6 Things You Need to Know About the SECURE Act 2.0

Andrea Taylor, CPA, MSA, Wealth Management Associate Advisor | Ryan Richardson, CFP®, Senior Wealth Management Advisor | January 26, 2023

The Secure Act 2.0 is the newest version of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which was originally signed into law in December 2019 and recently updated in December 2022. It is important to note- the Secure Act is designed to help Americans save for retirement and will create more flexibility for retirement savers. These 92 provisions will make it easier to access retirement savings and increase the amount one can save for retirement. Additionally, the Secure Act 2.0 provides incentives for employers to offer retirement plans by expanding employer benefits and tax credits. In this blog, we will review the six key features of The Secure Act 2.0, its effect on clients, and how Weatherly can help navigate the planning opportunities that are created.

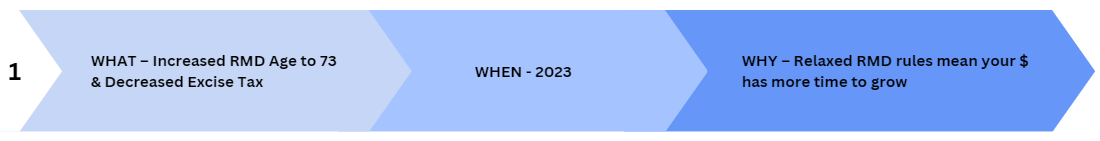

The Secure Act 2.0 is an important piece of legislation that has been passed to help Americans save for retirement. One of the most significant changes included in the act is the increase of the Required Minimum Distribution (RMD) age from 72 to 73 in 2023, and eventually to 75 (in 2033). This change is beneficial to older Americans, as it allows them to keep more of their money in tax advantaged retirement accounts for a longer period. The new rule will also help those who are still working to have more time to save and invest, increasing their chances of having a secure retirement. Additionally, the penalty for not taking an RMD from a qualified plan or IRA has been lowered from 50% of the required amount not taken to 25%. If an untaken RMD is corrected in a “timely manner” the excise tax could even be reduced from 25% to 10%.

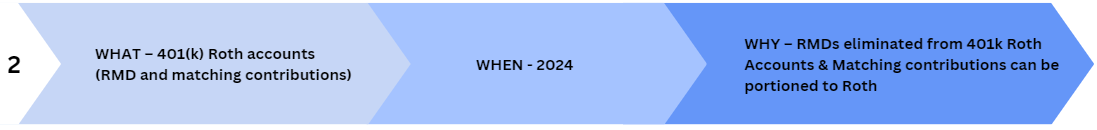

Another major development in the retirement savings landscape is the elimination of required minimum distributions (RMDs) from Roth accounts within 401(k) and other defined contribution plans. As a reminder, a “normal” Roth IRA account is never subject to RMD unless inherited, this is only in reference to 401(k) and other DC Plan Roth accounts. This means that individuals can now save more of their retirement funds for the future without having to worry about meeting RMD requirements. Additionally, the Act allows employers to make matching contributions to their employees’ Roth accounts (after previously only allowing pre-tax). This provides added incentive to save for retirement, giving individuals more flexibility and control over their retirement savings and allowing them to better plan for their future.

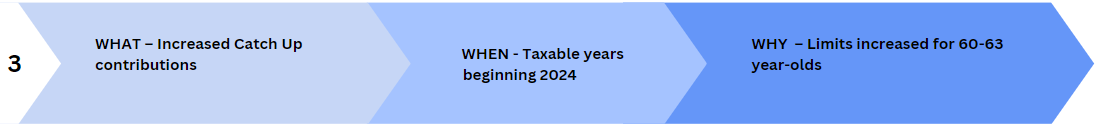

The Secure Act 2.0 has increased catch-up amounts in employer retirement plans for individuals aged 50 or older. This means that those individuals can make catch-up contributions to their 401(k), 403(b) or 457(b) plans, up to a limit of $7,500 for 2023. Starting in 2025, the limit is raised to 50% more than the regular catch-up limit for individuals aged 60 to 63. This is a major step in helping individuals save for retirement and ensuring that they have enough funds to live comfortably in their later years.

For more information please refer to Weatherly’s Key Financial Data Chart

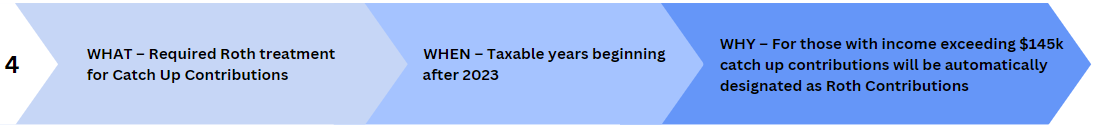

Beginning in 2024, the Secure Act 2.0 has a provision that states if an individual’s income is over $145,000, any catch-up contributions made to their retirement savings accounts must be Roth contributions. Roth contributions are made with after-tax dollars, meaning that the contributions are not tax-deductible. However, the money grows tax-free and can be withdrawn tax-free in retirement. This provision of the Secure Act 2.0 is intended to help individuals save more for retirement, while also providing tax benefits.

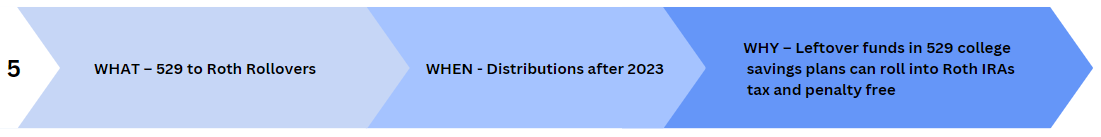

The Secure Act 2.0 has introduced an exciting new planning opportunity for parents wanting to balance retirement savings with college savings. 529 education accounts can now be rolled over to Roth IRAs for 529 beneficiaries, tax and penalty-free, if the 529 account has been open for at least 15 years. To avoid manipulation of the new rule, the 15-year clock is reset every time a beneficiary on the 529 is changed. The annual rollover amount is limited to the annual Roth contribution amount ($6,500 for 2023) and the rollover must be from earned income. Furthermore, there is a maximum lifetime rollover amount of $35k. This new provision provides a great opportunity for parents to plan for their children’s college expenses while also saving for their own retirement.

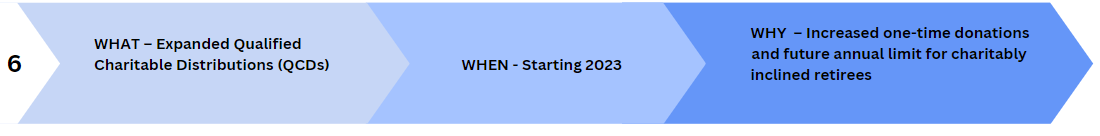

A QCD allows individuals who are 70.5 or older to donate up to $100,000 directly to one or more charities from a Taxable IRA instead of taking their RMD. Under SECURE 2.0 the QCD rules are expanded to allow for a one-time $50,000 distribution to a charity through a split-interest entity. This $50K distribution can go to one of the following- charitable gift annuities (CGA), charitable remainder unitrusts (CRUT), and charitable remainder annuity trusts (CRAT). Beginning in 2024, the $100K annual limit on QCDs will be indexed for inflation.

For more information on QCDs refer to WAM’s previous blog – Guide to Giving

Bonus – Impact on employers – auto enrollment 401(k) 403(b)

The Secure Act 2.0 includes a provision for auto enrollment in 401(k) and 403(b) plans. This means that employers now automatically enroll their employees in these retirement plans, unless the employee opts out. This is a great way to encourage employees to save for retirement, as it removes the burden of having to actively sign up for a plan. Additionally, employers can also choose to increase the default contribution rate over time, which can help employees save more for retirement. This provision of the Secure Act 2.0 can be a great way to help employees save for retirement and ensure that they are able to retire comfortably.

In Conclusion

Overall, the SECURE 2.0 is an important step forward in helping Americans save for retirement and secure their financial future. These new rules will continue to change retirement savings and retirement plan distributions over the next few years. We will continue to remain diligent in how that affects you as our clients and individuals. These provisions can be complex and everyone’s financial situation is different, reach out to your Weatherly Advisor today to learn more about how the Secure Act 2.0 changes apply to you.

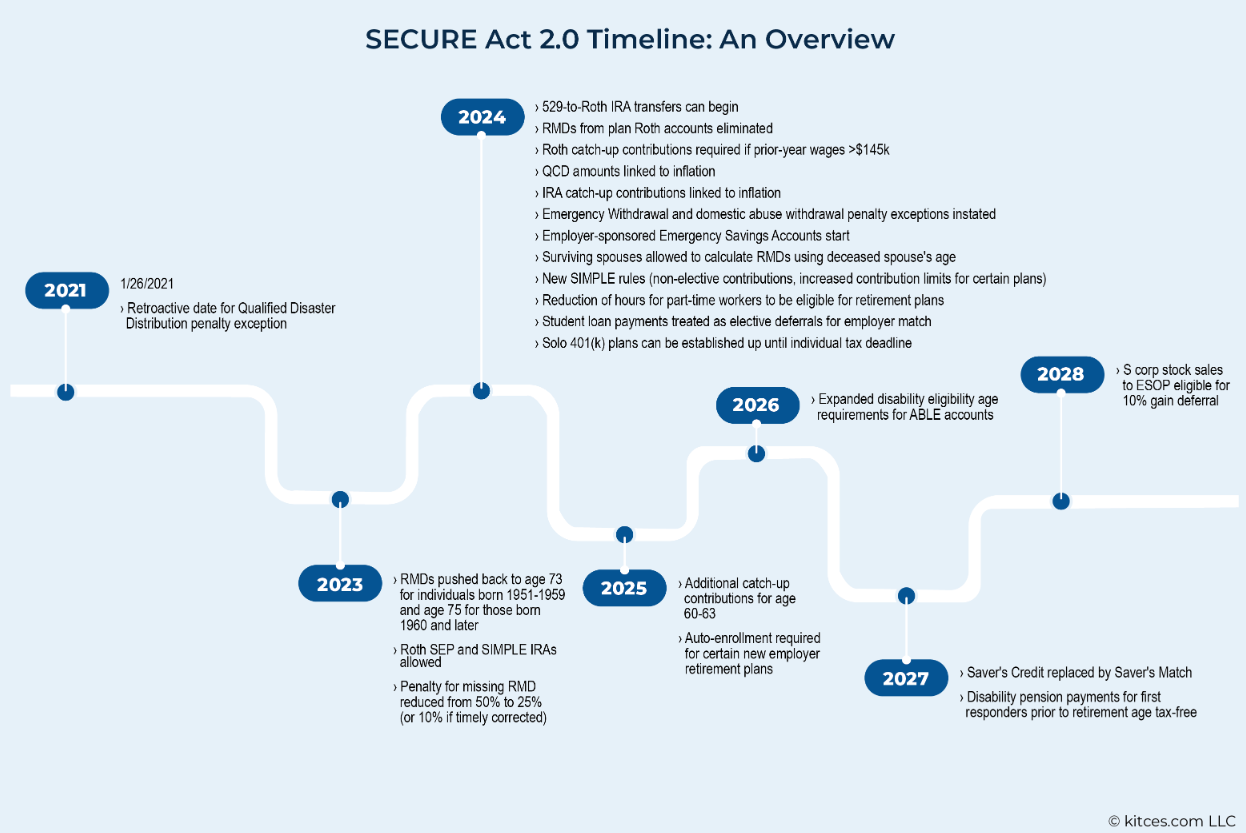

Timeline of rollout and enforcement of provisions, see attachment:

Chart Sourced from: Kitces

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.