil and West Africa, which are widely expected to subside going into 2026. As a result, speaking on the industry more broadly, farmers are seeing prices for their crops fall just as the input costs to produce those crops have increased. The main area of concern is the increased cost of fertilizers where prices have remained volatile due to supply disruptions stemming from geopolitical tensions. Other factors like slowing global growth and uncertainty regarding trade policy are also forecasted to push commodity prices lower.

Chart Source: https://blogs.worldbank.org/en/developmenttalk/the-commodity-markets-outlook-in-eight-charts1

Energy:

Within the energy sector, prices are also expected to fall in 2025 and 2026. The World Bank reports cites that the forecasted average price per barrel of brent crude will hover around $64/barrel in 2025 and $60/barrel in 2026. One of the trends effecting this drop in price stems from increased production among OPEC+ countries along with increased production from other countries including Brazil and Canada. This increase in supply is coming at a time of uncertainty for the global economy as the forecast is for slower growth moving forward. Other factors effecting the price of oil include the electrification of cars, a drop in demand from China, and the expansion of renewable energy sources.

Metals:

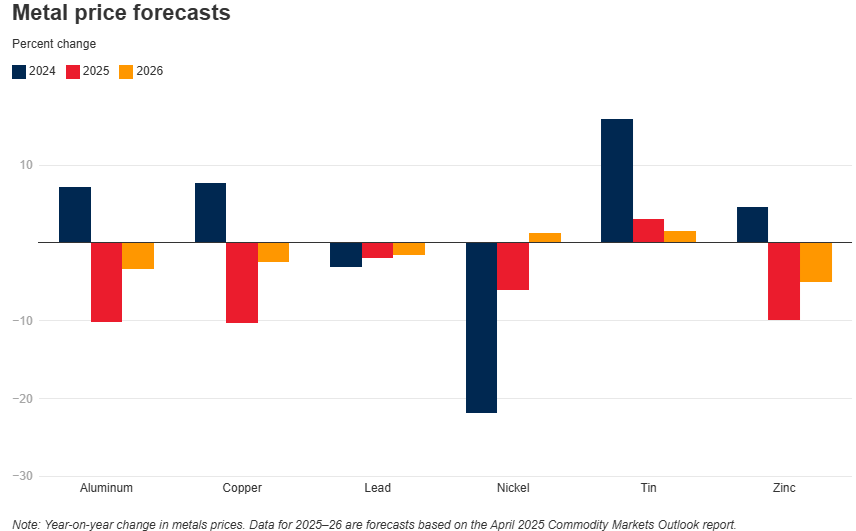

Prices for metals are also expected to decline in 2025 and 2026 after a modest increase in 2024. Some of the same themes that are playing out in the energy and agricultural markets are also present in the metals sector, such as the forecast for slower global growth. For metals, this is especially notable in China as demand there is expected to decline due to weakness in their real estate sector, a slowdown of domestic demand in China, along with uncertainty in trade policies. More broadly, the World Bank cites a slowdown in industrial activity and manufacturing worldwide as a cause of the drop in prices. However, with the increase in electric car demand, the rise of AI utilization, and other advanced technologies, the demand for what are referred to as rare earth metals is projected to rise significantly in 2025. Some of these rare earth metals include materials such as neodymium, dysprosium, and praseodymium.

Chart Source: https://blogs.worldbank.org/en/developmenttalk/the-commodity-markets-outlook-in-eight-charts1

Risks:

We would like to note that there are risks to this forecast provided by the World Bank. Risks include changing trade policies, increased geopolitical tensions, and changes in the global economy. Although prices are forecasted to fall, we would note that the dynamic nature of the global economy can alter these forecasts moving forward.

Commodities and Your Portfolio

With no shortage of news worldwide, whether that be ongoing trade negotiations, tariff impacts, or geopolitical tensions, Weatherly continuously monitors how these events will impact client portfolios. Our team of investment professionals are working closely with clients to ensure that their portfolio’s asset allocation levels are in-line with their financial goals and overall risk tolerance while also implementing proper diversification across client accounts. We continue to monitor which sectors of the economy may be affected by changes in policy and changing economic trends. Additionally, we continue to leverage our experience with holistic financial planning to assist our clients with developing a road map for their future while implementing stress tests and alternative scenarios to provide our clients with options and peace of mind. Our team is here to serve you and discuss your portfolio and help you establish a sound plan to navigate the ever-changing landscape of the investment world.

Sources:

https://ektinteractive.com/history-of-oil/

https://farms.extension.wisc.edu/articles/a-brief-history-of-grain-markets/

https://foodsystemprimer.org/production/history-of-agriculture

https://worldsteel.org/about-steel/steel-story/#steel-industry-today-and-future-developments

https://blogs.worldbank.org/en/developmenttalk/the-commodity-markets-outlook-in-eight-charts1

https://humanorigins.si.edu/evidence/human-fossils/species/homo-sapiens

*Disclosures:* The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Blog content is human-generated by the Weatherly team members. AI was used to assist with generating titles and subtitles.