Should I Stay or Should I Go – Relocating for Retirement

Stone Churby, M.S. Wealth Management Associate | Chase Hayhurst, CFP®, Senior Wealth Management Advisor | May 22, 2025

You’ve worked your whole life for this moment, retirement, it’s now the time for you to enjoy the fruits of your labor. This new phase of your life allows you to spend more time with loved ones, travelling, and developing passions outside of your business and career. As you prioritize your needs and wants in retirement, a move to a new state may be an option that you explore. If a move to a new state is in your future, there are many variables to consider beyond the basic costs of living.

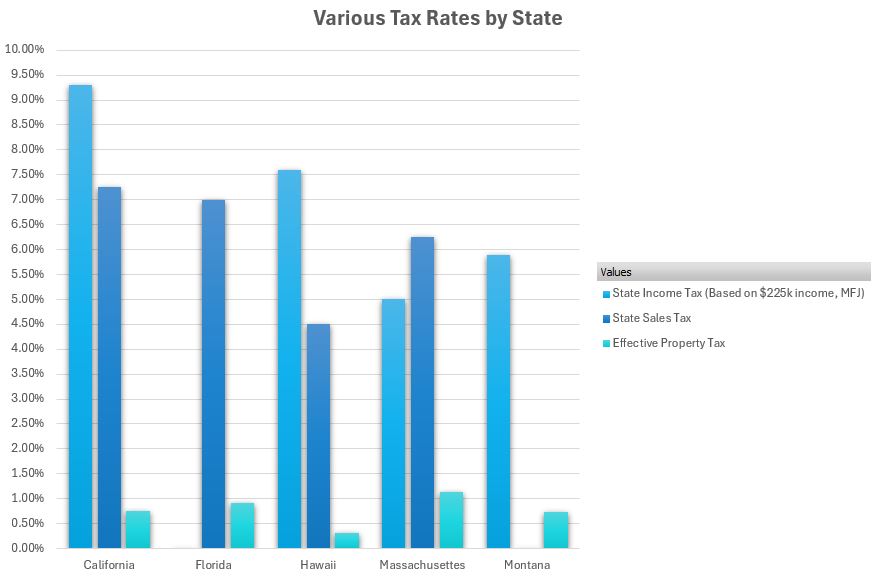

Often times, one of the first financial considerations that comes to mind when moving to a new state is income tax rates. This can have a varying degree of impact based on the individual’s income and wealth profile. Other factors such as sales tax, property tax, and insurance costs may outweigh the benefits of lower income tax. Additionally, retirement income such as social security, pensions and deferred compensation may be exempt or taxed differently from other income sources and should be reviewed with a tax professional regarding your specific situation. While these factors will have both short and long-term implications, it is an ideal time to make sure that your financial plan explores these scenarios for long-term success.

Data Sourced from the Tax Foundation & Rocket Mortgage

Maintaining a Residence

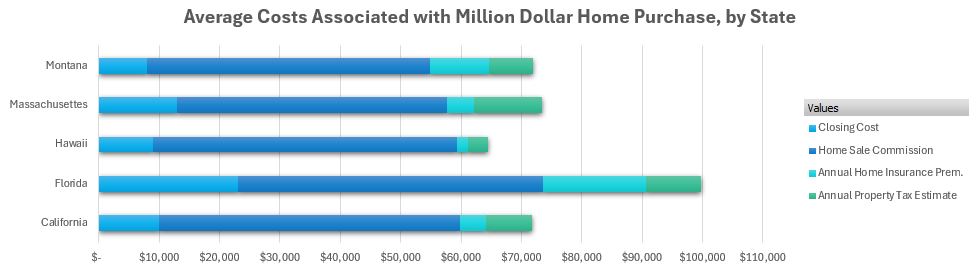

Moving to a new state may also involve a home sale and/or purchase. It is important to be aware of the various tax implications and costs that may come with the sale. The closing costs can vary greatly from state-to-state and may range from about 1% in Hawaii, to over 5% in Delaware, in addition to the agent commission that ranges from 5-6%. These expenses can add up and erode your net proceeds of the sale and should be properly accounted for if you plan to use this for a down payment or retirement planning.

Data Sourced from Bankrate & Insurance.com

While property taxes differ from state to state they may also be subject to change due to a move intra-state. These rates can vary greatly across the US with effective rates ranging from 0.3-2.2%. Another important factor that can have material impacts to costs over time is whether the state has property tax caps or not. These caps can apply to assessment, rate or levy limits. States with assessment caps will limit how much your property value can increase from one year to the next. For example, an assessment limit might not allow your home’s assessment to increase say over 2% even if the market value increases by 10%. Rate caps will help limit your tax bill from increasing if there hasn’t been any change in your property’s assessment. States like California also have legislation that may allow you to transfer your property tax base from one property to another. Lastly, levy limits cap how much property tax revenue a government can collect and usually refers to all revenue and not just revenue from one property.

As the true costs of moving continue to materialize, insuring your home can be one of the largest challenges. States like Florida, Nebraska, and Louisiana experience increased costs as well as insurance scarcity due to the frequency of natural disasters. We have seen a recent increase in insurance carriers cancelling coverage in California and Florida, driving up costs for consumers.

Maintaining two residences is an additional option that comes with some nuances. If maintaining two residences, it must be clear what state you are a resident of. While residing in California for 183 days of the year will qualify you as a resident, Oregon and Hawaii use 200 days. When leaving one state for another, you may be the target for an audit. Historically, the state of California has audited utility and credit card bills to determine the standing of your residence. Additionally, two residences may also require you to file a non-resident state tax return.

Estate, Asset Protection and Business Planning

After a move to a new state is complete, it’s important to acknowledge the potential changes in estate planning laws. States such as Washington and Hawaii impose estate taxes up to 20% and exemptions that are significantly lower than the federal exemption of $13.99 million per individual or $27.98 million per married couple. A move from a common law state to a community property state can also change the characterization of your assets, earnings, and contributions. A move to a new state should also invite a review of your will, trust, and any healthcare directives. Healthcare POAs and Durable POAs should be updated to ensure legal validity and no lapse in care.

For individuals or families who own a business, there are a variety of other considerations that should be explored before a move. From a legal perspective, registering your business in a new state, licenses or permits may need to be required depending on the location and industry, and employment laws will need to be addressed with your legal professional. Financial considerations such as taxation, insurance, utilities, along with operational costs surrounding customer base, supply chains and availability of employees are other factors that may need to be explored. A move or sale to a new state may cause the business to experience revenue clawback, especially for business owners leaving the state of California. These could include enterprise or opportunity zone credits, forgivable loans that may become payable, or capital investment credits, to name a few.

Healthcare Costs & Accessibility

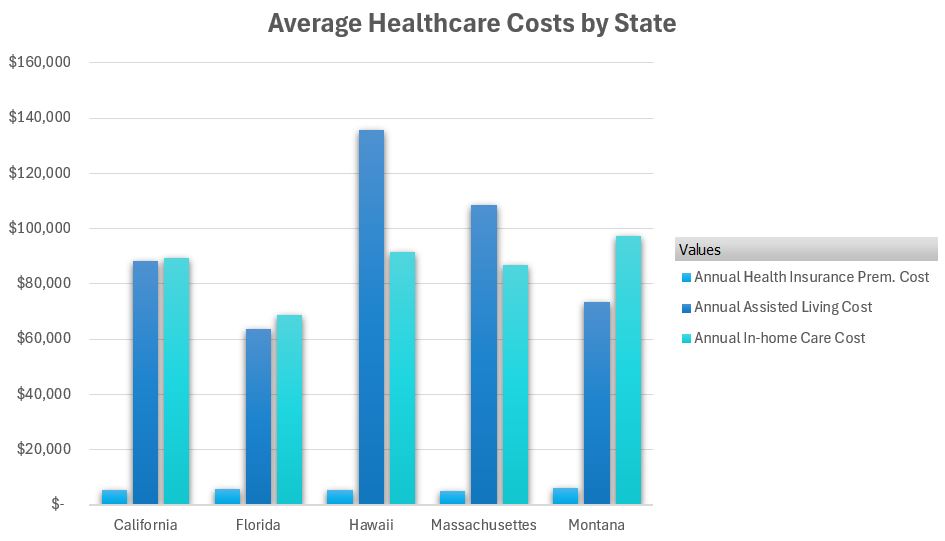

Moving to a new area also comes with an adjustment to the lifestyle, culture, and resources. A move to a quieter, less populated area can come with a decrease in medical resources and care for aging individuals. Medical care can become one of the largest expenses for individuals as they age, understanding where the care is coming from and the potential cost is crucial to peace of mind during retirement. Individuals may also choose to purchase health insurance from the marketplace in addition to Medicare coverage. While more expensive, marketplace insurance can provide flexibility and specificity to your healthcare needs. Aging individuals may choose to pay for a healthcare concierge. The service allows for a more personalized approach to your medical care and offers a direct line of communication between you and the doctor.

Data sourced from CareScout and KFF.org

Conclusion

You’ve worked hard for your retirement and prioritizing your health, family and comfort in this next phase of your life is crucial. Moving to a new state may help bring you closer to loved ones or enhance your way of life but is an important decision that should be fully vetted ahead of time. Weatherly alongside your other trusted professionals should be leaned on to help you answer the financial considerations that we have explored in this blog leaving you to live a life that you’ve always dreamed of.

Additional Reading:

https://taxfoundation.org/data/all/state/state-income-tax-rates/https://taxfoundation.org/data/all/state/property-taxes-by-state-county/https://www.kiplinger.com/retirement/601819/states-that-wont-tax-your-pensionhttps://www.kiplinger.com/taxes/property-tax-cap-by-state

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.