10 Ways The OBBBA Could Affect You

Aubrey Brown, CFP®, EA, M.S., Wealth Management Advisor | Andrea Taylor, CFP®, CPA, MSA, Wealth Management Advisor | August 14, 2025

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act (OBBBA) into law just six months before key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) were set to expire. While the bill’s 887 pages include many non-financial provisions, it carries broad implications for taxpayers, making several TCJA-era tax law changes permanent and introducing new rules moving forward.

Due to the quantity and speed with which these tax changes are being rolled out, the IRS is still working to update its tax forms accordingly and will likely release additional guidance on some items over time. In this blog post, we break down the 10 most broadly relevant tax law changes for our client base while acknowledging this blog could have been titled “101 Ways the New OBBBA Could Affect You”.

Many of the new changes have small nuances; pay attention to whether they are: temporary vs permanent, what kicks in for 2025 vs 2026, and whether certain provisions have income phaseouts.

Three 2017 TCJA Changes The OBBBA Made Permanent With Tweaks

1. Extended Standard Deduction

- Permanent

- 2025+

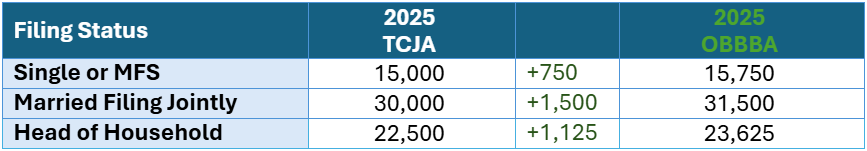

Taxpayers will receive a boost in the standard deduction across all filing statuses starting in 2025. The chart below outlines the new, increased amounts from the OBBBA in comparison to the previously anticipated TCJA limits for 2025.

Refer to the recently updated 2025 Key Financial Data Chart for more information.

Additional Source Material

What this means for you? With a higher standard deduction in place, the hurdle to benefit from itemizing deductions becomes even greater than in previous years. We’re evaluating strategies that allow clients to group itemized deductions, such as bunching charitable donations into a single tax year, to maximize itemized deductions.

2. Estate (& Gift/GST) Tax Exclusion

- Permanent

- 2026+

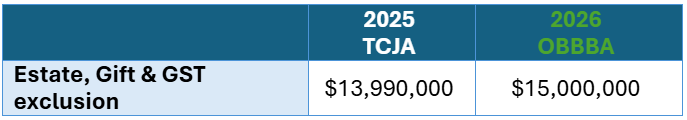

Beginning in 2026, the new tax law changes will make the estate exemption permanent and increase the base exclusion to $15,000,000 per individual, with annual inflation adjustments starting in 2027. The generation-skipping transfer (GST) and gift tax exemption will also match the updated estate exclusion.

Additional Source Material

What this means for you? Without the OBBBA, the federal estate tax exemption would have reverted back to nearly half (~$7M) beginning in 2026. Creating an urgency for high net worth individuals to use their exemption before it expired. Starting in 2026, married couples will be able to transfer up to $30,000,000 free of estate and gift tax, which significantly extends planning flexibility. This change reduces near term estate tax exposure for many clients and allows for thoughtful multi-generational planning with the understanding future legislation can always shift the landscape. We’ll continue monitoring updates and encourage clients to review their estate plans in light of these new thresholds.

3. Tax Brackets

- Permanent

- 2026+

The TCJA-era tax brackets have been made permanent with some slight adjustments starting in 2026. The 10% and 12% brackets will expand modestly, providing relief to lower and middle income earners with the 22% bracket narrowing to offset those changes.

What this means for you? Since the US has a progressive tax system, the overall dollar impact of these adjustments will be somewhat diluted. Although it is interesting to note, for the first time next year it is expected the 12% tax bracket for married couples filing jointly could reach six figures.

Five OBBBA Changes with Income Phase Outs

4. State and Local Tax (SALT) Deduction

- Temporary

- 2025-2029

- MAGI Phase Outs

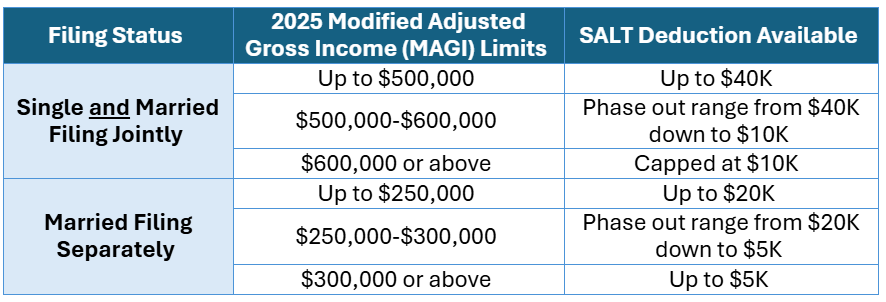

One of the headline provisions in OBBBA is the temporary expansion of the SALT deduction limit. From 2025 through 2029, the cap increases significantly from $10K to $40K (with a 1% annual inflation adjustment). Based on current law, the SALT will revert back to the $10K limit in 2030. We anticipate this provision will impact our clients who live in high tax states and whose sales or property taxes were previously capped at $10K.

Refer to the chart below for 2025 MAGI limits for eligibility.

For additional resources on the SALT Deduction.

Additional Source Material

What this means for you? High earners should be cautious of the steep phaseout, which can quickly reduce the tax deduction available while realizing additional income. Additionally, notice the same income phase outs apply to both Single and Married Filing Jointly, this presents an opportunity for some and a “marriage penalty” to others. If your income falls below the phaseout thresholds, the expanded SALT deduction presents a planning opportunity to bunching other itemized deductions into one tax year to maximize your benefit.

5. Enhanced Senior Deduction

- Temporary

- 2025-2028

- MAGI Phase Outs

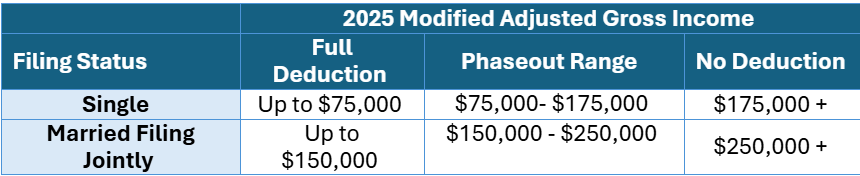

The OBBBA introduced an additional $6,000 deduction per person age 65 or older from 2025 until 2028. This deduction is available regardless of whether you claim the standard deduction or itemize but is phased out based on your Modified Adjusted Gross Income (MAGI).

For more information on the Enhanced Senior Deduction.

Additional Source Material

What this means for you? This temporary provision was designed to mimic no tax on Social Security for certain retirees and is separate from the existing over 65 additional amount tied to the standard deduction.

6. New Charitable Rules

- Permanent

- 2026+

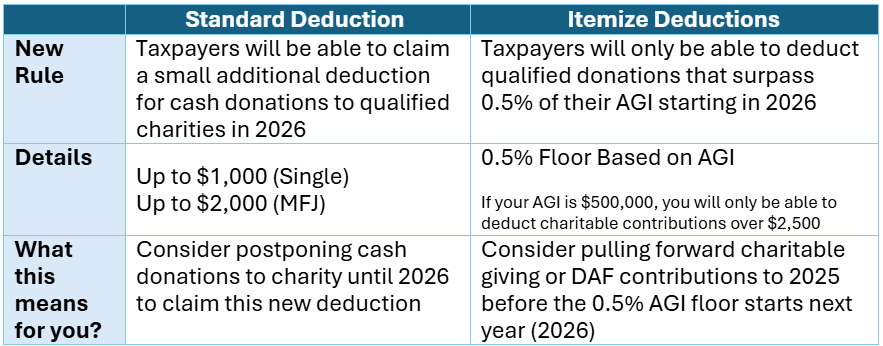

Starting in 2026, there are two new rules relating to charitable giving depending on whether you take the standard deduction or itemize. We outline both in the chart below.

Going forward, taxpayers should consider bunching strategies to maximize charitable deductions or strategically utilize QCDs once they qualify at age 70.5.

For more information on the new charitable rules.

Additional Source Material

7. Itemized Deduction Limitation

- Permanent

- 2026+

A cap on the value of itemized deductions for top earners will come into play in 2026. For taxpayers in the 37% bracket, itemized deductions will be limited to 35 cents on the dollar. This means that for every $1 in deductions, only $0.35 will reduce taxable income. Those in the 35% bracket and below will see no impact from this change.

For more information on the Itemized Deduction Limitation.

Additional Source Material

What this means for you? This rule is a targeted limitation on high-income earners and may significantly reduce the benefit of itemized deductions. If you are in the 37% bracket, consider accelerating charitable giving, property tax payments, or deductible medical expenses into 2025 since this rule doesn’t go into effect until 2026.

8. Child Tax Credit (CTC)

- Permanent

- 2026+

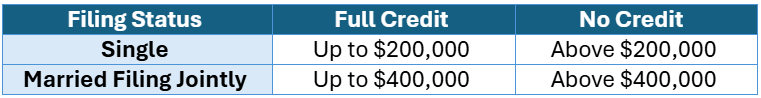

- MAGI Phase Out

Starting in 2025, the Child Tax Credit (CTC) is increasing to $2,200 per qualifying child under age 17. These updates increased the CTC by $200, made the income phase-outs permanent, and adjusted the refundable part of the credit for inflation. For 2025, the maximum portion of the credit that can create a refund is $1,700 per child.

For more information on the Child Tax Credit.

Additional Source Material

Two Next-Gen Saving Vehicle OBBBA Changes

9. Trump Account

Starting in 2026, a new tax-deferred saving account will be available for qualifying children born after December 31, 2024. These accounts are essentially restricted until the child turns 18, at which point it is presumed to follow traditional IRA rules. While the opening, funding, and distributions from these account are still being clarified, please reference the following article for more information.

What this means for you? Parents have yet another vehicle to save for their child’s future. Consideration should be placed on what the goal is of the account. For example, if college saving is the priority, then perhaps a 529 plan makes sense as outlined in this comparison article.

10. 529 Plan Enhancements

529 college savings plans will have expanded flexibility starting in 2026. Most notably, the annual K-12 tuition limit for tax free withdrawals will double from $10K to $20K per student and qualified expenses will expand to include books, tutoring, test fees, and a few more educational expenses. To maximize your 529 benefits, take a look at the following article from Saving For College or ask your Weatherly advisor which changes could benefit you.

What this means for you? With a broader list of qualified education expenses and the ability to front load five year’s worth of contributions using the super funding strategy- 529 plans have become an even more compelling tool for education gifting to children or grandchildren.

Other Notable OBBBA Changes

- Auto Loan interest deductible – For qualified vehicles, a temporary deduction of up to $10K in auto loan interest will be available from 2025 to 2028, with a MAGI limit of $100K Single and $200K MFJ.

- No Tax on $25K in Tips and $12.5K/$25K in Overtime Pay – This will be a temporary change from 2025 to 2028 and will only be eligible to those within the corresponding phase-out limits.

- Alternative Minimum Tax (AMT) Changes – In 2026, AMT exemption levels are permanently changing with phaseout thresholds set to $500,000 for Single and $1 Million for Married Filing Jointly (indexed for inflation starting 2027). Phase outs will now happen twice as fast as before with a higher phase-out rate of 50%, up from 25% in 2025.

- Small Business Changes – A number of new laws impact small businesses such as Section 179, expensing of research and development costs, bonus depreciation and more.

- Real Estate Changes – The OBBBA includes several provisions to benefit real estate investors or developers with some additional offsetting changes.

- Health Savings Accounts (HSAs) – Similar to 529 accounts, HSAs will see expanded flexibility through eligibility requirements and expansion to cover telehealth services.

- 3 Clean Energy and Vehicle Tax Credits Ending Soon – Be sure to complete any clean energy home improvement projects by end of year and eligible vehicle purchases by 9/30/2025.

What are the Tradeoffs?

While the new bill has implemented sweeping tax relief and planning opportunities, it comes with notable tradeoffs. The OBBBA made significant cuts to Medicaid and increased the requirements for access to Supplemental Nutrition Assistance Program benefits. Estimates from the CBO, non-partisan budget office, estimate it will add $2.8 trillion to the US deficit between 2025 and 2034. As a result, the federal debt is projected to reach 124% of GDP by 2034, up from 117% under prior law. The long-term budgetary implications of the bill’s provisions will continue to shape fiscal policy in the United States. For more on the Federal Deficit please look at our previous Weatherly blog.

How WAM Can Help?

The OBBBA not only builds on the Tax Cuts and Jobs Act (TCJA) but also introduces a wide range of new provisions that will affect taxpayers in different ways. These updates take effect on varying timelines, with several new-phase outs impacting deductions and credits. Because some provisions are temporary (set to expire in four years) strategic tax and estate planning is essential. We encourage you to work with your Weatherly advisor to review your most recent tax return, identify opportunities under the new law, and develop a plan that positions you for years to come.

Additional Source Material:

- CONGRESS.GOV

- Holistiplan Webinar

- Kiplinger OBBBA Article

- Tax Foundation Blog

- HR Block Article

- Smart Asset – Trump Tax Plan Impact Article

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.