The TCJA that was signed into law on December 22, 2017 made significant changes to the tax code. The changes were broad and sweeping which leads to questions about what changed and what we can do to mitigate taxes under a new code. While the increase in the Standard Deduction has some individuals moving away from itemizing, there are still ways to decrease tax liability with “above-the-line” deductions, business and charitable planning and investment strategies. Our Key Data Chart outlines the main figures to focus on for tax planning. Read on to see our Top 5 strategies that might make a positive impact on your tax situation.

![]()

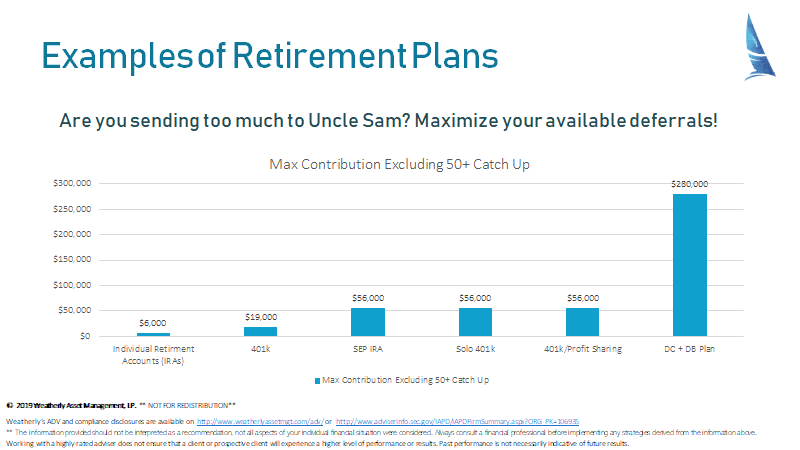

The What: Retirement plan contributions, an above-the-line deduction

The How: The most common way to reduce taxable income is a contribution to an eligible retirement account. This strategy is beneficial for two reasons – you can lower your tax bill now and access tax-deferred growth for the future.

This chart highlights the allowable deferrable amounts for various types of retirement plans, depending on your business structure and compensation. These contributions are “above-the-line” and directly reduce your Adjusted Gross Income (AGI), even if you are not itemizing deductions on Schedule A.

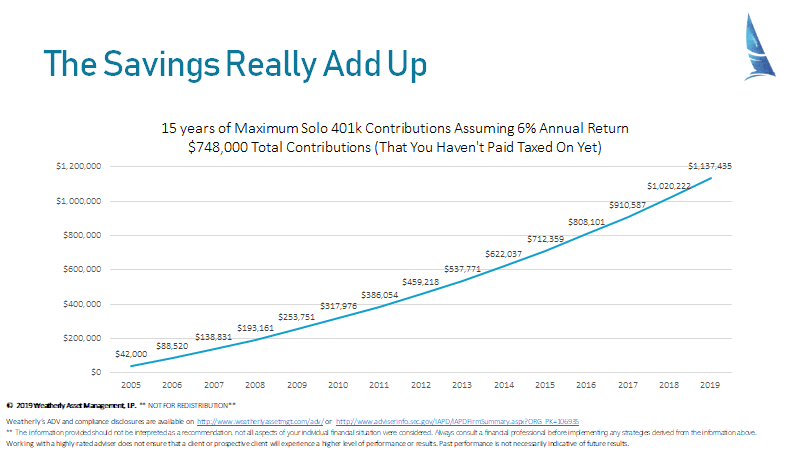

Retirement plan contributions not only reduce your taxes now, but also grow tax-deferred until you are required to take a distribution (RMD) at age 70.5. This graph notes the benefits of tax-deferred growth.

![]()

The What: Business structure, how the change in tax rates can impact your deductions

The How: C corps and qualified pass-through entities, including sole proprietorships, partnerships, S corps and LLCs benefit from the TCJA. C corps saw a reduction in tax rates from 35% to a flat 21%; pass-through entities with qualified business income are able to take a 20% tax deduction.

We’ve been encouraging our clients with business income of any sort to consult with their CPA on what business structure is appropriate for them and eligibility for the deduction. Similar to above-the-line contributions, you can take the 20% tax deduction, even if you aren’t itemizing under the new tax law.

![]()

The What: Charitable deductions, QCDs and bunching donations

The How: If you are over age 70.5, own a retirement account and are taking a Required Minimum Distribution, consider a Qualified Charitable Distribution. You are able to donate directly from an IRA up to $100,000/year. These donations are not included in taxable income on your 1040 and offer a tax benefit, even if you aren’t itemizing.

If you have a larger than usual tax year, consider “bunching” charitable donations to maximize your Schedule A deductions. With the TCJA reform, we’re seeing more individuals utilizing the standard deduction over itemizing. We’ve reviewed frontloading charitable funds on our blog, along with the advantages of donating stock and QCDs.

![]()

The What: Taking advantage of “gap years” with low income

The How: Financial planning is a tool most often used to visualize a path to retirement, but these plans are also helpful in identifying when you might have “gap years” of income in retirement. If you have a couple of years between retirement and collecting Social Security or RMDs, you might be able to take advantage of strategies like Roth IRA Conversions or even an IRA withdrawal to a taxable account. You might benefit your future self by removing assets from a Traditional or Rollover IRA in years when the tax rates are lower due to the TCJA versus having a higher RMD in later years when tax rates are less certain.

![]()

The What: Investing, utilizing tax-efficient stocks and bonds to maximize returns

The How: Although tax rates are lower, the limitation of itemized deductions, particularly in high tax states, makes tax-efficient investing even more attractive. Weatherly primarily utilizes individual stocks and bonds in our investment portfolios. Municipal bonds remain attractive, paying tax-free income at the federal level, and depending on the state of issuance and where you live, the income may be tax-free on your state return too. Qualified dividends and capital gains are taxed at a more favorable rate, and even in some of the “gap years” identified above we’ve seen individuals fall into the 0% bracket – you can offload low basis stock without the tax burden if planned appropriately.

Investment Management Fees and Tax Deduction

Prior to the TCJA, investment management and professional fees were tax deductible if they exceeded 2% of AGI. You can still pay investment management fees, as applicable, from a Traditional or Rollover IRA. This is a tax-free “withdrawal” which can help lower RMD impact in the future.

Some states conform to the TCJA at the federal level, mirroring the itemized deduction schedule. Others, like California, do not adhere to conformity and may still allow for deduction of investment management fees on your state return. You can check here or ask your CPA what you are eligible for at the state level.

Resources:

https://www.fidelity.com/viewpoints/personal-finance/taking-tax-deductions

https://www.nerdwallet.com/blog/taxes/pass-through-income-tax-deduction/

https://www.taxdebthelp.com/blog/pass-through-tax-deduction

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Carolyn Taylor represented Weatherly in an Advisors Magazine article focused on financial education and individualized portfolio management. “Using Real-World Scenarios to Educate Clients – Tailoring Examples to Personal Situations” was published in the January 2019 issue of Advisors Magazine. Please click here to read the full article.

With more than 35 years of portfolio management experience, Carolyn was asked by Advisors Magazine to provide her perspective on how she and her team use real-life scenarios and practical language to ensure that clients have a clear understanding of their investments and the firm’s overall approach to portfolio management.

The interview process was Q&A style focusing on financial literacy, education, overall financial planning and fiduciary standards. Interview questions were provided to Weatherly in advance. After the interview process, Weatherly had the opportunity to review drafted language proposed by the author and confirm accuracy of quotes prior to approval for publication.

It is not the intent of the article to endorse the participating businesses or to indicate quality. There was no fee to be interviewed for the article, and Weatherly was not required to advertise in (or subscribe to) Advisors Magazine. Weatherly opted to pay for a one-page published article based on the interview which included a high-resolution PDF reprint, one hard copy, unlimited digital magazine downloads, a direct link to the page location in the digital magazine and external audio and video links to books, podcasts, videos, and other professional resources.

No organizational memberships were required of the Firm or individuals. Inclusion in this article is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of inclusion in this article.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit: http://www.adviserinfo.sec.gov/IAPD/IAPDFirmSummary.aspx?ORG_PK=106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Aubrey joined the Weatherly team in 2019 to expand upon the Firm’s high-quality level of client support and financial planning services. His responsibilities include relationship management, research and analyses related to financial planning, charitable related workflows, and core investment management initiatives.

Aubrey’s prior 5 years of experience in the financial services industry provided opportunities to develop his skill set in financial planning, client service, insurance analysis, and business development.

Aubrey earned his Bachelor of Business Administration with a concentration in Finance and International Business from Gonzaga University in 2014. At Gonzaga, he played for the Men’s soccer team and worked as a lifeguard/swim instructor at the local YMCA. He was involved in the University’s Bulldog Investment Group ee and along with other Gonzaga students, he volunteered as a mentor for junior high school students at an on-campus chapel. In 2020, Aubrey completed his Master of Science Degree in Personal Financial Planninggg through the College for Financial Planning (CFFP). Aubrey currently volunteers his time as a committee member of the NexGen group of the Financial Planning Association (FPA) of San Diego. As President of the NexGen group, Aubrey organizes educational and networking events for young local advisors to connect and help advance their careers in the financial services industry+. Aubrey obtained his Enrolled Agent (EA)bbb designation in 2023.

Outside of Weatherly, Aubrey enjoys golfing, surfing and spending time with family.

Education:

Gonzaga University, B.B.A. Business Administration (Finance & International Business), Washington

College for Financial Planning, Master of Science Degree in Personal Financial Planninggg

Certifications:

License(s): Series 66 D

Insurance: (Life Only, Accident & Health, Variable Contracts)DD

Exams: Series 7D (inactive)

CERTIFIED FINANCIAL PLANNER™ professional (CFP®) A

CRPC® – Chartered Retirement Planning CounselorSMjj

MPAS® – Master Planner of Advanced Studiesii

Enrolled Agent (EA)bbb

Active Memberships:

San Diego chapter of the Financial Planning Association (FPA)+.

Awards & Accomplishments

Five-Star Best Personal Wealth Manager Award – Year(s): 2024